Warren Buffet called Bitcoin "rat poison squared" at the Berkshire Hathaway's annual shareholder's meeting in 2018.

Let's note that it was a good time to lash onto Bitcoin since it was the start of the bear market, and people may have been more receptive to such characterization. In the meantime, Buffet became more open to the blockchain technology, but not to bitcoin as an investment, although his hedge fund invested in a Brazilian bank that offers bitcoin investments as one of the products.

But I don't want to talk about Warren Buffet or bitcoin here. His stance on bitcoin is his business.

I just wanted to borrow his expression in the title, and made a short introduction about it, for anyone who didn't know it.

I want to talk about the regular people in crypto and what may be rat poison for them. Bitcoin is not rat poison, although I doubt enough of us would have enough bitcoin to make a difference, so maybe something else would.

But... what would? Choices matter! I mean I came across two pieces of information, which, put together paint a pretty grim situation for the regular crypto investor who might be... tempted by so many choices.

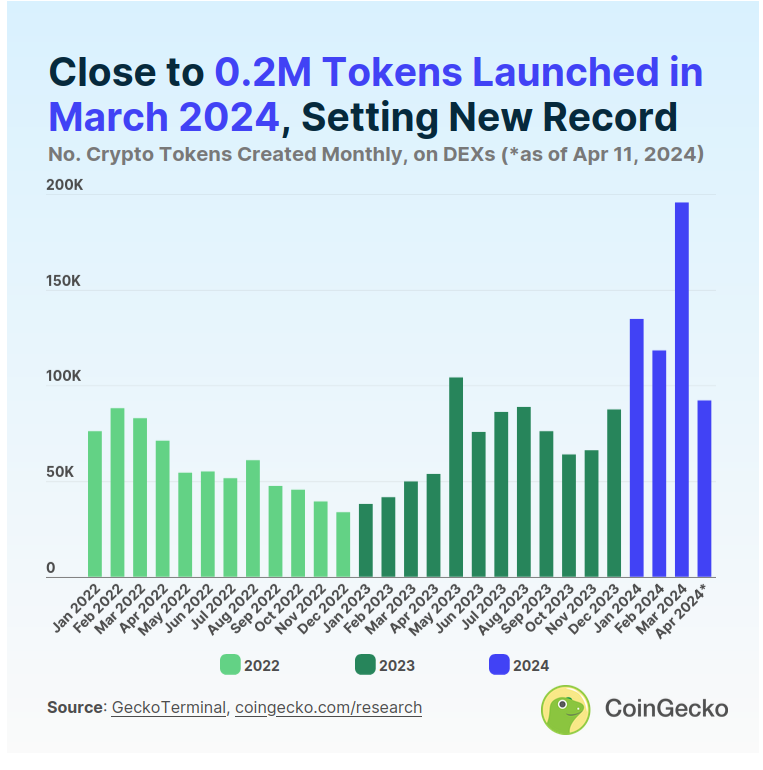

This is one of them, from Coingecko, although there was a better chart elsewhere but I don't seem to find it again:

In the first part of the bull market the trend of newly created tokens was up, obviously. It always is in a bull market. But almost 200 thousand new tokens created in March? Common! It's obvious nobody writes or reads the whitepapers (or any kind of information) for many of those tokens.

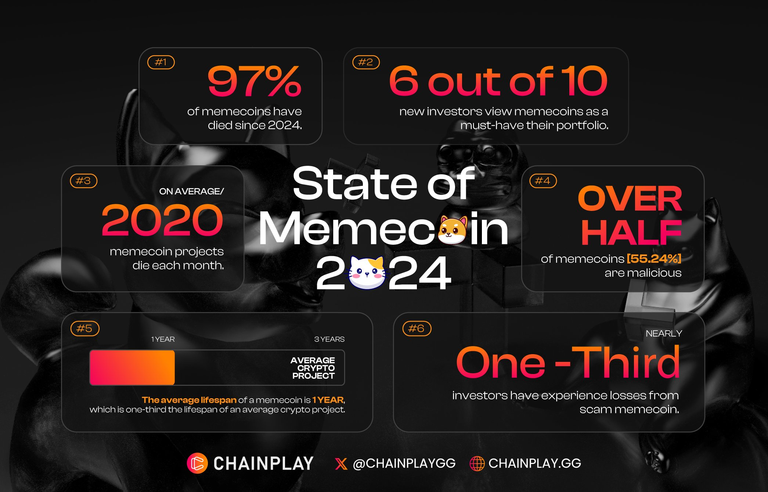

And here's the second one:

You can read the conclusions in the image above, but I'll list them in bullet point form too:

- 97% of memecoins have died since 2024 (note: we are in 2024, so less than 3% lasted more than a few months)

- 6 out 10 new investors view memecoins as a must-have in their portfolios

- on average 2020 memecoin projects die each month

- over half of memecoins (55.24%) are malicious

- the average lifespan of a memecoin is 1 year, which is 1/3 the lifespan of the average crypto project

- nearly one-third investors have experience losses from scam memecoins

These stats are pretty worrying, aren't they? Particularly that newcomers want to have them in their portfolio despite the risks. That's because memecoins are generally nothing but marketing/advertising when they pump, and they attract people.

These two pieces of info are what I would call rat poison for the masses, because most of them are meant to separate the investor/gambler from their funds, may that be fiat or a much better coin from the crypto space.

Can money be made with memecoins? Sure! Evidence shows exorbitant profits can be made with them. But the vast majority either loses or won't make life-changing money, and they expose themselves to extreme risks.

Posted Using InLeo Alpha