Hello and welcome to this weeks LBI Holdings and Income report. LBI is a pooled investment token based on HIVE with a range of assets backing its token. Each LBI token represents a share of the assets, and the value of that share is published daily on inleo.io as a thread. All you have to do is check our profile page to find the most recent "Asset backed Value" for the token.

LBI has just recently come under new management, and we are working on raising its profile, converting it into a token that shares a portion of its income each week with token holders, while also selecting investments to maximize growth. LBI's roots are firmly planted in the @spinvest ethos of "get rich slowly". We don't chase amazing returns and massive gains, we look for solid investments, long term growth and the magic of compounding.

I missed last weeks report, so all comparisons are to the report from two weeks ago. It's a real busy time for me in the real world, so it'll be pretty brief.

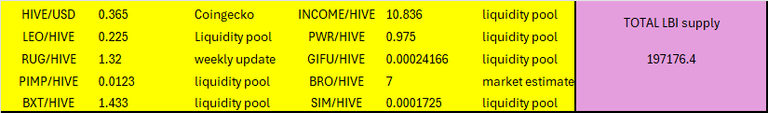

Asset prices this week:

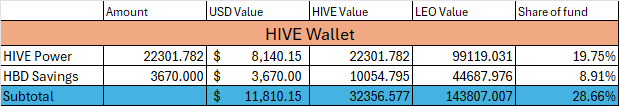

HIVE Wallet

Pretty steady over the last couple of weeks - 80ish HP added over the two weeks.

No changes for the HBD wallet, I continue to withdraw all the interest - most goes into the weekly income split, and a bit stays to cover HBD expenses (Inleo premium and our dev costs for the dividend bot)

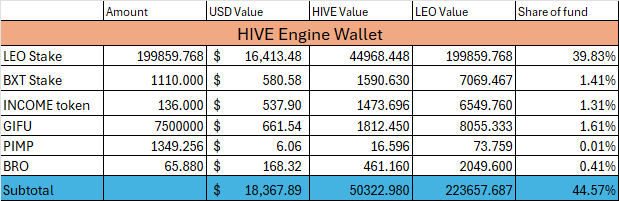

Hive Engine wallet

I have added PIMP into the holdings tracking. It is a solid project, and I plan to add a little each week to build a position. Other than that, our GIFU is going well, kind of tracking along with HIVE. LEO is creeping closer to 200,000. I have swapped us over to liquid payouts now, as 200,000 is our LEO target holding. The liquid LEO payout (instead of staked) will add to income each week, and you will see this on next weeks report.

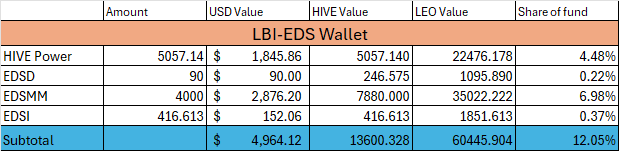

@lbi-eds wallet

There was an issue with the EDS project over the last week, but it was very quickly fixed by @silverstackeruk and this wallet has carried on like nothing happened. The only change is that our EDS tokens are replaced by EDSI. All is good, and I commend SSUK for the rapid fix to ensure the project remained on track. 35 EDS (or should I say EDSI) added over the last two weeks.

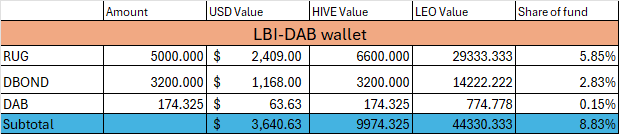

@lbi-dab wallet

We have added 17 DAB over the last two weeks, and 100 DBOND. Also, we have used the extra DBOND payouts from RUG to boost the income distribution.

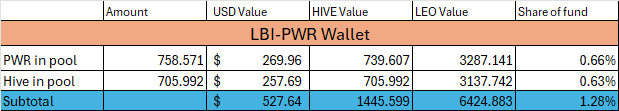

@lbi-pwr wallet

Very reliable as always. Steady income flow from the pool, and steady growth adding around 2.5 in HIVE value each day.

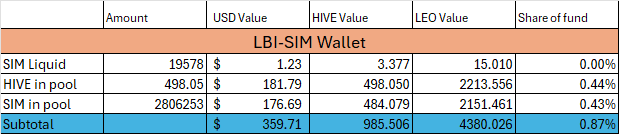

@lbi-sim wallet

Probably our least successful wallet since it was set up. It provides a decent income, but SIM has underperformed our other assets so we are bleeding HIVE out of our pool position from impermanent loss.

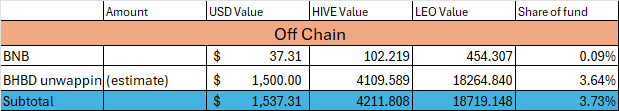

Off Chain

Week 21...

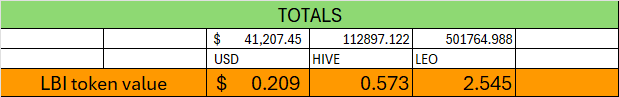

Totals

Nice to be over $40,000 in asset value. This is fluctuating widely of late with the volatility of HIVE - it was back under $30,000 only a couple of days ago. Still, the trend is up, so that is the important thing.

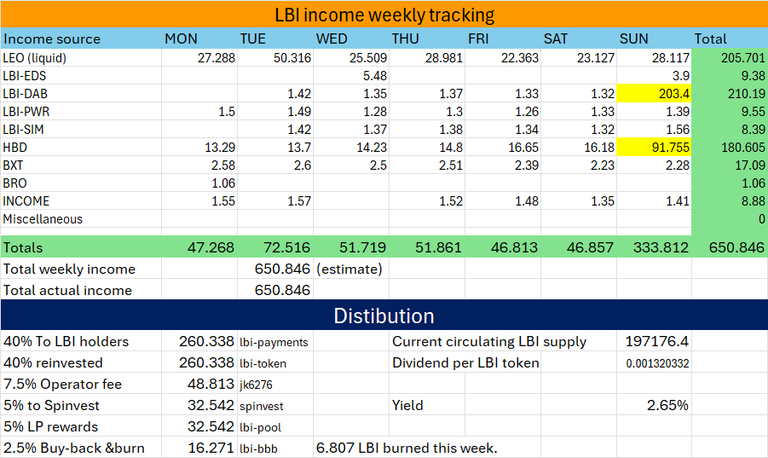

Income statement:

The weeks of 800 LEO per week income are over - it is a struggle to get to 600 these days. Because LEO has increased compared to HIVE, and a lot of the income for this project comes from HIVE income, we get less LEO tokens for our HIVE income.

- We burned 6.807 LBI this week.

- Yield was 2.65% APR for the week.

- The LP is still paying close to 20% APR.

- 260 LEO in dividends sent out (worth around $20)

That's a wrap, hope you all have a great Christmas and Holiday season.

See you all next week for the last report of the year.

Cheers,

JK.

Posted Using InLeo Alpha