I've been squeezing once again, things cost money and token portfolios do not liquidate easily, they must be caressed in just the right way. I want to have plenty of funds sitting around during the ECOBANK token sale just to make sure we can make the minimum sale amount and build the hotel infrastructure right away.

Plus its year end/new year, we all should be checking our positions and considering rebalancing in or out, up or down. What's working? What isn't?

I can tell you one thing that has been working for me - SIM:SWAP.HIVE LP position.

dCity has been a major part of my portfolio, and a major part of my overall success, for the whole year. I'm one of the top players in the world, definitely top 4.

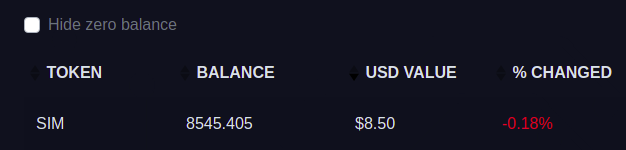

SIM itself is holding steady near a tenth of a penny, it has its ups and downs due to the hive price appreciation, but it has really remained remarkably stable.

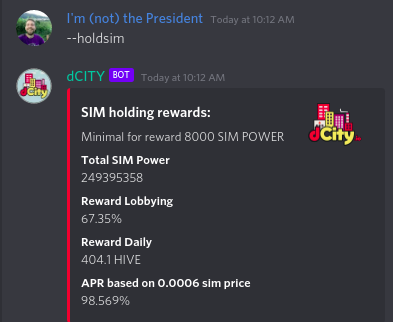

This pool is paying out just north of 48% APR right now, in a mix of mostly SIM and BXT rewards. But that's just the gravy, because the SIM holding rewards from dCity governance is paying out a huge APR right now.

Since its based in HIVE, as the SIM price falls, the holding APR (for marginal investors/holders) goes up!

Almost 100% apr right now, this is applied on only half of the LP. But this is actually a well thought out mechanism, because as the SIM price falls, LPs get more SIM, and increasing their SIM power increases the amount of daily holding rewards that get paid out (APR increase).

49+48 = 97% apr per year on the SIM: SWAP.HIVE pool between HIVE, BXT and SIM rewards.

Now that there is an airdrop coming up, we can expect that there will be some downward pressure on the SIM price as some might prefer to hold only HIVE. It might come to a price where buying in would make a lot of sense, locking into the LP for little HIVE and awaiting the inevitable bounce back.

The future is uncertain, but we keep stacking and building, let's make some new goals for the new year - one of mine will be to grow my LP position in SWAP.HIVE:SIM Liquidity Pool.

What has worked for you in 2021? Where are you stacking your gains?