In a decisive shift for the digital asset landscape, President Donald Trump has vowed to position the United States as the global leader in cryptocurrency innovation. Early moves, including an executive order establishing regulatory clarity, signal a more crypto-friendly stance. The order bans the development of a Central Bank Digital Currency (CBDC) and creates a digital asset national stockpile. Trump has also pardoned Ross Ulbricht, the controversial founder of the Silk Road marketplace.

While these steps signal progress, experts emphasize that significant challenges remain in fostering a sustainable crypto ecosystem.

A Shift Toward Crypto-Friendly Policies

The Trump administration's proactive measures aim to reverse years of regulatory uncertainty that have stifled innovation. Industry leaders are optimistic about this shift. Will Martino, co-founder of Kadena, notes that the harsh regulatory environment placed the U.S. at a disadvantage in the global Web3 landscape. However, he believes the current direction shows promise:

"It would be foolish to not be incredibly bullish on the U.S.-based crypto market," Martino said.

Martino advocates for a strategic crypto reserve that supports a broad array of U.S.-based blockchain projects rather than focusing exclusively on Bitcoin. This inclusive approach could foster widespread innovation and signal the U.S.’s commitment to nurturing its crypto industry.

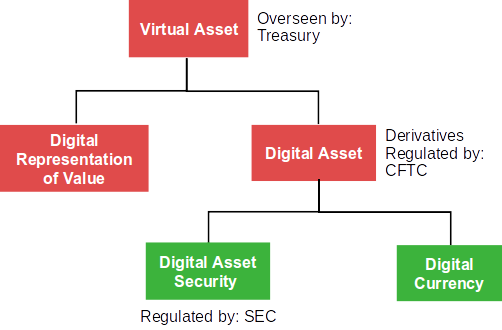

Reforming Crypto Regulations and ETFs

The Trump administration's move toward regulatory clarity has inspired hope among industry leaders. Avidan Abitbol, project director for the Data Ownership Protocol (DOP), highlights the need for the U.S. Securities and Exchange Commission (SEC) to adopt a clearer approval process for crypto exchange-traded funds (ETFs).

Abitbol believes such a framework would provide institutions with safer, more structured access to the crypto market. The resignation of former SEC Chair Gary Gensler has already led to a surge in crypto ETF applications, with 33 proposals currently under review. These applications span not only Bitcoin and Ethereum but also Solana, Litecoin, and even a Trump-themed ETF.

Ending Regulation-By-Enforcement

A critical aspect of the administration’s agenda is ending the regulation-by-enforcement approach that has driven talent and innovation out of the U.S. Inconsistent rules have left companies guessing and significantly increased legal and compliance costs.

Dave Hendricks, CEO of Vertalo, criticized this approach as a “pin-the-tail-on-the-donkey” style of enforcement. He and Martino agree that clear, predictable regulations are essential for fostering innovation.

Martino explained:

"U.S.-based Web3 companies are playing a game where we ‘think’ we know the rules, but they can change at any moment, leaving us at a loss.”

Challenges of the Bank Secrecy Act and Innovative Compliance

The Bank Secrecy Act (BSA), which imposes strict reporting requirements for financial institutions, has drawn criticism for its potential application to digital asset providers. Critics like Natalie Smolenski, executive director of the Texas Bitcoin Foundation, argue that the BSA infringes on personal freedoms by funneling all economic transactions through banks controlled by the state.

Smolenski emphasized:

"In a free society, using the banking system should be a choice, not a legal requirement."

Innovation in compliance, such as zero-knowledge proofs (ZKPs), could strike a balance between privacy and transparency. Abitbol advocates for the adoption of ZKPs, which enable transaction validation without revealing sensitive details, ensuring compliance while protecting privacy.

Tax Reforms: A Potential Game-Changer for Adoption

Tax policies remain a hurdle for both investors and businesses in the crypto space. New IRS guidelines introduced in mid-2024 require centralized exchanges to report digital asset transactions. While these measures aim to simplify tax compliance, they add complexity for market participants.

Abitbol highlighted the potential of eliminating capital gains taxes on U.S.-based crypto transactions, which could drive mainstream adoption by making it easier to use crypto for everyday purchases.

"This could be a game-changer for adoption," Abitbol said, pointing to the need for a balanced tax regime.

Educational and Legislative Challenges

Despite these advancements, misinformation and lack of understanding about blockchain technology remain significant obstacles. Martino expressed concern that policymakers and industry leaders often fail to differentiate between cryptocurrency and blockchain technology, limiting their ability to see the technology's broader benefits.

"There is a massive educational piece and a new narrative that needs to be told," Martino stressed.

Additionally, the lack of bipartisan cooperation poses a challenge to passing long-lasting legislation. Daniel Polotsky, founder of CoinFlip, warned that without legislative backing, pro-crypto policies implemented by the executive branch could be reversed by future administrations.

"With narrow majorities in both chambers, Republicans will have to work with Democrats to pass legislation before the midterms," Polotsky said.

Conclusion: A Pivotal Moment for U.S. Crypto Leadership

The Trump administration’s crypto-friendly measures represent a significant turning point for the U.S. digital asset industry. From fostering innovation to addressing outdated regulations like the Bank Secrecy Act, these efforts signal a commitment to positioning the U.S. as a global leader in cryptocurrency.

However, challenges remain, particularly around education, bipartisan legislation, and balancing innovation with regulatory clarity. If successful, these initiatives could usher in a new era of growth for the crypto industry, not only in the U.S. but globally.