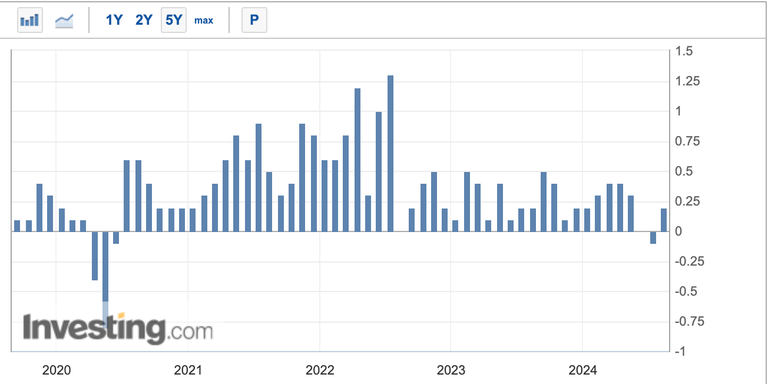

Almost all investors are impatiently waiting for the CPI data coming from the U.S. since the chair of the FED, Powel, always mentions the importance of the Core CPI data to take an action for the interest rates. Over the last 2 years, we have fought against the increasing prices and the central banks did not hesitate to use their weapon of interest rates.

What made the FED achieve its goal is that they played the game according to the rules. The cheap money era has long been over. Those who could not adapt to the shift have either lost opportunities or money over time. However, the economy books write the same way to deal with the sticky problem of the fiat money: increase the interest rates and burn money to diminish the velocity of money.

September is the month that will be full of fear in the market. The CPI data, the FED Meeting, the risk of the Japanese Central Bank increasing the interest rates, and many others.

Among all the data, decisions and risks, the (core) CPI might be one of the most influential one because it is the one that Powel relate everything to.

Interest Rate Cuts to Happen

There is no escape that the interest rates cuts will happen. In the case that the FED misses lowering the rates this month, I can assure everyone that we will witness the crash of all markets once again.

Knowing that the interest rate cuts are inevitable and the risk of recession surpasses the risk of inflation, the attitude of Powel is expected to be dovish.

For traders and investors, the opportunities to grow their bags might be very soon. The stablecoin or fiat money in the portfolios may be used to either Dollar Cost Average or add new assets once all the risks are eliminated.

Contrary to the case in Q1 and Q2 of 2024, I feel quite bullish in short and long terms for the markets. Ons Gold may test $2600+ levels and Bitcoin may stay above $60K if the CPI data, both month over month and year over year, does not exceed the forecast. Remember the fact that the divergence from the predictions can be interpreted as either recession or inflation. So, even though it sounds too difficult, we need to hit the bull's eye 👁️

It might be safer to close the laptops and open them in October for a less - stressful investing atmosphere but if you are a real degen, the party is about to start!

What do you expect to see in the CPI data today?

Share your thoughts below 👇

Hive On ✌️

Posted Using InLeo Alpha