Source

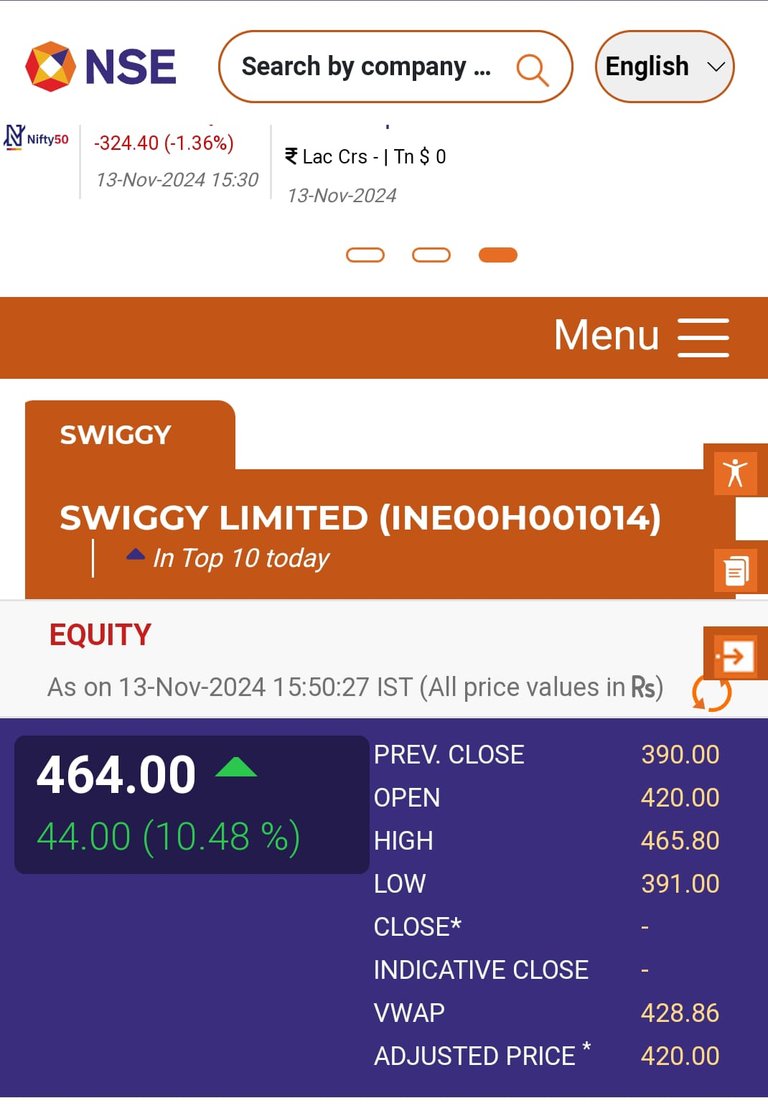

India's popular online food delivery platform, Swiggy, listed its IPO in the share market on Wednesday, giving investors a reason to smile. Swiggy’s stock debuted on the Bombay Stock Exchange (BSE) at a 5.64% premium, opening at Rs 412 per share. Meanwhile, on the National Stock Exchange (NSE), it listed even higher at Rs 420, a 7.69% premium. This listing day gave immediate profit to those who got allotments in the IPO. Although experts noted the listing wasn’t as strong as expected, they felt it was still impressive, especially considering the weak market conditions. Many recommend holding onto the stock, suggesting it has good potential to give better returns in the future.

Listing Day Profits

The IPO’s price band was set between Rs 371 to Rs 390, with a final issue price of Rs 390. Since it listed at Rs 412 on the BSE, early investors made a profit of Rs 22 per share. Soon after, the stock surged to Rs 449, giving investors a gain of over 13%.

Initial Lukewarm Response, Then a Strong Finish

Swiggy’s IPO was open for subscription from November 6 to November 8. The response from individual investors was slow for the first two days. However, on the final day, institutional investors showed strong interest, helping the IPO reach 3.6 times subscription.

Steady Growth After Listing

By the end of the first day, Swiggy’s stock closed at Rs 464, showing steady growth beyond its listing price. This performance has strengthened investor confidence. Experts believe that holding the stock for a while could yield further benefits, so there’s no need to rush to sell.

Conclusion

Swiggy’s IPO may not have had the biggest response initially, but it has proven profitable for early investors. With its listing at a premium and further gains after the market closed, Swiggy’s stock seems set to offer solid returns in the near future. For investors, it’s a promising start, and holding onto the shares could prove to be a smart move.