Hello and Namaste Everyone

Credit card is a very useful product by the bank and I say this based on my experience. I have been using credit for the last few years and its from HDFC Bank. First I applied for the card in 2021 and I got it in the next few days. It was new for me and I did not know how and where to use this card. I believe in learning and I learnt more about it. Now I use credit for most of my expenses wherever possible.

I am not a heavy credit card user but I make sure to pay the outstanding before the due date. I mean to say I don't spend a big amount and I use the card only for the necessary expenses and I can't avoid them. I understand that its not free money and I should be careful while using it. I not a luxury that I can use for unnecessary things because in that case repayment would be a challenge for me. I use credit cards only for the necessary expenses and I had to do it even with cash so its a good use of card. I earn some reward points also and it also helps me to build a credit history and its another good thing.

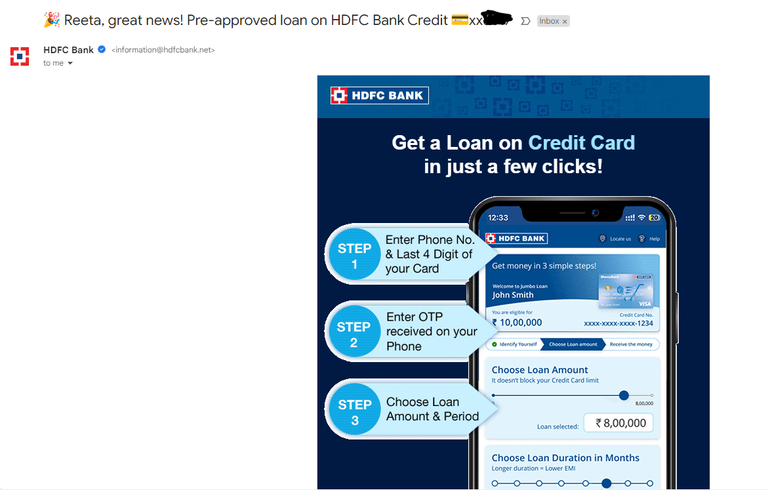

email received from bank

Now my bank is sending emails for pre-approved loan offers and its based on my card usage and payment record. I checked with my friends and they confirmed that this type of offer is received from banks only when the banks find the records are good. I am happy that my bank is happy with my way of card usage and paying back but I am not going to opt for this loan. I have never taken any loan from the bank and I don't like liabilities. Maybe in future if I plan something big then I can think about a loan but currently there is no need.

In India, there is a process that tracks the credit history of every individual. This is called CIBIL and a score is maintained according to the repayment pattern and many other factors. This score is reviewed when anyone applies for a loan or credit card so if the score is good then banks offer such products. But if this score is not good then banks reject the application and this is why its important to have a good CIBIL score. I don't know my CIBIL score but happy that if banks are offering this type of loan product then surely my score is good.

I am thinking of checking my CIBIL score soon and this will help me see how I am doing. I need to check the process to get this report and once I can figure it out then will be sharing more about it here. Currently, I use 2 credit cards from the bank out of which 1 card is digital. I can use it online and there is no physical card sent to me. Its a good card as I can make UPI payments also with this card and this is very helpful.

Thank you so much

Stay Safe

Posted Using InLeo Alpha