Trading Bitcoin can be a thrilling experience, with the potential for huge profits and losses. However, it's essential to follow trading rules to minimize risks and maximize gains. One of the most critical rules is setting a stop loss, which helps to limit losses if the market moves against you. In this blog, we'll explore the dangers of breaking this rule and the consequences of not setting a stop loss while trading Bitcoin.

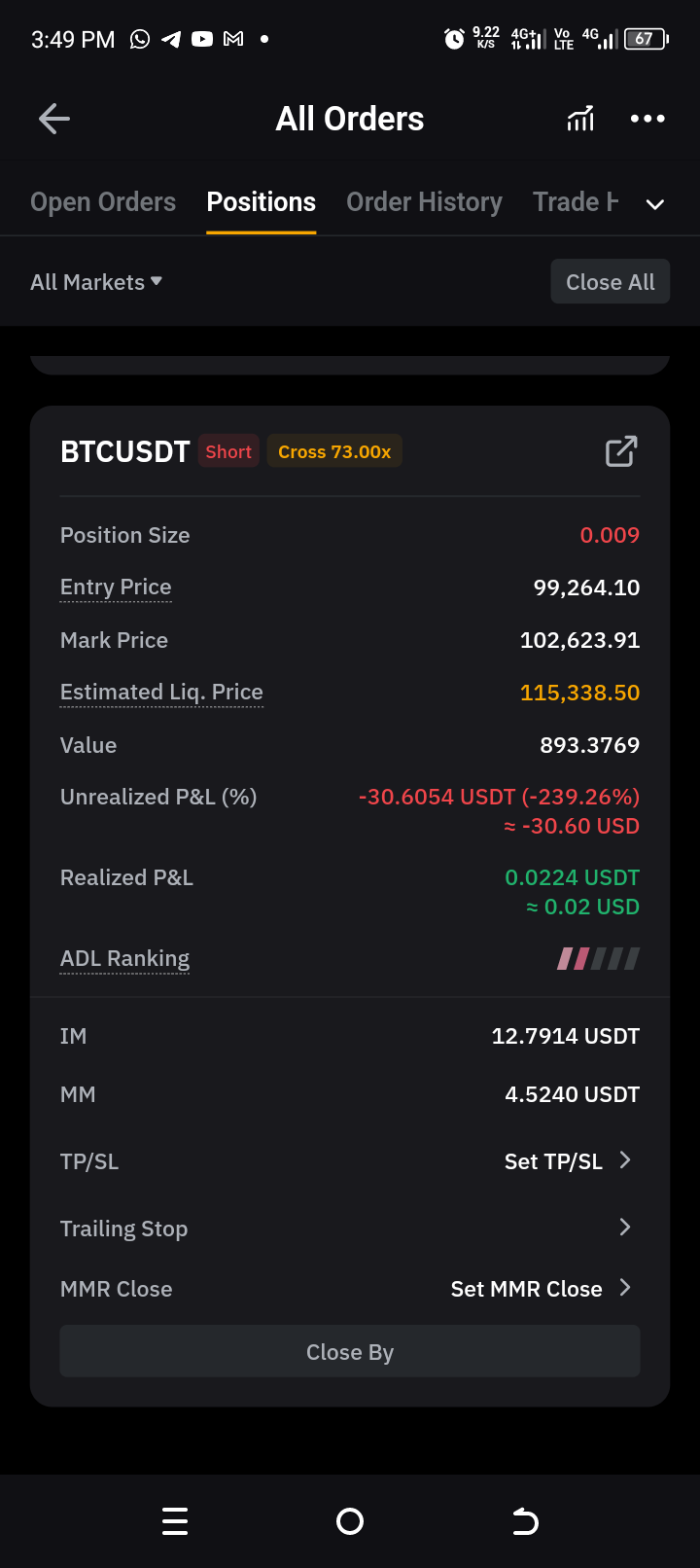

The Risks of Not Setting Stop Loss while trading Bitcoin can be disastrous. Without a stop loss, you're exposing yourself to unlimited losses, which can quickly deplete your trading account. The cryptocurrency market is known for its volatility, and prices can fluctuate rapidly. If you're not prepared for a sudden downturn, you could lose a significant portion of your investment.

Trading Bitcoin without setting a stop loss is a recipe for disaster. It's essential to follow trading rules and set a stop loss to minimize risks and maximize gains. By doing so, you'll be able to protect your investment and achieve your financial goals. Remember, trading is a game of risk management, and setting a stop loss is a critical component of a successful trading strategy.

The Consequences of Breaking Trading Rules, such as not setting a stop loss, can have severe consequences. Which may include:

Significant losses: Without a stop loss, you're exposing yourself to unlimited losses, which can quickly deplete your trading account.

Emotional distress: The stress and anxiety of watching your investment disappear can be overwhelming, leading to emotional distress and poor decision-making.

Loss of confidence: A significant loss can erode your confidence, making it challenging to continue trading and achieving your financial goals.

To avoid the dangers of breaking trading rules, it's essential to set a stop loss while trading Bitcoin or any speculative assets one should learn the following:

Set a stop loss: Determine a stop loss level based on your risk tolerance and market analysis.

Use a trailing stop: A trailing stop loss adjusts to the changing market price, ensuring that you lock in profits and limit losses.

Monitor your trades: Regularly monitor your trades and adjust your stop loss levels as needed.

What's your experience with setting stop loss while trading Bitcoin? Share your stories and tips in the comments below!