We cannot deny that cryptocurrency managed to become part of the political discussion this election season, at least in the United States.

While the last two Presidential administrations were unfavorable to crypto, there are people pinning their hopes on Trump and Harris.

The problem here is their track records.

Trump's administration was far from friendly to crypto. Perhaps this was the doing of Mnuchin who took a hardline stance. Harris, on the other hand, is supposedly a part of the decision making process of Biden's administration which probably was worse than Trump's when it comes to crypto.

Of course, we would be remiss if we didn't mention the United States Congress, which failed to pass any meaningful crypto legislation in the past 8 years.

Image generated by Ideogram

Politics Bringing Cryptocurrency Into The Mainstream

The Presidential candidates get all the attention but there are races all over the country. Member of Congress are involved in their own campaigns. Then you have all the state races. This is bringing a lot of attention as many candidates are bringing up the topic.

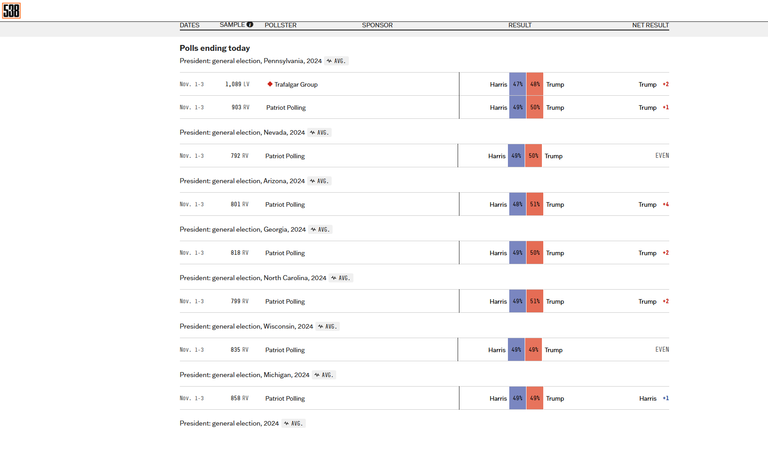

One metric that might be of interest is the fact that crypto is starting to register in battleground states.

So we measured swing states’ relative levels of crypto interest. Two battlegrounds expected to be among the tightest races in November — Pennsylvania and Wisconsin — have seen the fourth- and fifth-biggest jumps in crypto search interest since the last election in 2020, measured as a proportion of total searches using Google trends.

This is very interesting.

The projected close races saw large jump in crypto related searches. Is this something that voters are looking to for assistance with their decision.

Or does this reflect something else? Perhaps these are states, even though close in the Presidential race, where crypto is being adopted. Maybe the election is simply coincidence.

Again, the answers will likely never be known. What we do understand is that cryptocurrency is becoming a talking point for many candidates.

Ultimately, this will result is the passage of legislation.

Stablecoins

One of the points that is being driven home is the fact that stablecoins have a lot to offer the US government.

Stablecoins — which have become one of the most popular crypto products — are one of the biggest topics for policy discussion, with several bills already floating around Congress. One of the tailwinds, at least in the U.S., is the realization that stablecoins can fortify the U.S. dollar’s position abroad even as the dollar’s global reserve currency status slips. Today, more than 99% of stablecoins are denominated in USD, which dwarfs the next largest denomination: 0.20% in EURO.

There is a reason why tens of billions of coins are now backed by US Treasuries. Since it is the reserve currency, we are seeing the piggybacking of this as a medium of exchange. Many in Washington are hearing the attacks from the outside regarding their decisions. It is evident that the US is taking actions which could threaten its standing in the world.

Stablecoins serving to reinforce the US dollar might be a benefit these politicians did not expect.

This was further emphasized:

An open letter to leading United States presidential candidates written by Paxos CEO Charles Cascarilla urges them to adopt stablecoins to maintain the US dollar’s global dominance and improve inefficiencies in the traditional banking system.

He further adds:

Blockchain and stablecoins are “replatforming the financial system” to make it symbiotic with the Internet, Cascarilla wrote. He stated:

“Stablecoins or digital dollars—U.S. dollars digitized via blockchain technology—are the crucial upgrade for the payment system that will revolutionize money movement, allow greater participation in the global economy and ensure the supremacy of the U.S. Dollar for years to come.”

It is actually a sentiment that I agree with. We are looking at a powerful medium of exchange being tokenized, something that enhances the depth and liquidity of the dollar. This is being compounded by Wall Street and the likes of Larry Fink, who then are creating other products on top of this. With so many funds likely to pop up, we could see trillions in stablecoins created over the next few years.

Many of these will be tied to US Treasuries. From the government perspective, this is key.

My view is we will see, if this is resolved, a multitude of stablecoins developed. They will be tied to specific applications, similar to what PayPal did. It would not surprise me if X, Google, and Meta all brought out their own versions once the regulatory uncertainty cleared up.

Ultimately, the currency situation would mirror the present one except that it would mostly be US dollar based. There would be the top dogs, perhaps a USDC or Tether. Then we might have ones that are much smaller, such as a USD stablecoin for eBay.

However this progresses, the fact that crypto is on the radar of politicians is helping to bring a great deal of awareness. This will likely continue as we enter 2025.

Things are not going to slow down.

Posted Using InLeo Alpha