U.S Fed Reserve Announces Interest Rate Cuts

The crypto market has experienced a huge price rally which has been driven by the recent announcement by Federal Reserve Chair Jerome Powell indicating that the time has come for lower interest rates.

This announcement has sparked significant hope among investors which has resulted in a substantial increase in the value of crypto currency like Bitcoin and Ethereum. Powell’s statement made during the annual Jackson Hole meeting has not only reassured traditional markets but has also reignited interest in digital assets as a viable investment option.

U.S Fed's Interest Rate Shift

During his speech at the Jackson Hole Economic Symposium Jerome Powell highlighted the diminishing risks to inflation and the increasing risks to employment which is a potential shift towards interest rate cuts in the near future. This marked a significant departure from the Federal Reserve's previous position, where maintaining higher interest rates to curb inflation was a priority.

Powell’s comments suggested that the Federal Reserve is now more focused on supporting economic growth and employment aligning with the current opinions that inflation is under control.

Powell's statement comes amidst growing concerns over economic stability and the strength of the U.S. dollar. These concerns have created a favourable environment for alternative investment options, including cryptocurrencies, which are often seen as a hedge against traditional financial market volatility and inflationary pressures. This shift in focus from controlling inflation to stimulating economic growth has led to a surge in investor confidence pushing the prices of key crypto currencies higher.

Following Powell's remarks Bitcoin's price surged significantly, surpassing the US 64,000 mark after having been below US 50,000 earlier in the month. This dramatic increase shows the shift to a positive outlook in the market which is being driven by expectations of lower interest rates and a weakening U.S. dollar. Investors see Bitcoin as a hedge against potential devaluation of fiat currencies and as a safeguard against economic uncertainty.

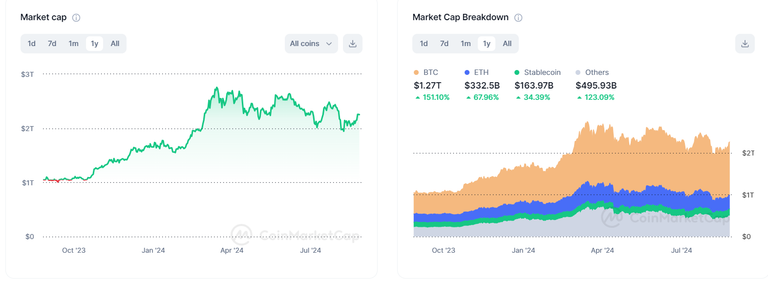

The positive momentum in Bitcoin has also influenced other crypto currencies with Ethereum and other altcoins experiencing notable gains. The broader crypto market capitalization has grown by over USD 623 billion this year alone highlighting the increasing appetite for digital assets among institutional and retail investors alike.

Market reaction

The announcement from the Federal Reserve has also bolstered institutional interest in the crypto market. Institutional investors including hedge funds, asset managers and corporations have been closely monitoring the macroeconomic environment. The prospect of lower interest rates makes high yield investments in traditional markets less attractive, pushing institutional investors towards alternative assets like crypto currencies that offer potentially higher returns.

Recent developments in the tech sector particularly with companies like Nvidia experiencing significant growth, have contributed to the optimistic outlook for the crypto market. Nvidia’s strong earnings and dominance in the artificial intelligence (AI) sector have reassured investors about the health of technology stocks. This positive sentiment has spilled over into the crypto market given the correlation between technology stocks and cryptocurrency prices.

The Federal Reserve’s shift towards potential interest rate cuts is seen as a strategic move to support economic growth amid global economic uncertainty. This approach not only impacts traditional financial markets but also has far reaching implications for the crypto currency space. Lower interest rates tend to reduce the cost of borrowing, encouraging investment in high growth sectors, including technology and digital assets.

Lower interest rates have been associated with increased liquidity in financial markets which often leads to higher valuations for risk assets. In this context crypto currencies are well positioned to benefit from an influx of capital seeking higher returns. The positive outlook for Bitcoin and other cryptocurrencies is reinforced by the anticipation of increased liquidity, which could drive further gains in the market.

U.S Election Impacts

The upcoming U.S. presidential election also adds a layer of uncertainty As noted by some analysts, former President Donald Trump’s pro crypto stance could lead to supportive regulatory shifts if he returns to power. On the other hand, a different political outcome could result in a more stringent regulatory environment which could impact the crypto market's growth prospects.

The Federal Reserve's recent indication that the time has come for lower interest rates has acted as a turning point for the crypto market. Bitcoin’s sharp price increase, along with gains in other major crypto currencies reflects growing investor confidence in digital assets as a hedge against economic uncertainty.

While the future of the crypto market looks promising people should consider the broader economic and political landscape when making investment decisions especially with the current global war’s occurring.

Image sources provided supplemented by Canva Pro Subscription this is not financial advice and readers are advised to undertake their own research or seek professional financial services.

Posted Using InLeo Alpha