So, we’ve got fresh news about inflation in the U.S., and it looks like things are heading in the right direction! As you’ve guessed, yesterday we got the latest Core PCE report—aka the Fed’s favorite inflation gauge.

INFLATION

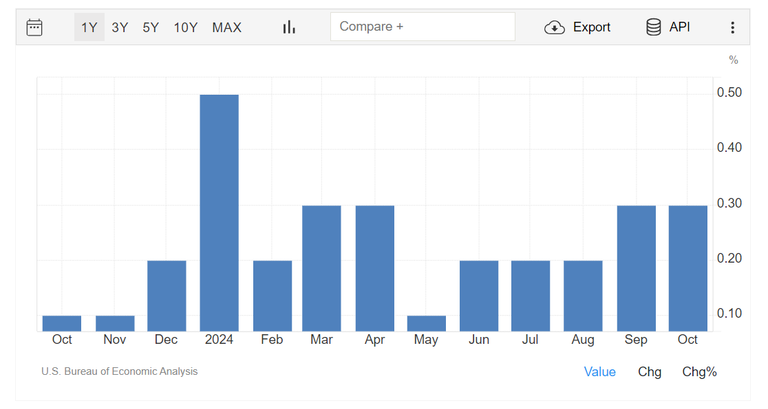

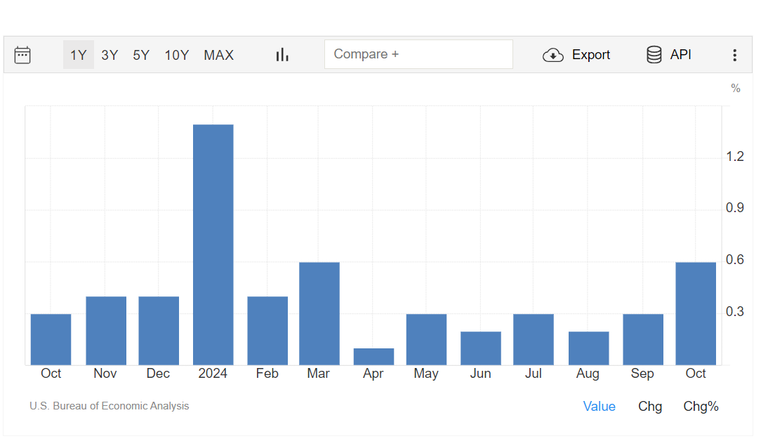

Here’s the deal: Core PCE came in at +0.3% month-over-month in October.

Sure, you might say, But , it’s the same as September, why the excitement? The point isn’t that it stayed the same but that it aligned with expectations, avoiding any unpleasant surprises.

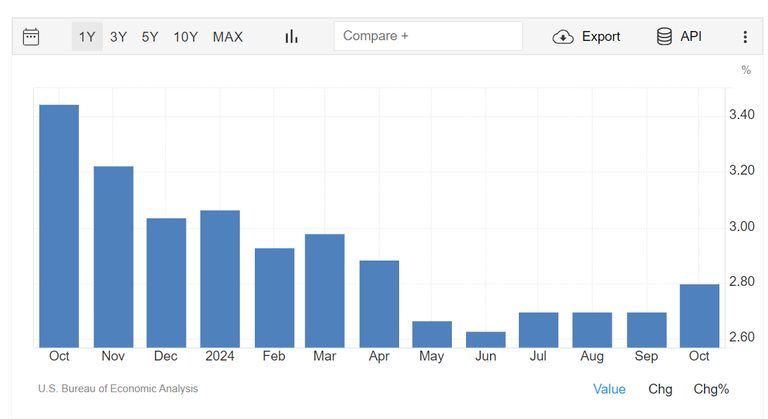

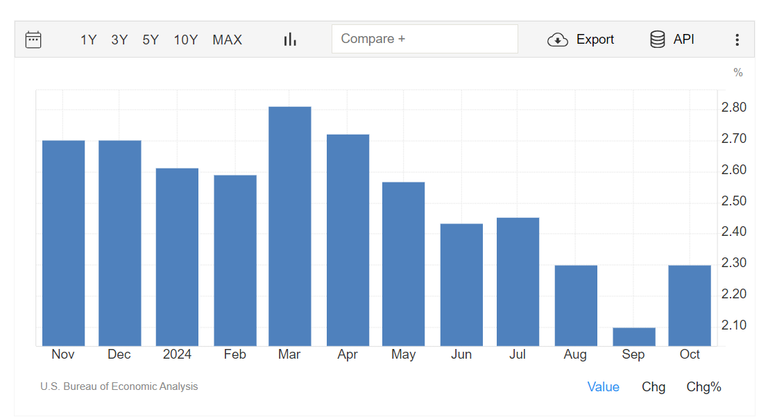

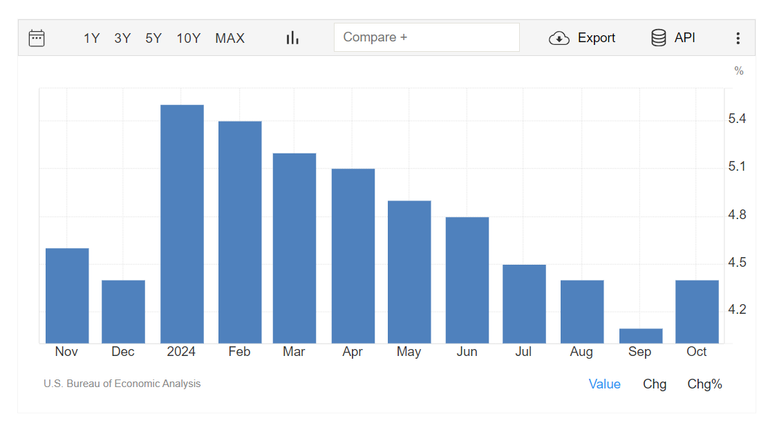

On a yearly basis, Core PCE hit +2.8%, a slight uptick from last month’s +2.7%, but exactly as analysts had predicted.

If we look at the overall PCE, which includes food and energy, it held steady at +0.2% month-over-month.

Year-over-year, it ticked up from +2.1% in September to +2.3% in October, but again, nothing alarming since the pace is stable.

INCOME

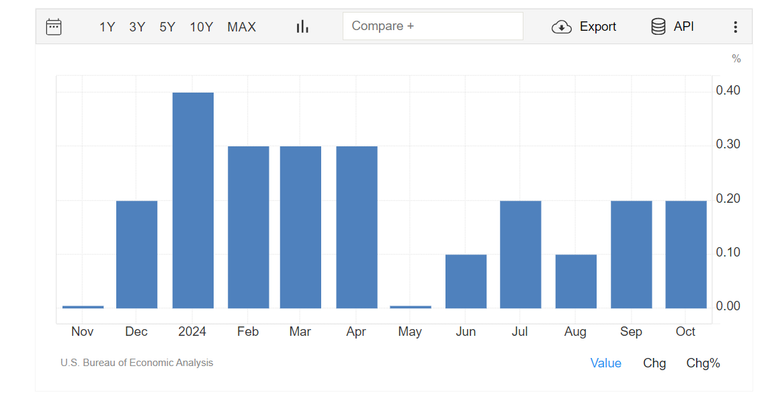

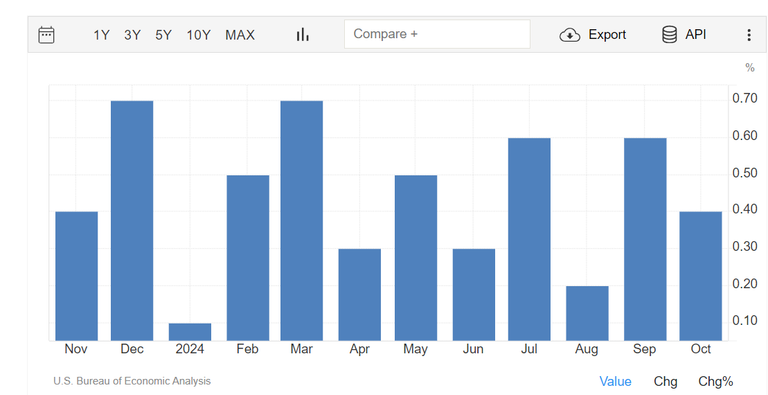

There’s more good news, though: personal income growth accelerated to +0.6% month-over-month in October, up from +0.3% in September, far exceeding forecasts. Meanwhile, disposable income also rose by +0.7% compared to the previous month.

Cool, but why should we care? Well, these numbers show a healthy economy with a strong labor market and increased purchasing power for everyone. Naturally, that’s a win!

SPENDING AND SAVINGS

Personal spending increased by +0.4%, reflecting a balance between rising incomes and controlled spending habits. At the same time, the personal savings rate climbed to 4.4%, up from 4.1% in September.

In simple terms, U.S. consumers are not just spending more but also managing to save. Talk about a financial sweet spot!

And what does all this mean ? Well, the steady path of the Core PCE and overall PCE suggests that the Fed is unlikely to rush into cutting interest rates. However, the strong growth in incomes and spending signals healthy economic activity, which naturally boosts investor confidence.

S&P 500

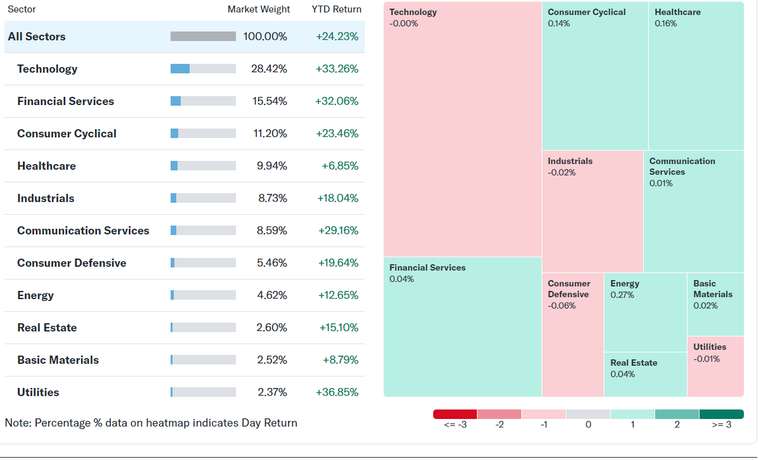

I was under the impression that in 2024 the best performing sector of S&P 500 was the best performing one but I was wrong.

- Utilities – 36.85%

- Technology – 33.26%

- Financial Services – 32.06%

- Communication Services – 29.16%

- Consumer Cyclical – 23.46%

- Consumer Defensive – 19.64%

- Industrials – 18.04%

- Real Estate – 15.10%

- Energy – 12.65%

- Healthcare – 9.94%

- Basic Materials – 8.79%

Posted Using InLeo Alpha