Microsoft is urging shareholders to reject a proposal from a think tank advocating for investment in Bitcoin, arguing that this stance aligns more closely with long-term shareholder interests. In a statement released Thursday, the U.S. tech giant suggested that revisiting this matter is unnecessary, as Microsoft’s leadership has “already carefully considered this topic.”

The company stated that past evaluations included Bitcoin and other cryptocurrencies among the options reviewed, and they continue to monitor crypto trends and developments to inform future decisions.

Balancing Stability with Crypto Volatility

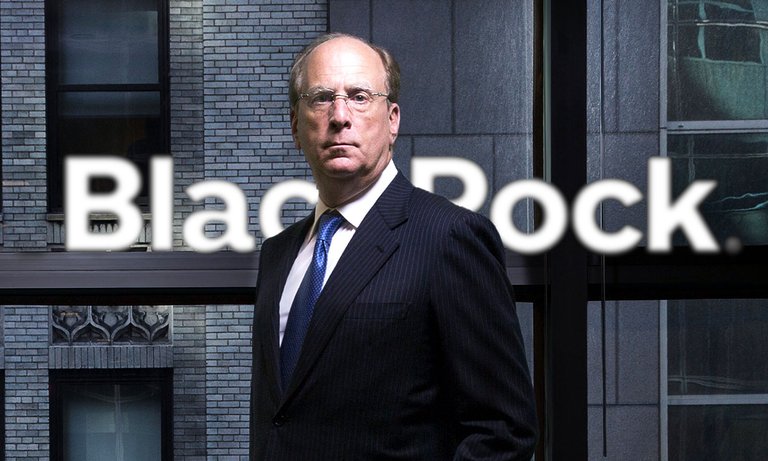

Microsoft maintains that its corporate balance sheet should prioritize stability and predictability, essential for maintaining liquidity and supporting operations. Major shareholders, including Vanguard, BlackRock, and State Street, must consider the potential impacts of cryptocurrency volatility on the company’s financial stability. Microsoft emphasized that it has robust processes for managing and diversifying corporate assets to benefit shareholders in the long term. The tech firm reiterated that a public review of this proposal is unwarranted given its established approach.

The Think Tank’s Proposal: Bitcoin as a Strategic Asset

The National Center for Public Policy Research, the think tank pushing the proposal, plans to introduce the idea of Bitcoin diversification at Microsoft’s upcoming annual meeting on December 10. Pointing to MicroStrategy as a case study, the Center highlighted that MicroStrategy’s bold investment in Bitcoin led to a 300% stock performance increase, despite the company’s comparatively limited business activity relative to Microsoft. The Center argued that institutional and corporate Bitcoin adoption is on the rise, noting that Microsoft’s second-largest shareholder, BlackRock, now offers a Bitcoin ETF to its clients.

The think tank suggested that companies consider allocating at least 1% of their assets to Bitcoin, as a strategic hedge or diversification move.

Strategic Investment in AI: Microsoft’s Recent Moves

Earlier this year, Microsoft made a significant $1.5 billion investment in G42, a UAE-based artificial intelligence firm, aiming to expand its presence in the AI sector. This move underscores Microsoft’s commitment to staying at the forefront of technological advancements, focusing on areas it perceives as more stable and strategically aligned with long-term growth.

Microsoft’s resistance to Bitcoin investments, despite the rising appeal among some major shareholders and institutions, reflects its cautious approach to financial stability and a commitment to shareholder value over time.

Follow

Follow