I love my crypto but it's volatile and apart from Hive and Bitcoin offers very little substance behind your investments. Money in the bank is worthless and worse losing value from when it gets deposited.

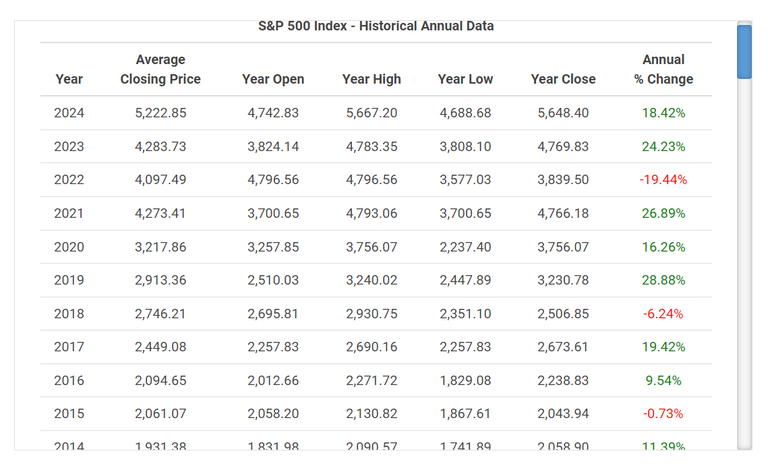

So time to diversify into stocks a little bit i think. I don't know much about them so research will be the first step but it seems that the Vanguard S&P 500 is a fairly safe bet composing of the top 500 companies in America and growing in value at a nice rate over the past twenty years.

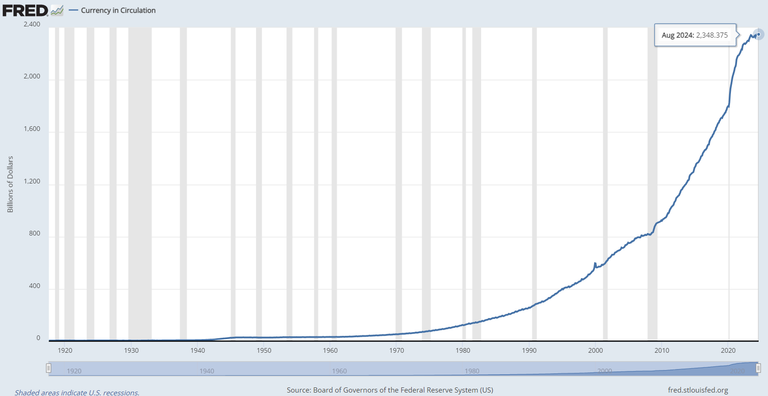

Now I would much rather start buying a year that it is dropping by 20% but that might not happen for a long time again. Instead it will be a DCA into the fund over a period of years instead of a big lump sum. With the value of the dollar dropping at an extraordinary rate it seems that these values should keep increasing as smart money won't be sitting in the banks.

Ref: Fredhttps://fred.stlouisfed.org/series/CURRCIR

From Chatgpt when asked.

Investing in the S&P 500 can be a good idea for many investors, but whether it's right for you depends on your individual financial goals, risk tolerance, and investment horizon. Here are some key factors to consider:

Advantages of Investing in the S&P 500:

The S&P 500 index includes 500 of the largest publicly traded companies in the U.S., spanning various sectors. This broad exposure helps reduce the risk associated with investing in individual stocks.

Historical Performance:Over the long term, the S&P 500 has delivered strong returns, averaging around 7-10% annually when adjusted for inflation. While past performance doesn't guarantee future results, the index has shown resilience over time.

Simplicity:Investing in an S&P 500 index fund or ETF is straightforward and requires less time and effort compared to picking individual stocks.

Lower Costs:Index funds and ETFs that track the S&P 500 generally have lower expense ratios compared to actively managed funds, meaning more of your money stays invested and can grow over time.

Compounding:Reinvesting dividends from S&P 500 investments can lead to significant growth over the long term due to the power of compounding.

A solid and relatively safe bet.

It has a lot of the factors that i look for with my investments. Long term and risk averse. Diverse set of stocks. Compounding investments. Historical gains.

From what i have seen in Ireland it's a very easy task to start investing into the Vanguard ETF. You just need to open an account with a site like Degiro who have zero ETF fees with a handling fee and annual charge instead. Small in the long run.

There are lots of options for buying into these funds but an established site like Degiro has good information on how to get started and makes it easy to jump in at a low cost.

Their total expense ratio is 0.07 which is about as low as you are going to get for these accounts. I'll make a small purchase for now and do more research for the future.

Posted Using InLeo Alpha