The interest rate cuts by the FED are inevitable thanks to the downtrend in the inflation of the U.S. economy. As the inflation has been going lower, the slow down in the economy has given birth to the risk of recession, as well. Now, we are in the middle of an uncertainty regarding the future of the markets as both narratives are quite influential.

If the upcoming data in the U.S. economy does not surprise us with extremely high or low actual data, we may escape from a possible series of red markets once again. However, in the case that the predictions diverge significantly from the actual data, then there will be more rumors regarding the base points of interest rate cuts that will happen.

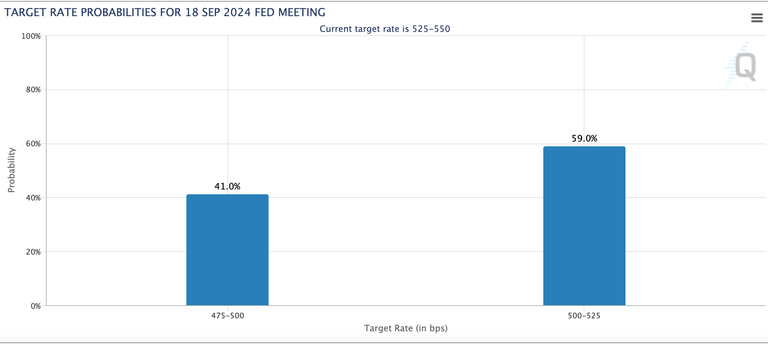

FED Watch by CME provides a great tool to observe the expectations of the investors.

25 bps Cut Expected

The 59% of the investors expect to see 25 bps interest rate cut on September 18. The most reasonable way of performing the interest rate cuts by the FED is definitely keeping the base points as low as possible to secure the growth of the economy while controlling the abnormal price hikes in the services and goods.

The uncertainty in the markets can be clearly understood from the percentages of expected cuts. Under normal circumstances, the division would be 30% for 50 bps whereas 70% for 25 bps as the healthy way of energizing the economy could be this way.

Important Data Coming Friday

However, the expectations may change drastically as a consequence of 2 data coming tomorrow.

The first data to follow will be the nonfarm payrolls for August. The median expectation is to get 164K tomorrow. However, getting lower than 140K or higher than 190K might be a disaster for the markets as one side will buy the story that the inflation stays sticks if people do not lose their jobs whereas the other side will claim that the recession is coming due to the drastic drop in the payrolls.

Regardless of the direction, the data needs to be in line with the median expectation of the investors. Otherwise, the reaction of the price will not be liked by many of us.

Similarly, the unemployment rate forecast is 4.2% for August. As long as the rate comes as 4.2%, there may not be turbulence in the global markets. However, a significant level of mismatch in the forecast and actual data can hit the market terribly.

How many base points of interest rate cuts do you expect from the FED?

Share your thoughts below 👇

Hive On ✌️

Posted Using InLeo Alpha