Aave has been around now for a while since it's birth in 2017 it's become one of the biggest staples for TLV (Total Locked Value) With a current price point of $138.28 at the time of writing this it's comes in as the 43 token on the top crypto list.

As we can see from the chart below the price of Aave skyrocketed like many others during the defi boon of the lockdowns and so shows the potential of the token like other existing defi tokens in terms of possible price points in the next bull run with altcoin season we still haven't yet seen. (which is starting to feel overdue and might simply be waiting for the presidential election)

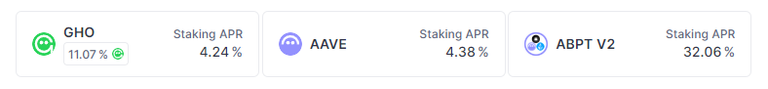

Aave also pays a a decent staking reward APR which at the moment comes in at 4.38% which is on par to what is earned in most bank savings accounts.

Grayscale Dips Their Toes

Grayscale once again is making moves and this time it's with Aave as they have just launched what is known as a "trust" these trusts are easier to launch over something like a ETF and is normally how it starts before a ETF is pushed for.

It's important to note however that Grayscale actully has a large number of these trusts and it's not just Aave however whenever one is added it shows demand for the asset and Aave being defi in nature feels like it should have increasing demand as bull markets heat up. It feels like a proactive play on the side of Grayscale.

A trust is a closed-end fund that has a fixed number of shares so a max that can be bought and sold. While a ETF is open-ended which allows for accumulation of whatever is available.

A trust also has higher fees and are considered "active" in terms of trading. The trading of these funds are often done in blocks as large transactions instead of on the spot like with ETFs.

What Is Aave?

Aave is a decentralized lending platform so think of it as loans over transitional style of defi. It runs on the Ethereum blockchain so again it's focused on Ethereum which seems to be a recurring trend here with all of these ETFs and Trust listings showing the confidence in Ethereum over other blockchains at the moment.

Grayscale also just a few weeks ago launched a trust fund for the AVAX token. Now it's pretty clear that these funds don't seem to impact the price o the crypto asset they are buying and selling for the most part as they are often smaller scale. But it does give them an option to see the bead on the markets and if it would be a viable option for a possible ETF in the future if the demand is there. That's because these companies make most of their money through the buying and selling of the assets via fees.

It's also unclear as of yet if these companies stake any of the tokens and earn on them that way. Even if they collected fees of the token and staked them it would start to rather quickly build their assets in the crypto markets simply by volume alone.

Posted Using InLeo Alpha