We are likely to enter a period where we see economic activity skyrocket.

To start, this discussion, we can look at where economic growth comes from. Basically it mostly boils down to technological advancement and population growth. There are other factors that complement this such as financing. However, for the sake of this article, we will concentrate on those two components.

Could we be heading towards an economic singularity?

The answer to that question presumes we have a definition of what it means, something that should not be taken for granted. Thus, we will simply state this is a jump of 20%-30% annually of GDP.

Is this even possible?

Many do not believe that is the case. However, if we look at the factors of economic productivity, we can deduce where it might come from.

The question then becomes, if we achieve this state, what role does cryptocurrency play?

Image generated by Ideogram

Crypto: Value Capture

Cryptocurrency's main role going forward will be value capture. This is very important.

Some will point out that stocks already do that. While that was accurate in a pre-technological world, it is no longer the case, at least not in full. This is a point where crypto does something the existing system cannot.

Technology is deflationary by default. This means that, over time, the monetary aspect related to it declines. We see this clearly when we look at the digital world.

Here we see the first major problem with our present system. Stocks do not reflect this.

The key issue is that as prices decline, value, overall, actually increases.

Let us take the example of communications. There was a time when, within the United States, it cost 10-15 cents per minute to communicate outside the calling area. This generated tens of billions of dollars each year for long distance carriers. Under the GDP scenario, we can see the positive impact it made.

This was a huge revenue generator for a company like AT&T. Today, that is gone. Long distance billing has imploded. Why? The Internet.

Consider how many ways we can communicate today and what we get out of it. The cost to do this is either free or a nominal fee for a data plan.

We can interact with 5.35 billion people all over the planet. No longer are we limited to just voice communication. This can now be done through voice, images, text, and video.

Let us take another example: breast cancer.

This is also, sadly, a positive on GDP. We have an entire industry built around this. What happens if we cure breast cancer? The revenues (and profits) generated will disappear. Suddenly we have a negative on GDP due to technological (medical) advancement.

We also would see jobs lost.

Obviously, solving breast cancer would be a major benefit. But how is it captured?

This is where tokenization enters. If we consider the world of digital real estate, all of this can be tokenized. We can build business models around this whereby, as the value increases, it is captured by the platform.

Our present metrics do not adequately handle demonetization. This is where cryptocurrency steps in.

Economic Singularity

Reverting back to the first point brought up, is it possible to see economic output that makes a "singularity" possible.

If we use the basis of technological advancement and population growth, then yes it is.

The latter will obviously be an issue as most countries, especially in the developed world, are facing a population decline through the rest of this century. This means economic productivity is likely to decline.

On the surface that is true. That said, the equation changes when we look at technology. In the physical realm, this means robotics.

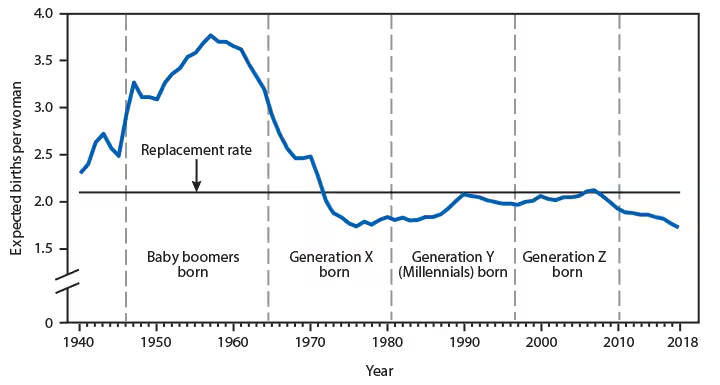

Here is a chart of US births:

Source

The concept can be applied to any country.

If we look at the peak, we were around 3.75 million births. The latest rate, as of this chart, was less than half of that. Naturally, this is not the only factor in population since immigration also plays a role.

What if the United States, was able to produce 25 million humanoid robots in a year? That would be more than the immigration totals over the last 4 years PLUS the new births. And when it comes to robotic production, this is a low number.

It is likely, before the end of this decade, we see yearly production at a couple hundred million (globally). This is the impact that it can make.

We can immediately sense the threat to jobs. If these machines are proficient, then the cost of running them versus humans is a wide gap. We covered this in other articles so we will no dive into that.

To pertinent point here is the economic output will skyrocket. When dealing with immigration, there is often a learning curve. At the same time, when it comes to humans, there is a 2 decade lag before these beings are part of the labor force.

With robots, it is a few days after arrival at the factory.

Basically, economic output will skyrocket, potentially pushing the growth mentioned earlier. Of course, GDP is a lousy indicator, losing much of the value generated as demonetization occurs.

Cryptocurrency can capture this. It is a way for platforms to ascend in value even if the revenues from a service dry up.

This is the major difference and the role cryptocurrency will play.

Posted Using InLeo Alpha