Robert Kiyosaki, the well-known investor and author of the bestseller Rich Dad Poor Dad, famous for his predictions of looming financial crises, has once again expressed his optimistic outlook on Bitcoin. According to Kiyosaki, the leading cryptocurrency could soon experience a significant surge in value.

In his most recent post on social media platform X (formerly Twitter) on September 15, Kiyosaki explained that Bitcoin, along with precious metals like gold and silver, is likely to see strong price increases following the next interest rate cuts by the U.S. Federal Reserve (Fed).

Kiyosaki believes that once the Fed reduces interest rates, there will be a shift of capital from what he calls "fake assets," such as U.S. bonds, to "real assets" like gold, silver, real estate, and Bitcoin. He predicts that investors holding these tangible assets are in a prime position to significantly grow their wealth during this economic shift.

Kiyosaki's post stated:

"The prices of Bitcoin, gold, and silver are about to explode. As I’ve mentioned before, while you all argue about which is better—gold or Bitcoin—you’re missing the point. The real losers are those stuck in fake assets. When the Fed makes its ‘pivot’ by cutting rates, real assets will skyrocket in value, and the so-called fake money will flee from fake assets.”

Gold vs. Bitcoin: A Redundant Debate

Kiyosaki has made it clear that, in his view, the ongoing debate over whether gold or Bitcoin is the superior asset is irrelevant. He likens this argument to a debate over whether a Ferrari or Lamborghini is the better car.

For Kiyosaki, what matters is not which asset is better, but the role these assets play in safeguarding wealth, particularly during times of economic turmoil. He stresses that both Bitcoin and gold serve as reliable stores of value and are essential for protecting one’s financial standing during periods of uncertainty.

Drawing from his military background, Kiyosaki urged investors to follow the principle of “Acta non Verba,” which means “Actions, not words.” In his view, when facing financial instability, it’s more important to take decisive action rather than engage in endless discussions. Rather than continuing to debate, Kiyosaki suggests that it’s time for investors to start acquiring real assets.

He wrote:

“Remember the lesson I learned from the military academy and the Marines: Acta non Verba. Your actions speak louder than words. Stop talking and ask yourself: ‘How much gold, silver, and Bitcoin do I actually own?’”

Criticism of the Federal Reserve and the Call to Invest in Real Assets

Kiyosaki has been a vocal critic of the Federal Reserve's monetary policies, particularly accusing the central bank of driving high inflation and contributing to economic instability. He argues that the Fed’s actions have created an unsustainable system of "fake money" that props up traditional financial assets like bonds.

According to Kiyosaki, when the Fed eventually lowers interest rates, these so-called "fake assets" will lose value, leaving investors exposed to significant losses. As a precautionary measure, he advises investors to prepare for a potential market crash by allocating their capital toward more stable, tangible assets—namely gold, silver, and Bitcoin.

In addition to his focus on these traditional stores of value, Kiyosaki has also expressed interest in other emerging sectors, including lithium mining, carbon credits, and alternative cryptocurrencies (altcoins) like Ethereum and Solana.

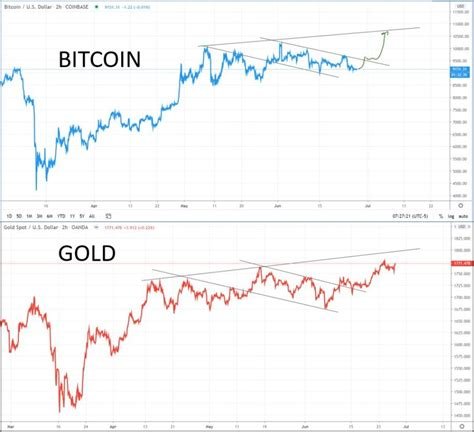

Kiyosaki has consistently warned about the dangers posed by the mounting U.S. national debt, which he believes only further underscores the importance of investing in assets like Bitcoin, gold, and silver. Historically, these assets have performed well even in uncertain economic environments, with gold reaching an all-time high of over $2,500.

Bitcoin Price Analysis and Predictions

After reaching a high of $60,000 over the weekend, Bitcoin has experienced a slight decline, currently trading at around $58,537. Despite this dip, Bitcoin has shown a positive performance in the weekly chart with a gain of 5.99%, although it has seen a minor 1.18% loss over the past month.

Renowned analyst Alan Santana has raised concerns about Bitcoin’s near-term trajectory, suggesting that the cryptocurrency may face further downward pressure. Technical indicators in the chart display bearish signals, leading Santana to forecast that Bitcoin could drop to a price range between $53,500 and $39,000.

Conclusion

Kiyosaki’s long-standing advocacy for Bitcoin, gold, and silver stems from his belief that these assets provide a hedge against the instability of the traditional financial system. With the possibility of the Federal Reserve lowering interest rates in the near future, Kiyosaki maintains that investors should move quickly to protect their wealth by shifting away from traditional assets like U.S. bonds, and instead focus on acquiring what he sees as more reliable, real assets. His warning comes at a time when the crypto market faces both volatility and potential growth, adding urgency to his call for action.