For those who may not be familiar, a hedge position is a trading strategy where you take a position in a security to offset the risk of another position. In my case, I had taken a long position in Ethereum, expecting the price to rise. However, as the price began to fall, I decided to hedge my position by taking a short position in Ethereum. My goal was to limit my losses in case the price continued to drop.

As a cryptocurrency trader, I've had my fair share of ups and downs. But one experience that still haunts me is being trapped in a hedge position while trading Ethereum. In this post, I'll share my story of how I got stuck in a hedge.

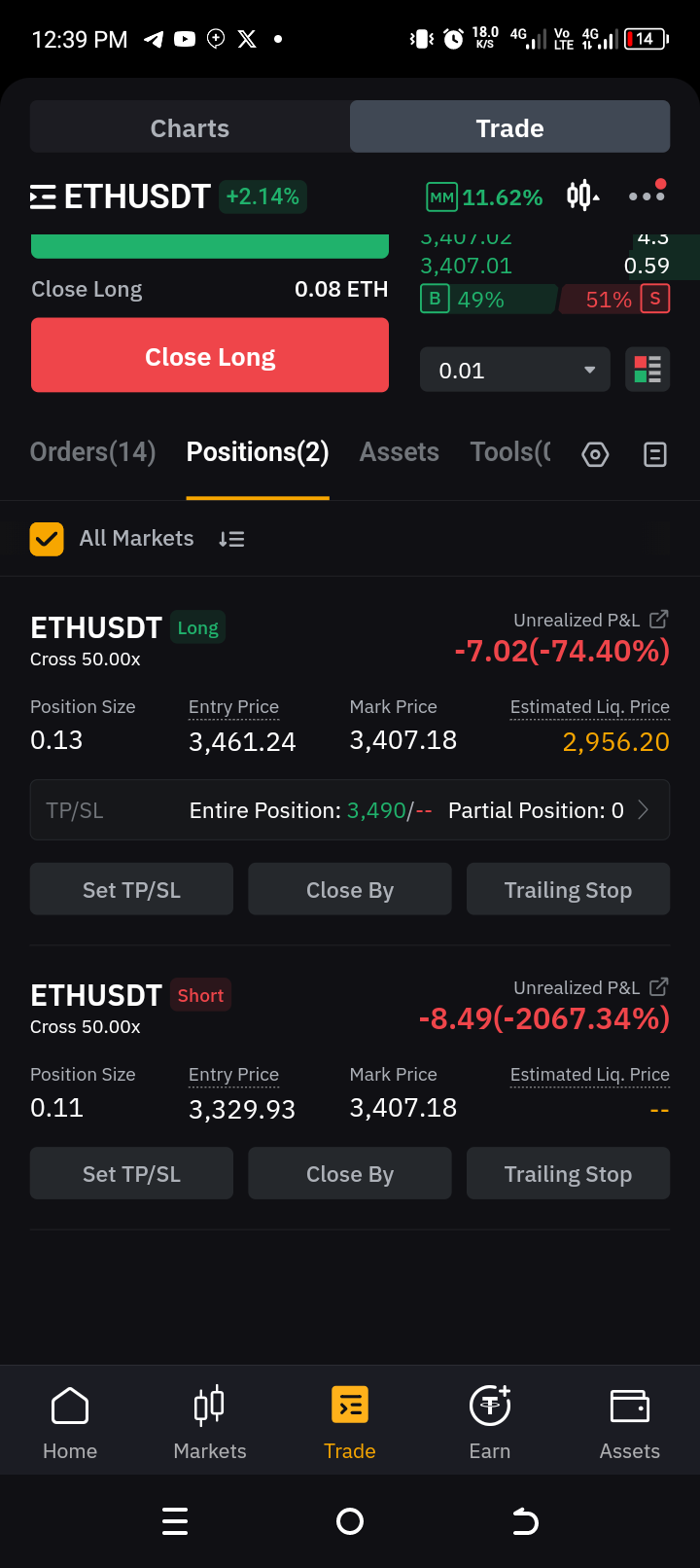

How I Got Trapped: As the price of Ethereum continued to fall, my short position began to gain value. However, my long position was still open, and I was unable to close it due to the significant losses I would incur. I was essentially trapped in a hedge position, with my short position gaining value but my long position losing value. Being trapped in a hedge position is a nightmare for any trader. You're stuck in a situation where you can't close your positions without incurring significant losses. The market is moving against you, and you're powerless to do anything about it. The emotional toll of being trapped in a hedge position is immense, and it can be devastating to your trading psychology. As the notion of Escaping I tried to escape the hedge position, I faced several challenges. The first challenge was the significant losses I would incur if I closed my long position. The second challenge was the risk of the market moving against me, causing my short position to lose value. The third challenge was the emotional toll of being trapped, which made it difficult for me to think clearly and make rational decisions.

Lessons Learned while been stuck is that , I realize that I made several mistakes that led to me being trapped in a hedge position. The first mistake was not having a clear exit strategy for my long position. The second mistake was not managing my risk properly, which led to me taking on too much exposure. The third mistake was not being patient and waiting for the market to move in my favor.

Being trapped in a hedge position while trading Ethereum was a painful experience, but it taught me valuable lessons about risk management, trading psychology, and the importance of having a clear exit strategy. If you're a trader, I hope my story can serve as a warning and a reminder to always be careful and patient when trading. Remember, it's not about being right or wrong, it's about managing your risk and protecting your capital.

What are your thoughts on hedge positions and risk management? Share your comments and experiences below.

Thank you for stopping by.