The signs are everywhere.

With AI, the world was shocked by the introduction of Deepseek. This sent havoc through the markets with Nvidia, the largest maker of GPUs, plummeting. Priced in dollars, the company suffered the largest one day drop in history.

Speculation was running wild. The United States versus China debate kicked into high gear. Many questioned the future viability of the likes of Google and Meta, companies that invested tens of billions into building their models.

Of course, the media being what they are, there were a lot of other things that happened which show the reality of the situation. We will bring these to the forefront in this article.

At the core, we are dealing with the accelerating pace of technology. When it comes to AI, this is operating at a speed never envisioned. There might be a point where things slow down but we are evidently not there yet.

This will have an enormous impact upon cryptocurrency also.

The Acceleration of AI And Crypto

For the crypto world, which was overshadowed by Deepseek and others, the big news was the stablecoin market surpassing $200 billion. This is something that got overlooked yet is very telling.

Deepseek garnered the headlines yet it was not the only release. In fact, there were two models that some are reporting surpass Deepseek according to the benchmarks.

The first was Molmo released by the Allen Institute For AI in Seattle. Obviously, this is a US based company. Not to be outdone, Alibaba came out with Owen.

What we have in AI is the idea that if you do not like where things stand, wait a couple weeks...they are certain to change. It was barely 4 days that Deepseek held the throne (if the benchmark reports are true).

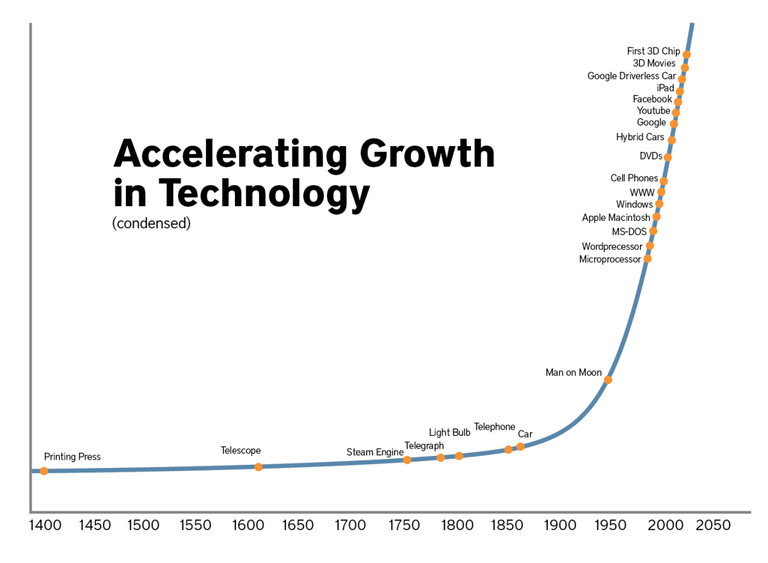

Most people have seen images such as this posted online:

This particular view is a bit dated but it drives home the concept. We are looking at a curve that is heading almost straight up compared to historicial norms. This is for technology overall something that is outpaced by AI.

What we have is a situation where the impact upon society is much quickly. Things are compressed.

For example, if we look at progress over the last 40 years, since the start of the computer era, we see how this covers most of the chart.

Where things get interesting is highlighted by the belief that we will likely see similar progress over the next decade. If we simply reflect upon how much things have changes in the 2 years since ChatGPT was introduced, projections forward go even more vertical.

Crypto Riding The Curve

The $200 billion milestone by the stablecoin market was something that went overlooked. While some probably thought "that is nice", little was done to emphasize what it means long term.

$200 billion is an insignificant number. The value, however, resides in the fact we are seeing growth. To me, this is the basis of where crypto and AI meet.

When it comes to medium of exchange, stablecoins fill that role. In the AI world, this is the place for cryptocurrency. We will not see Bitcoin utilized nor will this go through banks. Instead, AI agents, tied to digital wallets, will conduct transactions using stablecoins of some sort.

This is why the continued growth of the stablecoin market is crucial. To faciliate tens of billions of agents, many of them engaged in some form of commerce, trillions of tokens will be required. We are about to embark upon a time when the quantity theory of money meets a velocity of money that is mindblowing. This is the basis for another economic singularity that we are embarking upon.

Let me give you an example of how this looks based upon a project I read about.

Tesla has a product called the Powerwall. This is a battery storage system people install in their homes which allows them to draw in electricity (either from the grid or solar). It is stored until it is needed, when it is dispensed.

If we are dealing with the grid, the ability to arbitrage the electricity exists. Here is where the battery is filled during slower hours (when it is less expensive) and discharged during peak times.

One entity is looking to utilize this to power data centers. The idea is to pull the energy from the battery capacity, effectively tapping into a virtual power plant. A problem that arises is that power walls do not have bank accounts. So how is this problem solved?

Enter cryptocurrency.

This is just one example of the millions of different opportunities that will be created. As people start to experiment and innovate, we are going to see the expansion take off. How many transactions of this nature can occur?

If the stock market is any indication, automations sends the numbers up in a massive way.

Accelerating Decentralization

The advancement of Web 3.0 has to take place at a similar pace. In fact, there needs to be more done to push the different levels of AI away from Big Tech. They have a massive advantage but one, as evidenced by the open source, Deepseek, that is not insurmountable.

Decentralization means crypto. While it is possible for people to establish non-crypto projects, when AI agents become the norm, the payment rails will use crypto.

There is, however, another factor. Crypto-assets are mostly value capture tokens. This means the projected value of AI, which is enormous, will be housed, in part, via crypto. The only requirement is people start to tokenize what they build. VeniceAI certainly provided a pathway to follow.

AI will keep accelerating for the near future. The open source community seems poised to stake their claim, as more AI projects emerge under this realm. It is time for crypto people to wake up to the link between the two and dive in on an epic scale.

The result will be crypto riding the massive AI wave, distributing wealth throughout the world.

Posted Using INLEO