Let’s get straight to the point. Yesterday, we got the latest data on U.S. inflation, and, like every month, we’re going to take a look to see where we’re at.

INFLATION

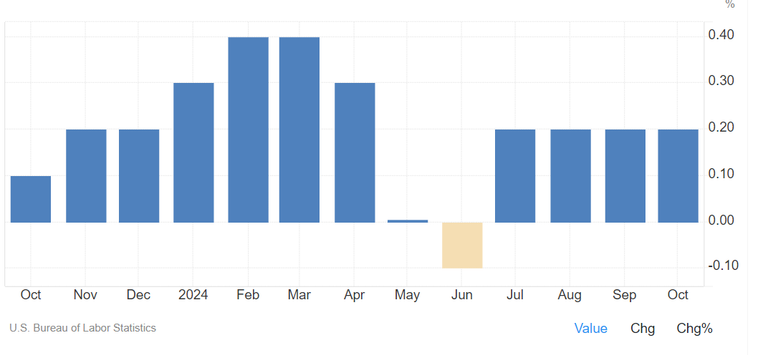

So, according to the latest Consumer Price Index (CPI) report for October, on a monthly basis, inflation rose by 0.2%, remaining steady for the past three months!

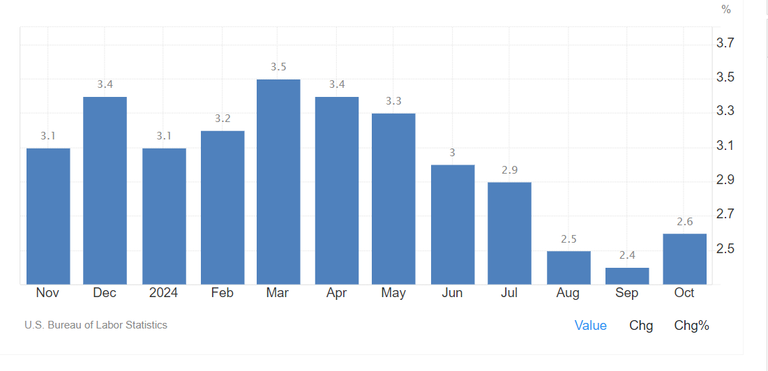

On an annual basis, the CPI rose to 2.6%, which matched analysts' expectations, showing a slight increase from September’s 2.4%.

So, what do these numbers mean? you might ask. One thing only! That inflation is stabilizing near the FED’s target, which is seen as a positive sign for the direction of markets and the economy overall.

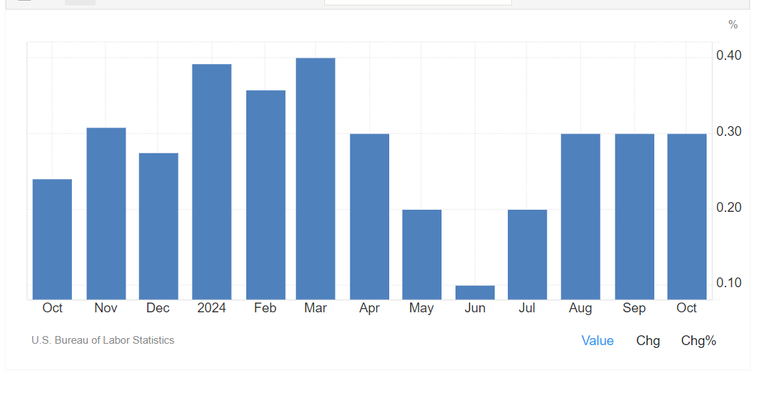

Now, in terms of the sectors driving this inflation increase, housing costs led the way, rising by 0.4%, which accounted for over half of the total monthly increase. At the same time, food prices rose by 0.2%, while the cost of used cars jumped by a striking 2.7%!

And what about energy? That’s our main concern! you might wonder. Fortunately, energy prices remained relatively stable (after a 1.9% drop in September), which helped limit the overall increases in inflation.

As for Core CPI, which excludes food and energy, it held steady both monthly and annually. Specifically, it rose by 0.3% for the third consecutive month, while the annual rate hit 3.3%, in line with analysts’ expectations.

FED

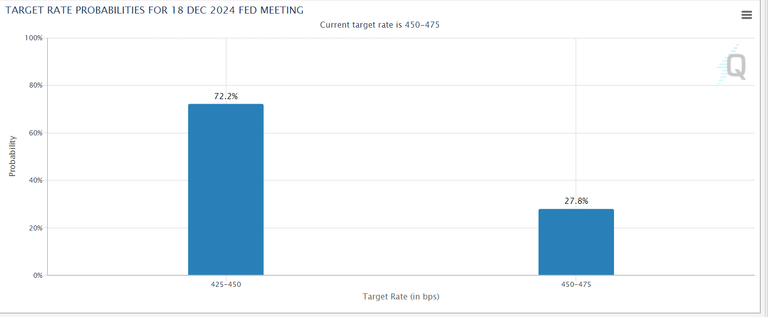

And now you may be wondering, what can we expect from the FED going forward? Well, the CPI on its own doesn’t give a complete picture of the economy's trajectory. The FED still has a lot of economic data to consider before its next meeting. However, the fact that inflation has remained relatively stable is a very positive sign.

And of course, this gives the FED the flexibility to continue with rate cuts. As for forecasts, many investors are anticipating another cut of 25 basis points in December.

As we already know, another rate cut will further boost liquidity in the markets and help businesses grow even more vigorously.

In any case, inflation stabilizing confirms that the FED’s strategy is working. And that’s something we can all be glad about!

GOLD

Gold recently took a significant plunge, something we haven’t seen since 2021. More specifically, it dropped by -3% in a single day, with its weekly return now sitting around -5%.

But why would this happen? Isn’t gold supposed to be a safe haven for investors? Well, gold’s decline is directly tied to Donald Trump's election (as is much of the recent market activity).

Trump’s win led to a strengthening of the dollar, as his proposed policies are expected to boost the economy. And as we know, gold and the dollar have an inverse relationship. When the dollar goes up, gold goes down, and vice versa. This alone was enough to cause gold’s price to drop.

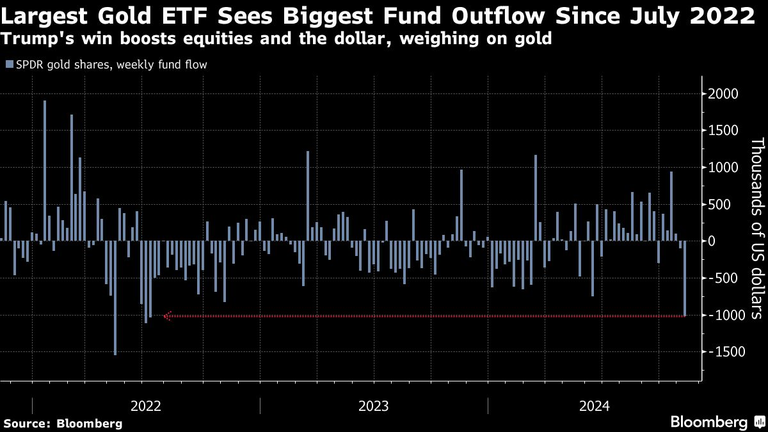

Furthermore, the world’s largest gold ETF, SPDR Gold Trust, recorded the largest outflow of funds in the last two years, showing that investors aren’t feeling very secure with gold at the moment.

Posted Using InLeo Alpha