Since the last hard fork, it is worth watching how the Hive Backed Dollar (HBD) performs. The base layer stablecoin is going to be a vital part of the ecosystem going forward. For that reason, it is important that we be aware of how it is operating.

While the peg was lost for a few weeks, it appears to be back in order now. This is going to happen since the market is non-liquid at the moment. With only around 5 million out there before the latest move up, we can see how easy it is for pricing to go awry. With more liquidity comes less volatility.

The fact that there was something like 20 million HBD produced over the last few weeks means there is potentially more stability in the pricing. We will have to see what the exact amount is to keep near the peg. It is possible more HBD is required before we get there.

Conversion Mechanisms

HBD is truly a community driven coin. The production is decided by those who are involved with Hive. There is no algorithm to determine the rate at which they will be produced.

The conversion mechanisms that are in place enable anyone to convert Hive-to-HBD or vice versa. This is a powerful weapon in keeping the peg in place. It enables the community to arbitrage the situation for profit, something that will put pressure on the price.

For example, the reason why we saw a great deal of HBD created recently is the price jumped to $1.20 for a couple weeks. This led many people to convert Hive to HBD and then sell it on the open market for a gain.

It does not take a degree in high finance to see how this will add more sell pressure on the open market. This is the desired outcome. When the price is too high, market forces are needed to push it back towards the peg.

Of course, the intent is to have the same thing if the price drop below the peg. HBD priced at 90 cents is no better than it at $1.10. Thus, the intention is that when the price reaches a certain point, conversion of HBD will take place, reducing the supply. This is the same effect as "buying HBD" providing the individuals with a profit in the other direction.

Let us say the price of HBD drops to 80 cents. Since we know the peg is $1.00, it is safe to presume it will eventually get back to that point. Hence, a trader could see a 25% profit by amassing HBD at this below peg pricing.

Ultimately, having a pegged HBD is vital to the commercial success of Hive. With so much attention being given to stablecoins, having something that is truly decentralized could be a major benefit.

Elasticity And The Hard Cap

For those who are not aware, there is a hard cap on HBD. Since it is a debt instrument, the initial intention is to ensure that the ratio of debt-to-equity did not get too high. Nevertheless, there does need to be some elasticity so that the market can expand or contract the amount of HBD.

At present, this ratio sits at 10%. That means that if the market cap of HBD reaches 10% of the total market cap of Hive, the production of HBD shuts down. All payouts automatically convert to Hive Power and liquid $Hive (on the 50/50 reward option). This continues until the ratio is restored.

As we recently saw, the easiest way to re-align this is for the price of Hive to escalate. Once that happens, the level at which the 10% limit is increased. Thus, even though more HBD was recently created, there is a larger buffer since the price of Hive jump 50%.

This is a mechanism that is hard coded into the chain. Therefore, the only way to change it is with a hard fork. This is out of the hands of the witnesses. We are approaching a time when a discussion of increasing the cap is needed.

To be honest, the 10% looks like an arbitrary number that was assigned years ago. Perhaps in the early stages, this made sense. However, we are at the point now where Hive is a lot more robust than it was when things were originally coded.

HBD for Commercial Purposes

The goal is for HBD to be used for commercial purposes. A stablecoin ultimately used for transactions. The idea is for people to pay for goods and services using HBD. Obviously, having a consistent peg is vital for this end. It is also evident that we are going to require a great deal more HBD.

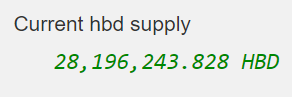

Here is the latest HBD count according to HiveBlocks:

For commercial activities, it is evident that having 28 million HBD is not going to be enough to operate. Of course, this also includes the amount that is locked up in the Decentralized Hive Fund (DHF) which is, for the most part, not liquid.

In short, we need a lot more HBD if commercial activity on a large scale is to occur.

Here is where we see the idea of lifting the HBD debt-to-ratio ceiling. It is starting to see some discussion and worthy to express our ideas on it.

To start, this is something that should remain hard coded into the blockchain, at least for now. We do not know all the attack vectors that are created so it is best to proceed with some caution. Nonetheless, we are tasked with expanding HBD while also protecting the tokenomics of the chain. Security is obviously included in this.

Here we can see how raising the limit to 15% or 20% in the next hard fork is a good starting point. It is something that can be looked at as each new one approaches. If overall network stability is still maintained, the cap can keep being moved up.

In Hive dominance HBD buffer, @edicted formulated some reasoning as to why we need to remove the "training wheels". While removal might be too aggressive at this point, moving it higher with each hard fork could be a viable path.

This will ensure the ability to keep expanding the HBD supply for commercial purposes is there.

HBD Savings Account

During the last hard fork, we also saw a new feature implemented where HBD that is moved to savings is paid interest. This is a rate determined by the witnesses, presently at 10% (do not confuse this 10% with the HBD ceiling which carries the same rate). Therefore, this can be adjusted at any time by them.

It also serves to help expand the supply of HBD. Each month, those who stake HBD receive a payout. This puts more HBD on the market, further assisting in what was described about.

Here a different discussion needs to take place.

With the saving program, a balance between liquidity and attractiveness has to be maintained. The point this occurs requires some experimentation.

We want people to be enticed by the return yet do not want it to be so great that every HBD on the market is shoveled into savings. This would eventually cause a liquidity crisis, negating the utility of a stablecoin.

It is an aspect of the ecosystem needs to provide some stability. All interest earned is paid into savings, requiring one to go through the withdrawal window to get it liquid.

We should keep in mind, this is base layer operation not necessarily focusing upon providing maximum return. There are a variety of benefits this brings to Hive, all of which need to be balanced. If hunt for return is the only consideration, there is nothing preventing HBD from being incorporated into a second layer DeFi application.

Is the 10% paid out in savings enough to pull more HBD off market and get it into savings? At this point, is it even necessary? The utility of HBD in terms of commercial purposes is not present at the moment. However, locking away a fair amount of HBD does provide more stability to the network.

This is something that the witnesses can play with. The medium among the consensus is 10%. If some feel that we need to go higher, they can increase their choice to 12% or even 15%. Certainly a case could be made for experimenting with it.

What are your thoughts on this? Do you think that lifting the hard cap ratio in the next hard fork is a good idea? If so, what should it be?

Also, what is your thinking on the interest paid? What is the fine line because return and still maintaining the utility of the token? Is it 15%? 20%? 12%?

Personally, it looks like we should phase both these up. Take the ratio in, perhaps, 10% chunks. With each hard fork, approximately every 6 months, look at how things are doing and, if the system looks stable, increase it another 10%.

As for the interest paid, a couple percent every quarter or so might make sense. The advantage here is the situation can be quickly reversed if problems arise since it is all in the hands of the witnesses.

Let us know what your thoughts are in the comment section.

If you found this article informative, please give an upvote and rehive.

gif by @doze

logo by @st8z

Posted Using LeoFinance Beta