Hi, it's me again. Your favorite nonregular crypto blogger. <3 I have recently started to look, again, at Crypto Cards. And that obviously made me think about weighing something about it all. I think it could be something that possibly could help some of you in a similar situation. Just so you know upfront, I live in the EU, so that means I have access to some options many others outside the EU do not have. With that out of the way, let's dive in.

What is a Crypto Card?

It is a card similar to a credit card, debit card, or ATM card. But the main difference is that it allows you to spend your crypto instead of your fiat or old-school money. This means that it also serves as an off-ramp, by allowing you to directly use your crypto to purchase things. Instead of having to take the normal steps of selling your crypto for fiat and then making a bank transfer from the exchange. To then finally be able to use your money.

In short, it can greatly speed up the process of being able to use your crypto to make purchases as well as simplify the whole process to some extent. Personally, I think the speed factor is the absolute biggest selling point. Knowing how banks sometimes can drag their feet with money transfers. This more or less gives you instant access to your money.

One thing that can be good to know about these cards is as far as I have seen all of them require a KYC, or Know Your Customer. This means you have to be able to identify yourself in order to get access to one of these cards. This might be a no-go for some of you, so I thought I would let you know upfront. Also, I will not cover any withdrawal limits a card might have, as this is a common feature, at least in my experience, on these types of cards. Therefore I will skip noting these. Instead try more if it doesn't have one, or any other related feature.

Most of these type of card limits the type of crypto you are allowed to use directly. This means that you might be forced to swap to a specific type in order for you to be able to spend your funds. The most common ones used are large ones like Bitcoin or Ethereum, as well as some stablecoins.

Also, none of the cards have an annual fee unless I specifically note they do. Also, all cards technically are debit cards and not credit cards, only one card has that feature in addition. And it only allows for credit, or a loan, against assets you have so it is not really pure credit either. Keep that in mind.

I will try and link to the relevant info in the article as well as at the bottom of the post.

Which Crypto Card should I get?

The easiest answer, and a bit of a copout, is it depends. But that's where this post comes in, hopefully, it can help you somewhat by letting you know some of the different features of the different cards. By no means will I cover all the different cards, so do not use my post as an end-all-be-all. Use it as a starting point. Let's start.

Crypto.com

This card is a Visa card, meaning it works just as your standard Visa card and has the same limitations. This means there are some places that do not take this type of card, but in my experience, they are very few and far between. They have a tier system, meaning that you are able to unlock more and better features. This is achieved by having $CRO staked, the amount needed varies from $0 for the basic card all the way up to $1,000,000. The first step up from the basic card is $500. The following steps come at *10 intervals, $5,000, $50,000, and so on. The last step however goes from $500,000 to $1M. Allowing for a whopping six different tiers.

Pick a card, pick any card. No not that one you can't afford that one. Source: https://www.mygermanfinances.de/

The main reason why you might want to level up your card is the added benefits it will unlock. Probably the most interesting one is you can earn a 2%, or higher, cashback on your spending. This means that if you spend $100 you will at the end of the month get $2 back. This will be in $CRO. The first and second tires have a monthly limit to how much you can earn on the cashback. This is $25 and $75 respectively. It does mean you have to spend $1250 and almost $2150 in the same month.

The strange feature of the card is that it is a prepaid card. Exactly how this works is a bit unclear to me. Byt my guess is you need to buy something akin to a gift card to fill up the available money you then can spend.

Now to some bullet points:

- Works, as far as I can tell, everywhere the exchange works. US, EU, and most likely UK as well

- Cashback ranges from (0%) 2% - 8% depending on your level

- Travel rewards on the 4 highest tires, $5,000 and up, and access to the Airport lounge as well. The highest 3 tires, $50,000 and up, allow for a guest as well

- "Exclusive Experiences" on F1, UFC, UEFA & more top 3 tires, $50,000 and up

- "Comming Soon" banking and stock features

- Limited free ATM accessibility, depends on the tire (Europe and US rules)

Debit / Credit card top-up fee varies on where you are, specifics are in the links above

Summary: if you can get a Crypto.com account you can most likely access their crypto card as well. It uses a prepaid system, meaning it takes a little bit more planning on your side before you can use the card. But as long as you have an internet connection and a device to access the site on you should be able to top up your account even in a pinch.

Some hurdles are simply too big. Source: https://pixabay.com/

The card has a cashback feature, but in order to have access to it you need to have a $500 $CRO, or more, stake on Crypto.com. This can be annoying or outright a no-go for you, depending on your personal preference. But the lowest tire still allows you to use your crypto, just without the small bonus.

The fees and specific rules for each region vary so make sure you are aware of your region's specific rules and limits. Or you can get some annoying minor fees. An example would be if you want to top up your card using another credit card, and you forget the small fee. This means you now have to do a second top-up to have the amount you need.

Crypto.com is one of the larger centralized exchanges for crypto and the only one that is operating in the US. That probably makes it about as good as a centralized exchange can get from a customer safety perspective. Not saying a lot. But have that in mind. Not your keys, not your crypto, and all that.

You should be able to find all relevant info here, or by searching for the specific thing you are looking for. Like the link to the fees, I had to search for that one.

Coinbase

This is another of the largest centralized exchanges out there that have a crypto card available. Depending on where on Coinbase.com you look you will find different information on the availability of the card. I will assume that this simply is a feature on the site or in me and how I interpret things. I will therefore continue under the assumption that the card is available to the US (excluding Hawaii), EU, and UK users.

The card is also a Visa card, meaning all the Visa features and limitations are applied. The biggest upside of this card is that it does not have any fees for spending or ATM withdrawals. Well as long as the ATM company does not charge you any that is.

No fees on this card, is that important for you? Source: https://card.coinbase.com/

The card has a cashback feature as well. The exact function of it is however something that seems to elude me. The only information I am able to find is a few years old. On the site, it simply says you log in and will be able to choose your type of reward. It seems to mean that depending on the crypto you choose to get paid in, the % amount can vary. In the old Coinbase post, they give two different examples. Allowing the user to choose between a 1% cashback in Bitcoin, or a 4% cashback in $XLM. But those examples are four years old, meaning the numbers and available cryptocurrencies to choose from most likely have changed. You can find the old info post here.

A lot of information about the card, its use, and its limitations appear to only be available to the user after you get the card. SIGH =(

Summary: The biggest feature of the card, I think, is that there are no fees for using it. Be it in the ATM or just using it in a store directly. There appear to not even be any transaction fees for spending the crypto, as long as you use one of the supported ones. They do say there can be other fees and taxes that apply. Not really sure what type they are eluding to. Might be the IRS tax, capital gains tax, they are talking about. You can find what little info there is here.

Coinbase safeguarding the pertinent information. Source: https://pixabay.com/

The biggest problem I see, and it annoys me a ton, is the whole secrecy. Or safeguarding of information. There is a lot of "log in to the website or app and see/select thingy".

There is no tire structure, meaning that all features should be available to all cardholders. With the caveat that your account might have some limit only seen to you when you are logged on, like spending limits and such.

Nexo

This is also a card from a centralized exchange. Be it a smaller one than the two previous ones mentioned above. It is however only available in the UK European Economic Area (EEA). So sorry US. The EEA is slightly different from the EU so make sure to check before if you can get it if you think it is a good fit for you. The card has a cashback feature as well. You can choose between getting paid in NEXO Tokens, $NEXO, or in Bitcoin. Similar to how the cashback, presumably, works with the Coinbase card you get a higher % if you choose to get paid in $NEXO compared to Bitcoin. They do have a four-tire system that also impacts the % you will get. It works a bit differently from how Crypto.com´s tire system works.

Here there is no need for staking or anything like that. The tire your account is in appears to simply be decided by how big % of your assets are $NEXO tokens. This means that in order for you to reach the highest tier you do not need to have $1,000,000 like you need with Crypto.com. They also only have four tires and not six. The cashback amount for the different tires goes from 0.5% to 2% for $NEXO and 0.1% to 0.5% for Bitcoin. The different tires also have other benefits for your account, you can read more about them here.

There are however two hurdles for you to get over before you get access to the card. The first one is you need to have at least $50 in your account. Once you have you get access to your virtual card. A virtual card works the same way as a physical card, but with the obvious limitation that it is virtual. In order to get a physical card you need to get over two slightly larger hurdles. You need to have at least $500 in your account balance as well as have your account at Gold Tire. That means you need to have between 5% and 10% of your balance made up of $NEXO tokens. I assume you can drop below that $500 mark after you have the card, as well as the gold tire.

Do you need to use your crypto but still keep it? Then this card is for you. Source: https://nexo.com/

The one feature they have that makes them stand out is they have a credit function. This allows you to borrow against your assets. This means that you will still have your crypto. It is not a major thing, but still a feature I found worth highlighting. And one that some might find useful.

Judging by the pictures on the website, the card appears to be a Mastercard. Meaning it is more or less just as easy to use as a Visa card.

Bullet points:

- ATM, depending on your tire you are allowed to withdraw €200 / £180 to €2,000 / £1,800 every month. Going over will incur a 2% fee, minimum €/£1.99

- Transaction fees, there are transaction fees that come with using this card. They are lower on weekdays compared to the weekend. And they are much higher if you use the card outside of EEA/UK/CH. They are 0.2% or 0.7% in EEA/UK/CH, and 2% or 2.5% for the rest of the world

- Interest, you will earn interest on your balance

- Priority spending, you can select which crypto you want to spend first. Allowing you to prioritize which you will keep the longest

Summary: While not completely free, the $50 minimum needed in order to activate the virtual card should most likely be something most people who are looking at these types of cards can manage. And a virtual card will in the majority of cases work just as well as a physical one. The ATM limits also appear to not really be that big of a deal, as they are based on your account tire, which is easily increased. The only issue tho is the need for a minimum balance of $500 to get the physical card.

It is also nice to have the added feature of being able to borrow against your assets, not having to sell them. Especially useful in a bull market. Although it is not something I think most people have the amount of assets needed in order to properly take advantage of.

The biggest drawback is the wonky transaction fees. Especially with them being higher on the weekends. Also, you have to be aware of the company location when shopping online, unless you are fine with the higher fee.

Gnosis

Now we come to the first card which is very different. In what way you ask, well it is not based on an exchange. Instead, it allows you to use a self-custodial wallet. As an example MetaMask. That means you will have absolute control of your crypto, just like you have today. It is currently only available in 32 countries, including the UK. But not on the list is the US. For a complete list look here. They do say that the US, along with several other non-EU countries are being worked on. But by the looks of things the US will not be among the first batch added.

If avoiding a CEX is important to you, then this card lets you use crypto from your self-custodial wallet such as Metamask. Source: https://metamask.io/

They also have a cashback system. This one is also based on just holding $GNO in your account. In order to get cashback you need anywhere from 0.1 to 100 $GNO. Then you will get anywhere from 0.1% to a nice 4%, paid in $GNO tokens. And if you are an early adopter as well, you get the OG NFT that grants an extra 1% cashback. FOR FREE!!! #JPGE4LIFE (looks like this is no longer available tho) This means you can max out at 5%.

Almost forgot, the card is a Visa card with all that it entails.

Bullet points:

- Card cost, there is a cost for getting the card, €30.23. Once you have the card you do get a referral link that if used gives them a free card

- ATM, there is a limit in place here £/€ 200 per month or 5 withdrawals per month, anything on top of that comes with a fee, read more here

- Country restriction, you are not able to use the card in some countries, a full list can be found here as well as other limitations and restrictions

- IBAN (International Bank Account Number) is a unique code that identifies your bank account across borders. You can send EUR to the IBAN and mint EURe directly into the safe ready to be spent. Read more about that here

- Zero fees, there are no fees connected to the use of the card. They will cover any gas fee incurred

Summary: being able to use your MetaMask wallet directly like this is something I think would be appealing to most crypto users. Having the ability to simply skip the whole stage of having to put your crypto on an exchange, even if only for a short time, would or more accurately should be appealing to everyone. And then the ability to get cashback of up to 4% or 5% if you manage to find the NFT on the secondary market is also something that sounds very appealing. Is there any downside to this then?

If you use an ATM a lot, then this card might not be the best one for you. Source: https://pixabay.com/

Well, there is the cost of the card, the very odd number of €30.23, but at least your friends can get a free card using your referral link. =) There is however one small asterisk. That is the $GNO token. Or I should say its price. As I am writing it is currently sitting at $273.21. That means if you are looking to max out the cashback you are looking at a substantial amount of $$, $27,321 to be precise. While it is no way near the $1M some demand you have it still means that most people likely will not be able to get the 4% cashback. Looking at the site you also need to put the $GNO in something akin to staking, let it be there for 7 days and then you will unlock the cashback. I could not find out if the mentioned "safe" simply means you exclude those tokens from being used for payment, or if they require an actual transaction out of your wallet. I guess the former.

You will however get a 2% cashback with 1 $GNO. Putting it on par with some of the others.

THORWallet

Just like Gnosis this is also a self-custodial wallet, meaning you have full control of your crypto and no central exchange is involved. It is also a Visa card, again. Here you also get the free option of getting a Swiss bank account. Both that and the card is issued through ThorWallets partner Fiat24, a Swiss financial institution. This card, and bank account, is however only available to most European countries including Switzerland, but excluding the UK.

The KYC is done through Fiat24, and THORWallet is not involved or has access to that part.

The big difference between this and Gnosis, is that this does not connect directly to your wallet. Instead, you need to transfer the funds you want to spend to the bank account. Meaning it works more or less like a normal account. You do any crypto transfers through the THORWallet app, and it then will do the conversion for you to fiat that then goes into your bank account. At least that's how I understand it to work.

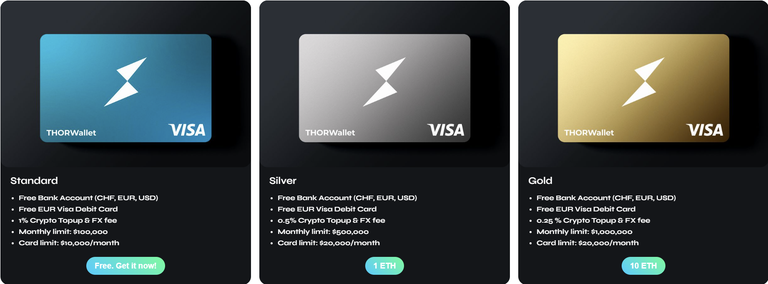

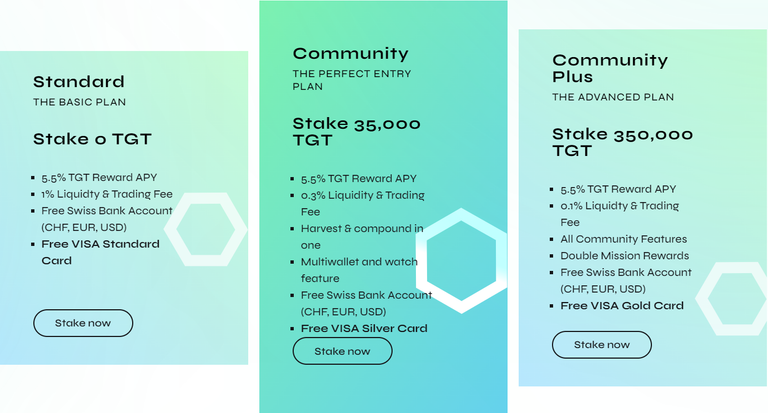

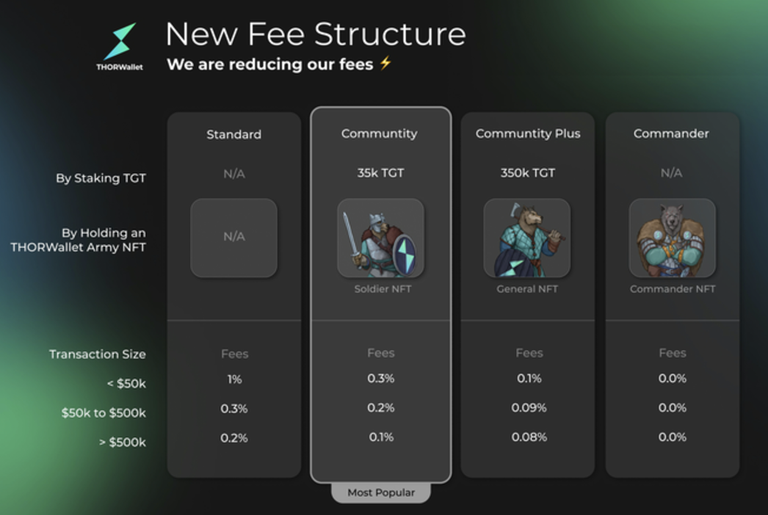

They do have a tire system in place, three tires to be exact. The first appears to have no cost associated with it or any form of staking. Again here is a bit of a mixed bag regarding the information. It looks like the two higher tires of cards either cost 1 $ETH respectively 10 $ETH, or you can stake either 35,000 $TGT tokens or 350,000 $TGT tokens respectively. And by the looks of things, there is a third way, by having a certain NFT. In the worst possible case, you need to both pay the $ETH and stake the tokens.

Source: https://www.thorwallet.org/card

Source: https://www.thorwallet.org/

Source: https://faqs.thorwallet.org/general/community-tiers

My best guess is that there are some crossed wires and some places that have not been updated with the correct information. At least I am fairly sure that is the case to some degree.

Regarding the fees, it appears to only be one form of fee connected and that is the top-up and FX, Foreign exchange fee. And those come from Fiat24 and they are 1%. Then there is a THORWallet fee on these transactions as well. And by the looks of it, the fees range from 1% to 0.25% depending on which tier of card you have. Topups done through bank transfers have no fees.

Bullet points:

- Welcome bonus and mission, there are some welcome bonuses and missions that allow you to earn some $SRB or $TGT, you get a total of 25 $ARB for completing the KYC and depositing the first 50 euros

- IBAN, you will get a Swiss IBAN connected to your Swiss bank account

Summary: with how hard it is to find info, and know which of it is correct, or how things work. I would say this has by far been the worst offender of this. As an extra bonus example on this page at the bottom, they have a "related FAQs" section with three titles listed. But they are not linked to anything. All in all, I would say this gives off an unprofessional look and vibe on THORWallet's part.

The big, and honestly only, selling point is the Swiss bank account that you will be able to get. But if I were in need I would start by contacting Fiat24 directly to see if I can just get an account through them. Sure it would not have the crypto aspect connected to it, but as I see it that part was not the selling point here.

That concludes my list of crypto cards I have taken a closer look at. This is however by no means a complete list. As I stated in the beginning, use this as a starting point and take a look at a few other cards before you settle on one. One thing more I would like to add is that you should also take a look at, and read up on, any token that is "needed" in connection with a card. That can tell you a lot about the project as well. At the very least it will give you an indication of how long the token has been "alive" for. If it is an old proven project that is the foundation, or a very new token, it is unproven because it has not been around for a long time. Simply looking at how long a token or project has been around for can give you a good indication of how risky it would be for you to invest in.

As for me and my decision, I would say it is still up in the air which one I decide to go with. =) Or have I perhaps already decided, and simply chose not to tell?? ^^ Or can it simply be that I don't want to impact your choice by saying which one I chose to go with? Perhaps I will let you know in a future post.

As always, if you have any questions, or comment or like to discuss anything related to this, or anything other as well. Feel free to drop a comment down below and I will respond as fast as I can.

If you would like to support me and the content I make, please consider following me, reading my other posts, or why not do both instead. I really appreciate it if you do.

See you on the interwebs!

Picture provided by: Fair use, each picture force is under each picture

Resources

https://crypto.com/eea/cards

https://help.crypto.com/en/articles/5977463-crypto-com-visa-card-fees-and-limits-europe-applicable-to-europe-residential-address-users-only

https://help.crypto.com/en/articles/5966563-crypto-com-visa-card-fees-and-limits-united-states

https://www.coinbase.com/card

https://www.coinbase.com/blog/coinbase-card-launches-in-the-us

https://help.coinbase.com/en/coinbase/trading-and-funding/other/coinbase-card-faq

https://nexo.com/crypto-card

https://nexo.com/loyalty

https://gnosispay.com/

https://help.gnosispay.com/en/articles/8340445-gnosis-card-country-eligibility

https://help.gnosispay.com/en/articles/8663251-fees-and-limits

https://help.gnosispay.com/en/articles/9094801-restricted-countries-for-card-usage

https://help.gnosispay.com/en/articles/9791917-frequently-asked-questions-iban

https://www.thorwallet.org/card

https://www.thorwallet.org/

https://faqs.thorwallet.org/general/community-tiers--