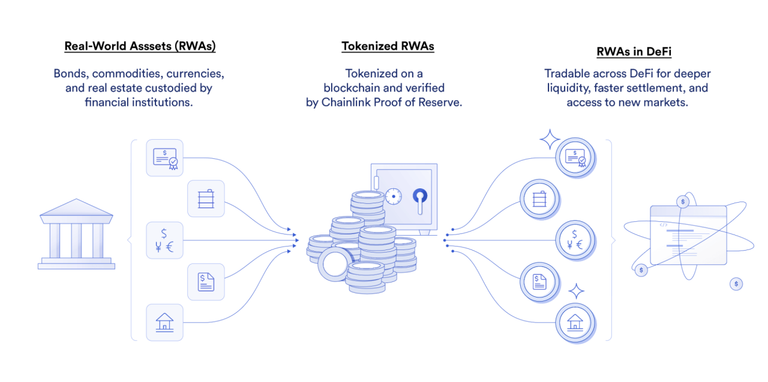

Massive Growth Potential:

- The tokenization of real-world assets (RWA) is expected to disrupt various market sectors, with projections suggesting a growth of over 50 times by 2030, according to a report by Tren Finance. Currently, approximately $185 billion worth of real-world assets have been tokenized, with stablecoins dominating the RWA sector, holding over $170 billion in market value. Other key sectors experiencing tokenization include real estate, commodities, and government bonds.

Expansion into Unique Markets:

- As the tokenization of real-world assets matures, its application is likely to expand beyond traditional financial markets. Niche projects are emerging, demonstrating that RWAs can revolutionize industries in unexpected ways. Zachary Nelson, head of growth at Tren Finance, highlights that improvements in blockchain infrastructure, such as scalability, security, and interoperability, have significantly lowered adoption barriers, enabling founders to explore non-traditional asset classes.

SkyTrade and Tokenization of Air Rights:

- A prime example of this expansion is SkyTrade, which focuses on tokenizing and trading air rights. These rights allow property owners to monetize the vertical space above their land, including drone flight paths. The global market for air rights is vast, with SkyTrade estimating its potential value at up to $30 trillion. For instance, air rights in New York are valued at around $550 billion, while those in London are estimated at $51 billion.

- Jonathan Dockrell, co-founder and CEO of SkyTrade, explains that property owners can claim their air rights through the platform, tokenize them, and make them available for trading. These tokenized air rights have multiple use cases, including repurposing, drone operations, and view preservation. Dockrell notes that demand for air rights is growing, driven by real estate development and advancements in drone technology, and SkyTrade aims to create an efficient market for their exchange.

Simplifying the Tokenization Process:

- SkyTrade has already tokenized 7,000 airspaces worth $35 million as of early 2024. Dockrell elaborates on how property owners or brokers can list airspace on the platform, where tools help estimate the value based on factors such as location, demand, and future use. The platform converts these rights into land tokens using smart contracts, ensuring secure and transparent transactions. The tokens are recorded on the Solana blockchain, providing an immutable ownership record that builds trust in the process. These tokens can be traded on SkyTrade’s marketplace, offering opportunities for buying, selling, or leasing air rights.

Innovative Applications: LEGO Model Tokenization:

- Another unique application of tokenization is seen in the LEGO industry. 3DPass, a community-driven layer-1 blockchain, enables users to upload unique 3D objects like LEGO models onto the blockchain. Adam Moor, a representative from 3DPass, explains that creators can scan their LEGO models, tokenize them through the 3DPass app, and even break them down into individual bricks for transfer or sale. This approach also helps combat counterfeiting through a digital fingerprint, known as HASH ID, which verifies each object’s authenticity.

Agricultural Tokenization with SankalpTaru:

- The potential for tokenization extends to agriculture, a market expected to grow from $11.3 trillion in 2022 to $15.6 trillion by 2030. Ankur Rakhi Sinha, co-founder and CEO of Airchains, describes how the SankalpTaru NGO in India is tokenizing tree plantations. Using innovative technology, every tree planted is recorded as a tokenized transaction secured by advanced cryptographic techniques such as zero-knowledge proofs and fully homomorphic encryption. This ensures privacy and data integrity while providing a transparent, verifiable record of each tree planted. SankalpTaru has registered over 10 million trees on the blockchain, enhancing transparency for donors and helping organizations meet corporate social responsibility (CSR) goals.

Challenges Slowing Adoption:

- Despite these groundbreaking innovations, challenges such as regulatory uncertainty, liquidity risks, asset price volatility, and operational vulnerabilities could hinder widespread adoption. A report from the Financial Stability Board highlights these concerns, but Zachary Nelson of Tren Finance remains optimistic. He points to the growing success of tokenization initiatives by major institutions like BlackRock and Franklin Templeton as evidence that the sector will continue to expand, potentially democratizing access to traditionally exclusive markets.

Future of Tokenization:

- Nelson believes the future of tokenization lies in its ability to democratize access to markets and services historically reserved for large institutions. As more targeted solutions emerge across various industries, tokenization has the potential to make these sectors more accessible to everyday users while addressing specific market needs. This could lead to a transformative shift in how assets are managed and traded on a global scale, opening up new opportunities for individuals and businesses alike.

In summary, the tokenization of real-world assets is poised to revolutionize various industries, from real estate and agriculture to niche sectors like air rights and digital models. While there are regulatory and technical hurdles to overcome, the growing adoption of blockchain technology, combined with innovative applications, signals a promising future for tokenized markets.