Alright, let’s get straight to the point. Today, I am diving into recent developments in global trade, the role of BRICS, and the moves by the U.S. government that prove why the American economy remains the strongest choice for any investor.

BRICS

Let’s start with the so-called “threat” posed by BRICS.

What threat, dude? you might ask. I’m referring to BRICS’ discussions about de-dollarization.

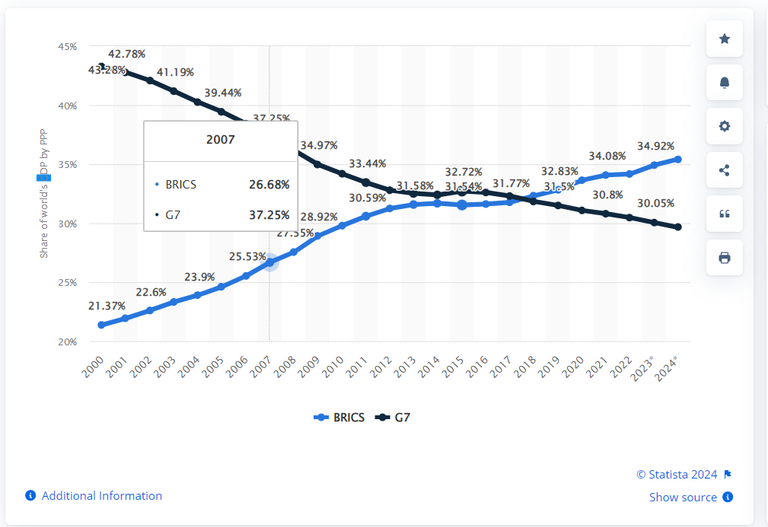

These countries (which, by the way, represent over 35% of global GDP) have been exploring ways to reduce their dependence on the dollar. In a symbolic move, they even introduced their own currency in 2023, which they claim will “destroy” the dollar.

And? Will they succeed? you’re probably wondering. Let’s get REAL. Despite these ambitions, the BRICS countries have massive political and economic differences. Plus, let’s not forget that many of them maintain strong ties with the U.S., making it incredibly difficult to fully detach from the dollar.

The U.S.

And since we’re on the topic of the U.S., why is everyone focusing on what BRICS is saying but not looking at the other side? I mean, how can anyone believe that America will just sit back and let another currency take the dollar’s place?

Enter Donald Trump. In his classic fiery style, he made things crystal clear. In a post, he warned that any country daring to undermine the dollar’s position would face serious economic consequences—like tariffs as high as 100%.

This approach isn’t exactly new, though. The U.S. government has been using trade as a tool to defend its economic dominance for years. And honestly? Makes total sense to me.

And What About Investors?

What do investors think? you might be asking.

Investors know full well that the dollar is the cornerstone of global trade. That’s exactly why, despite all the chatter about the “end of the dollar,” markets continue to see the dollar as the safest means of transaction.

Posted Using InLeo Alpha