JPMorgan announced its quarterly results, and as expected, the world's largest bank surpassed analysts' expectations in both revenue and earnings per share.

source

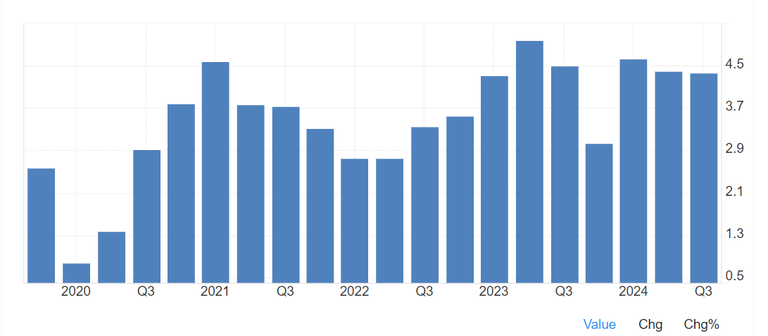

As anticipated, following the earnings report, JPMorgan's stock skyrocketed, closing Friday's session with a 4.44% rise!

Earnings

First of all, JPMorgan reported net earnings per share of $4.37, beating analysts' expectations of $3.98. Yes, you read that right—it crushed them! Although, compared to the previous quarter, there was a drop from $6.12, but in relation to last year, there was a slight increase from $4.33.

Why did the earnings drop compared to the previous quarter? The reason is that while interest income increased, reaching $23.4 billion (higher than the $22.7 billion expected), the bank made larger provisions for loan losses. In other words, it expects that many more people won't be able to repay their loans. Specifically, $3.11 billion in losses are expected, which is significantly higher than last year's $1.38 billion!

Okay, but why are they making such large provisions for loan losses? The answer is simple: the bank anticipates that macroeconomic conditions—namely the state of the global economy and geopolitics—will make it harder for many people to repay their loans.

Now, regarding revenue, the bank posted $42.7 billion, which is down from the $50.1 billion in the previous quarter but higher than the $40.7 billion during the same period last year. Where did this revenue come from? Let's break it down.

The Consumer & Community Banking division generated $17.8 billion in revenue, up 1% from the previous quarter but down 3% from last year.

Revenue from the Commercial & Investment Bank division reached $17 billion, which is 8% higher than last year, while the division's net earnings rose by 13%.

Lastly, the Asset & Wealth Management division brought in $5.44 billion, up 9% from last year, though net earnings were down by 5%.

Posted Using InLeo Alpha