Understanding Liquidity Pools and Staking

Before diving into the specifics of the ETH-SPS pool, it's essential to understand the fundamentals of liquidity pools and staking.

What Are Liquidity Pools?

Liquidity pools are a core component of DeFi platforms, providing the necessary liquidity for decentralized exchanges (DEXs) to function. These pools are composed of tokens supplied by users, known as liquidity providers (LPs). In return for contributing their tokens, LPs earn fees generated from trades within the pool.

What Is Staking?

Staking, in the context of DeFi, involves locking up your tokens in a smart contract to earn rewards. These rewards can come from various sources, including transaction fees, interest, or additional tokens as incentives. Staking helps secure the network and provide liquidity.

SushiSwap: A Brief Overview

SushiSwap is one of the leading DEXs in the DeFi space, known for its community-driven approach and innovative features. It started as a fork of Uniswap but has since evolved to include unique offerings such as SushiBar (for staking SUSHI tokens) and BentoBox (for optimized yield strategies).

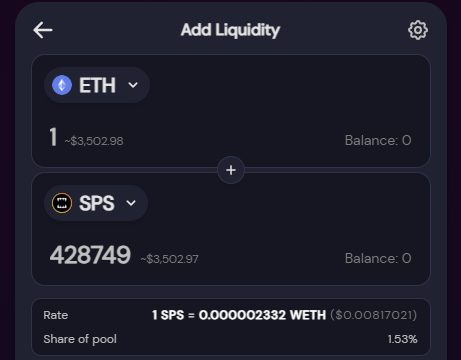

The ETH-SPS Pool: A Closer Look

The ETH-SPS pool on SushiSwap is an attractive option for liquidity providers due to its potential for high returns. Here's why:

- Dual Rewards

One of the primary incentives for providing liquidity to the ETH-SPS pool is the dual rewards mechanism. By staking your ETH and SPS (Splinterlands) tokens, you earn rewards in both ETH and SPS. This dual-reward system can significantly enhance your overall yield, making it an appealing choice for those looking to diversify their income streams.

- High APY

The Annual Percentage Yield (APY) for the ETH-SPS pool is often higher compared to other pools, thanks to the incentives provided by SushiSwap. This high APY over 20% can make a substantial difference in your earnings, especially when compounded over time.

- Community Support and Governance

SPS is the governance token for Splinterlands, a popular blockchain-based trading card game. By staking in the ETH-SPS pool, you not only earn rewards but also gain voting rights in the Splinterlands ecosystem. This dual benefit of earning and having a say in the future direction of the platform adds an extra layer of appeal.

Strategies to Maximize Returns

To make the most of your staking experience in the ETH-SPS pool, consider the following strategies:

- Monitor Impermanent Loss

Impermanent loss is a risk inherent in providing liquidity to pools with volatile assets. To mitigate this, keep an eye on the price correlation between ETH and SPS. The closer the price movement of the two assets, the lower the risk of impermanent loss. Additionally, you can periodically rebalance your portfolio to minimize exposure.

- Reinvest Rewards

Compounding your earnings by reinvesting the rewards can significantly boost your returns. SushiSwap makes this process relatively straightforward, allowing you to claim and restake your rewards with minimal hassle. Regularly reinvesting your earnings can lead to exponential growth over time.

- Stay Informed

The DeFi space is dynamic, with changes occurring rapidly. Stay updated on the latest developments related to SushiSwap, ETH, and SPS. Participate in community forums, follow official announcements, and engage with other stakeholders to ensure you are making informed decisions.

- Diversify Your Portfolio

While the ETH-SPS pool is attractive, it's prudent to diversify your investments across multiple pools and platforms. This diversification can help spread risk and increase your chances of capturing high returns from various sources.

Risks to Consider

While the ETH-SPS pool offers numerous benefits, it's crucial to be aware of the associated risks:

- Market Volatility

The prices of ETH and SPS can be highly volatile, impacting your returns and the value of your staked assets. Ensure you are prepared for potential price swings and have a risk management strategy in place.

- Smart Contract Risks

DeFi platforms are built on smart contracts, which are not immune to bugs or vulnerabilities. Although SushiSwap has undergone audits, it's essential to be aware of the potential risks and consider insurance options if available.

- Regulatory Risks

The regulatory landscape for DeFi is still evolving. Changes in regulations can impact the operations of platforms like SushiSwap and, consequently, your investments. Stay informed about regulatory developments to adapt your strategies accordingly.

Disclaimer

As with any investment, due diligence and continuous learning are key. Engage with the community, stay updated on the latest trends, and be proactive in managing your portfolio. The world of DeFi offers immense potential, and with the right strategies, you can navigate it successfully to achieve substantial rewards.

If you haven’t yet experienced Splinterlands, I highly recommend giving it a try. It’s more than just a game; it’s a vibrant community and an exciting journey into the world of blockchain gaming. Dive in, and you might just find yourself as captivated as I am.