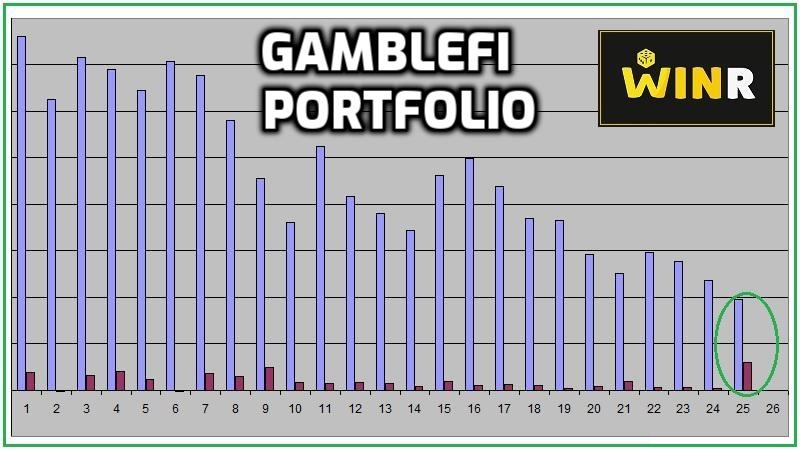

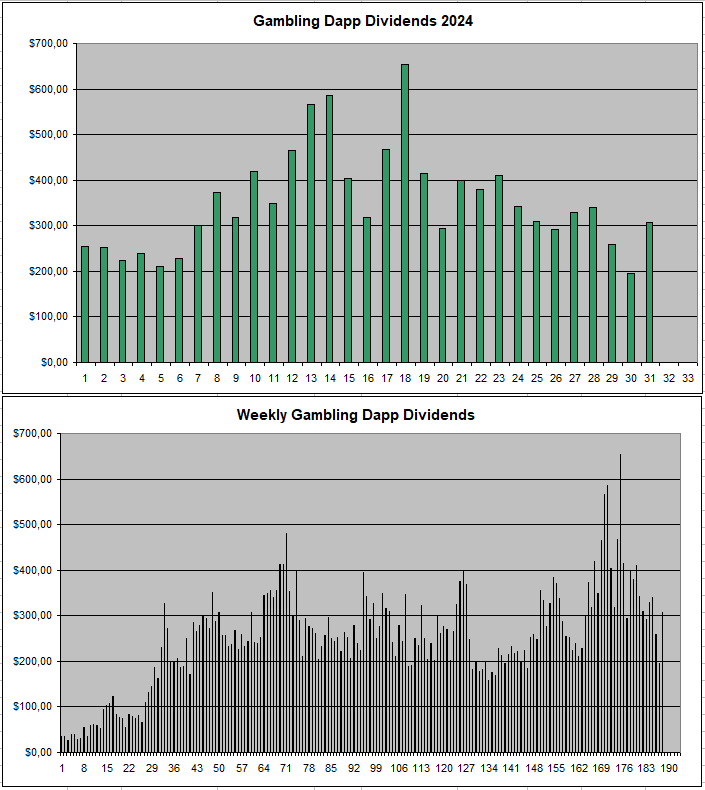

After a dip last week where the Passive Earning from my GambleFi Portfolio were just below 200$, they now performed better again landing at a nice 306$ while the overall value of all coins combined was more or less unaffected by the entire crypto crash. It once against showed that this sector is a very nice hege against volatility while bringing in funds each week to continue investing and compounding.

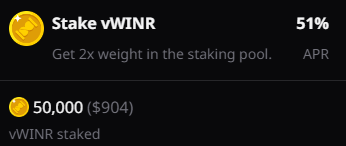

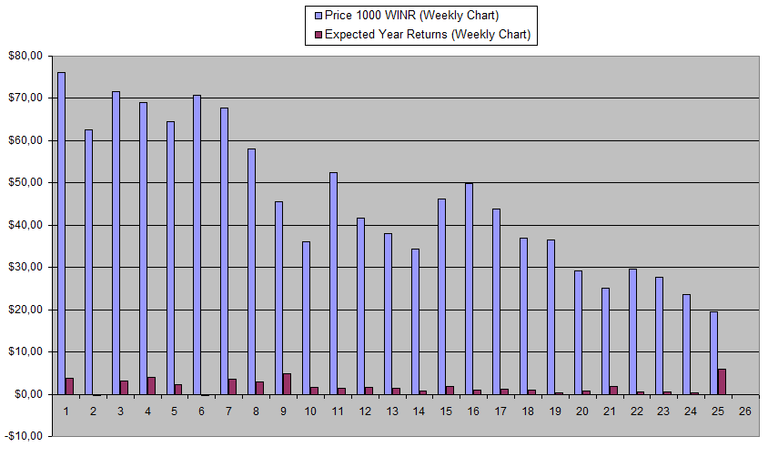

Winr Protocol is one that I bought an initial bag of early in February to test it out and see for myself how the returns are at the time 1 WINR went for 0.077$ which was a 50% discount compared to the top. Ever since, the price continued to trend down as hype faded while the actual earnings didn't justify the price. However, I do still like what they are trying to build believing there is potential for some adoption resulting in higher platform revenue which pushes the dividends and the price up. I bought some extra WINR early in the week not yet staking it and for the first time there was a big spike in dividends. I assume that this is fully due to the Crypto market crash and everyone on their leverage trading platform getting liquidated. So I don't really have high hopes that this will be the new norm from here on out. However, it does show that not all too much is needed to really increase the returns. I currently own 30k WINR which I paid 1234$ for while it's only worth 585$ now. This is still quite low as an investment for this portfolio so I opted to double down today and buy 20k extra getting myself to a 50k stake.

I don't by any means expect a 51% APY next week which currently is indicated on the site though. I will continue to monitor things week by week and see where it goes. At this point, I still have a relatively low stake and if it looks favorable I still might add some.

Price down and Dividends up is what you really want to see as a possible sign to get in which is exactly what it showed last week. it will be interesting to see how it evolves the coming weeks as there is a chance it will all just fall flat again.

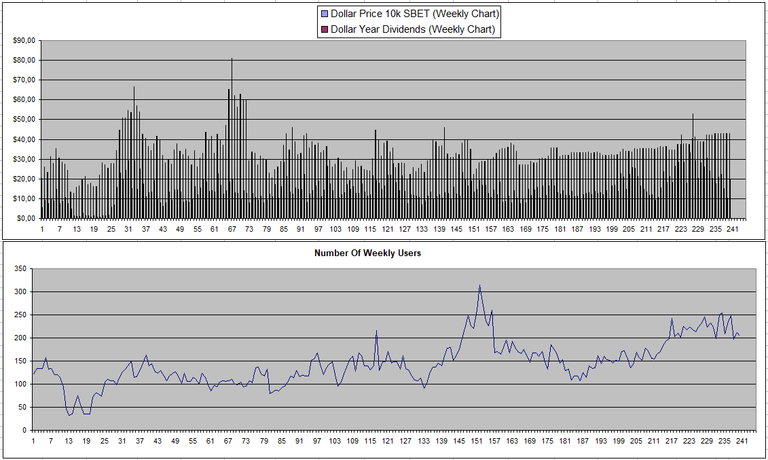

Sportbet.one (SBET)

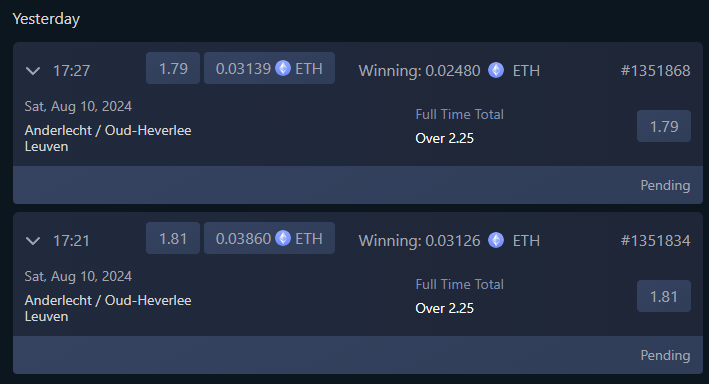

SBET came back after a weak performance last week and this while all the major sports league still have to start. The price is also totally unaffected by the crypto market crash. I continue to use the earning I'm getting from it to re-invest in other coins and I'm also still actually using their sportsbook at times to place some crypto bets on the Belgian League.

I also really like their model where odds actually move base on money flow which prevents them from getting overly exploited on bad lines.

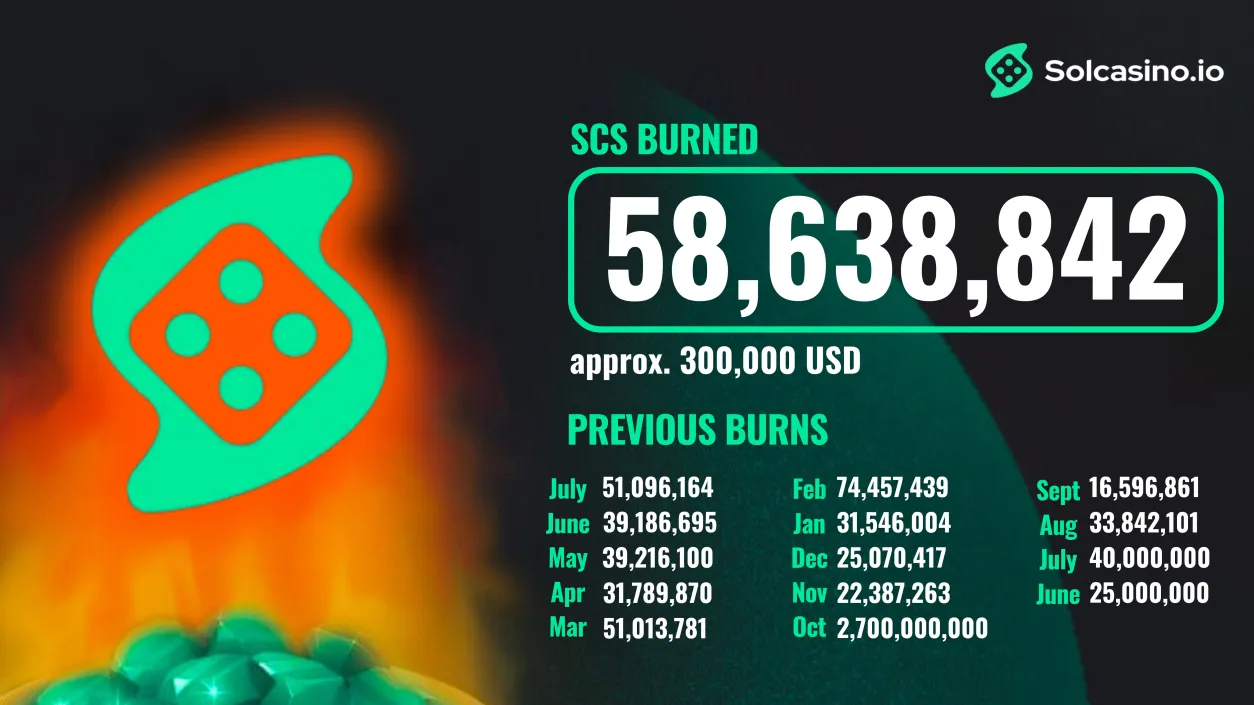

Solcasino.io (SCS)

SCS is one of those coins that fully is connected to the crypto space so there was quite the drip in price. I'm not really tempted to buy more at the moment as the amount of SCS staked on average has gone up with 4% weekly putting pressure on the returns.

At the same time, last month saw a 300k dollar burn which equaled 58.6M SCS since all profit made from people who bet with SCS is burned. These burns have been quite consistent for over a year now. This one equaled 0.86% of the total supply which is a small step forward.

Based on the current price, there APY is around +36.12% so certainly respectable.

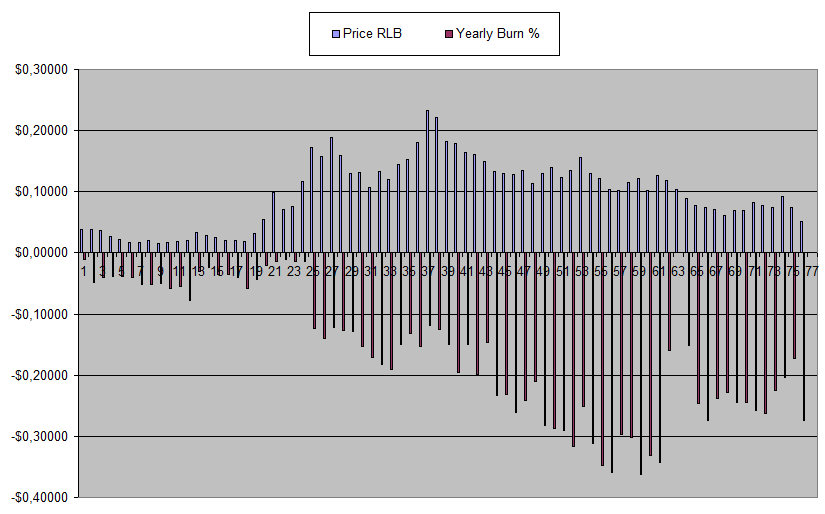

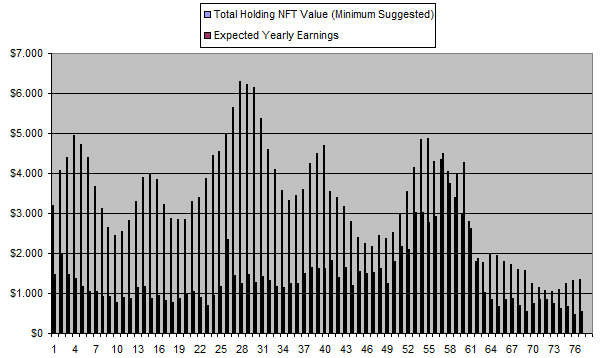

Rollbit.com (RLB) & Rollbot/Sportsbot NFTs

The main metric I watch for RLB is the rate at which the supply is burned, this saw an increase again this week to a level of 27% which remains quite crazy.

Based on all the numbers, holding RLB as a longer-term position should be really good and the main risk is that it's centralized and hard to tell what's really going on after the screens.

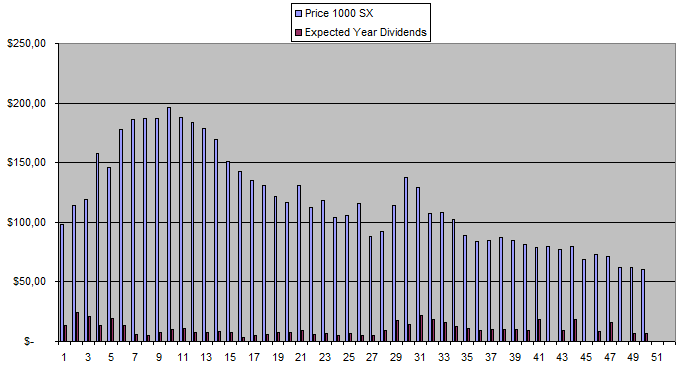

Sx.Bet (SX)

Not all too much going on with SX from what I can see as they are still just releasing more coins as a way to distribute earnings which puts pressure on the price.

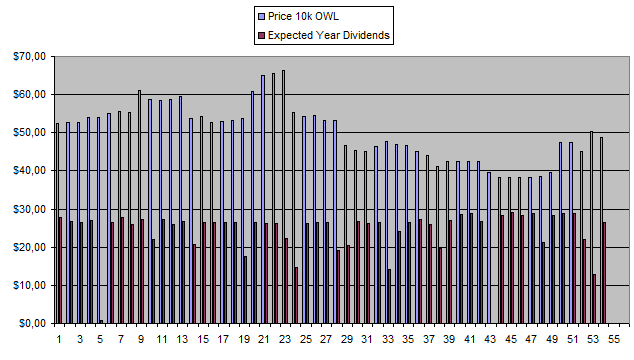

Owl.Games (OWL)

OWL also fully held up during the crypto crash and continues to pay out dividends at a rate where it's a matter of time before I have earned back my initial investment.

| Date | Hold | Invested | Value | Week Divs | Total | % recov | Total |

|---|---|---|---|---|---|---|---|

| 08/08/2023 | 395k | 1954$ | 1850$ | 13.76$ | 21.9$ | 1.12% | -82$ |

| 05/09/2023 | 500k | 2636$ | 2437$ | 20.30$ | 83.9$ | 3.18% | -115$ |

| 03/10/2023 | 500k | 2636$ | 2600$ | 21.15$ | 182.99$ | 6.94% | +147$ |

| 07/11/2023 | 600k | 3179$ | 2877$ | 30.43$ | 310.14$ | 9.75% | +8$ |

| 05/12/2023 | 600k | 3179$ | 2851$ | 20.12$ | 421.99$ | 13.27% | +94$ |

| 01/01/2024 | 600k | 3179$ | 3521$ | 25.76$ | 538.76$ | 16.95% | +881$ |

| 08/01/2023 | 600k | 3179$ | 2933$ | 17.00$ | 555.76$ | 17.48% | +310$ |

| 15/01/2024 | 600k | 3179$ | 2879$ | 30.35$ | 586.11$ | 18.43% | +286$ |

| 23/01/2024 | 600k | 3179$ | 2888$ | 30.45$ | 616.56$ | 19.39% | +325$ |

| 30/01/2024 | 600k | 3179$ | 2825$ | 30.45$ | 647.01$ | 20.35% | +293$ |

| 06/02/2024 | 600k | 3179$ | 2825$ | 22.16$ | 669.17$ | 21.05% | +315$ |

| 13/02/2024 | 600k | 3179$ | 2469$ | 23.57$ | 692.74$ | 21.80% | -17$ |

| 20/02/2024 | 600k | 3179$ | 2407$ | 30.74$ | 723.48$ | 22.76% | -48$ |

| 27/02/2024 | 600k | 3179$ | 2385$ | 30.27$ | 753.75$ | 23.71% | -40$ |

| 05/03/2024 | 600k | 3179$ | 2464$ | 30.67$ | 784.42$ | 24.67% | +69$ |

| 12/03/2024 | 600k | 3179$ | 2527$ | 16.29$ | 800.71$ | 25.19% | +148$ |

| 19/03/2024 | 600k | 3179$ | 2485$ | 27.72$ | 828.43$ | 26.06% | +134$ |

| 26/03/2024 | 600k | 3179$ | 2470$ | 30.70$ | 859.13$ | 27.02% | +150$ |

| 02/04/2024 | 600k | 3179$ | 2393$ | 31.35$ | 890.48$ | 28.01% | +104$ |

| 09/04/2024 | 600k | 3179$ | 2330$ | 29.95$ | 920.43$ | 28.95% | +71$ |

| 16/04/2024 | 600k | 3179$ | 2184$ | 22.75$ | 942.18$ | 29.60% | -53$ |

| 23/04/2024 | 600k | 3179$ | 2245$ | 31.25$ | 973.43$ | 30.60% | +39$ |

| 30/04/2024 | 600k | 3179$ | 2245$ | 33.02$ | 1006.45$ | 31.66% | +72$ |

| 07/05/2024 | 600k | 3179$ | 2246$ | 33.40$ | 1040.85$ | 32.74% | +107$ |

| 14/05/2024 | 600k | 3179$ | 2246$ | 30.83$ | 1071.68$ | 33.71% | +138$ |

| 21/05/2024 | 600k | 3179$ | 2103$ | 0.00$ | 1071.68$ | 33.71% | -4$ |

| 28/05/2024 | 600k | 3179$ | 2035$ | 32.81$ | 1104.49$ | 34.74% | -40$ |

| 04/06/2024 | 600k | 3179$ | 2035$ | 33.48$ | 1137.97$ | 35.79% | -6$ |

| 11/06/2024 | 600k | 3179$ | 2035$ | 32.60$ | 1170.57$ | 36.8% | +27$ |

| 18/06/2024 | 600k | 3179$ | 2029$ | 33.22$ | 1203.79$ | 37.86% | +53$ |

| 25/06/2024 | 600k | 3179$ | 2039$ | 24.55$ | 1228.34$ | 38.64% | +88$ |

| 02/07/2024 | 600k | 3179$ | 2098$ | 32.75$ | 1261.09$ | 39.67% | +180$ |

| 09/07/2024 | 600k | 3179$ | 2519$ | 33.17$ | 1294.26$ | 40.71% | +634$ |

| 16/07/2024 | 600k | 3179$ | 2519$ | 33.38$ | 1327.64$ | 41.76% | +667$ |

| 23/07/2024 | 600k | 3179$ | 2394$ | 25.35$ | 1352.99$ | 42.56% | +568$ |

| 30/07/2024 | 600k | 3179$ | 2673$ | 14.85$ | 1367.84$ | 43.03% | +861$ |

| 06/08/2024 | 600k | 3179$ | 2579$ | 30.66$ | 1398.50$ | 43.99% | +798$ |

** The High 7% cost to go from buying to having it staked and the 5% tax to sell is fully included in the numbers.

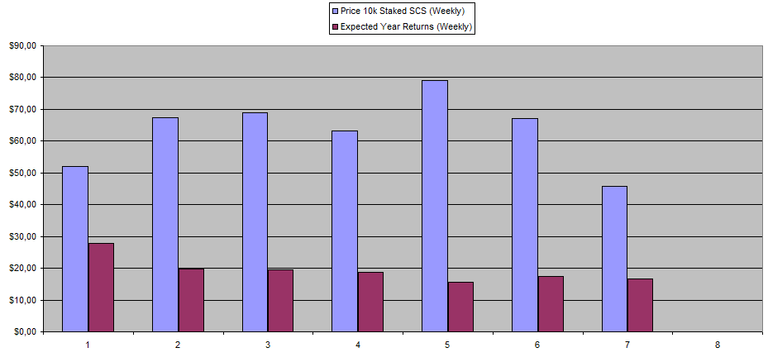

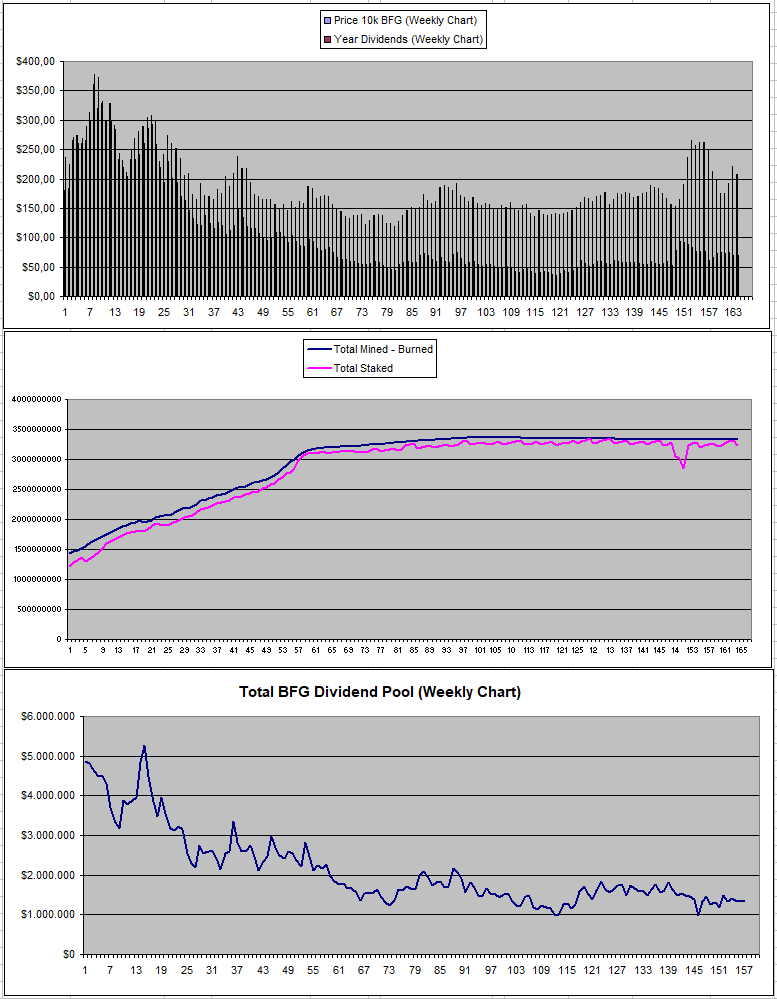

Betfury.io (BFG)

More of the same for BFG which continues to give between 60$ and 70$ for staking 500k BFG which equals a 33% APY.

APY Based on Current Price and Dividends from the last 7 days

All these numbers are based on prices of Monday

| Project | APY |

|---|---|

| Sportbet.one (SBET) | +46% APY |

| Betfury.io (BFG) | +33% APY |

| Rollbit.com (NFTs) | +40% APY* |

| Owl.Games (OWL) | +54% APY |

| Sx.Bet (SX) | +11% APY |

| WINR Protocol (WINR) | +30% APY |

| Solcasino (SCS) | +36% APY |

Note: Token prices going up or down have a major influence on the actual returns going forward either amplifying them if they go up or destroying them when the price would dip. These are my personal numbers and RLB varies based on the trait of the Rollbot NFTs you own and (*) they are based on the minimum suggested by prices which can be way lower than the actual prices.

Personal Gambling Dapp Portfolio

A Solid 300$+ last week while the value of the portfolio barely went down despite the market crash I'm now holding 5M SBET | 500k BFG | 2 Rollbot NFTs | 600k OWL | 25k SX | 50k WINR | 60k SCS. I'm still looking to diversify with other good gambling dapps that pay the losses or fees from the gambler to those holding a token. Anyone that has tips on this, please leave a comment below...

Crypto & Blockchain-Based Bookies and Exchanges that I'm personally using with some allowing anonymous betting with no KYC or personal restrictions...

|  |  |

|---|

Play2Earn Games that I am Playing...

|  |  |

|---|