It's been a while since I have made a market related post, but with the entire space freaking out over the latest dip, and seeing the different reactions people are having, here I am to bring some logic back to the space.

One thing I have learned from my years in the stock market and cryptocurrency space is that markets tend to over react about EVERYTHING! That's where you get market volatility that traders need to earn a living. This is where FUD (fear, uncertainty, and doubt) come into play. The big money players like to create this volatility so they can shake out the weaker hands and buy up assets at a big discount. Again, this is how they make their money off of you.

Many Calling The Bitcoin Top

Now, here on Hive and InLeo, I have seen a fairly positive sentiment around the price drop as people want to pick up assets at a cheaper price, even if they don't do what they say they are doing. With X on the other hand, you would think the sky is falling. Even saw a couple of people say they sold everything and are out because the cycle is over. Well, I am here to tell you that I don't think that is the case. And that is based on charts, not emotions. So now let's use that statement to segue into talking about the Pi Cycle Top indicator.

Pi Cycle Top Indicator

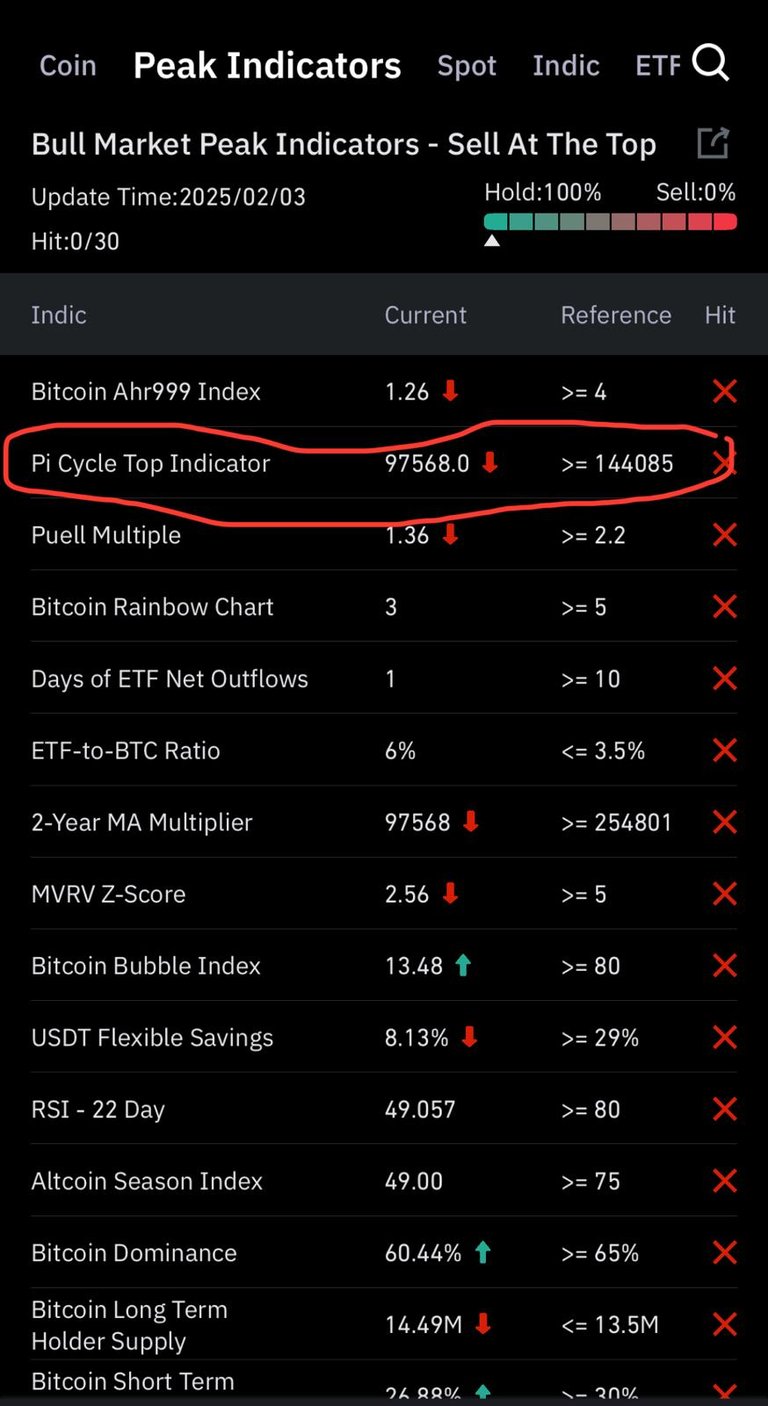

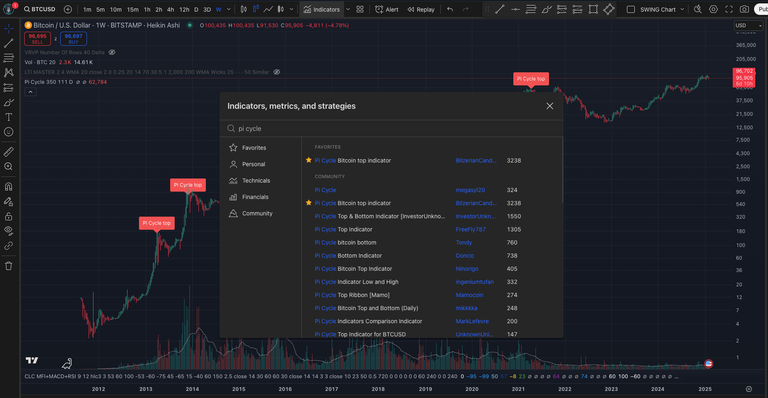

This indicator is a free Tradingview indicator that you can use to try and call the top of the Bitcoin market. It has historically called the top within 3 days, EVERY FREAKING CYCLE! I mean, just look at it...

From the indicator post on TradingView. I suggest adding it to your chart and seeing for yourself.

The whole thing is, I don't feel like this is the market top, by any means, because the indicator has not fired yet. We are just in some consolidating market structure building phases of the cycle. You have to remember, Wall Street is in charge of the price action these days, so things could absolutely be different this time around, but I tend to go on historical data, not emotional anon traders on social media. I think you get where I am going next...

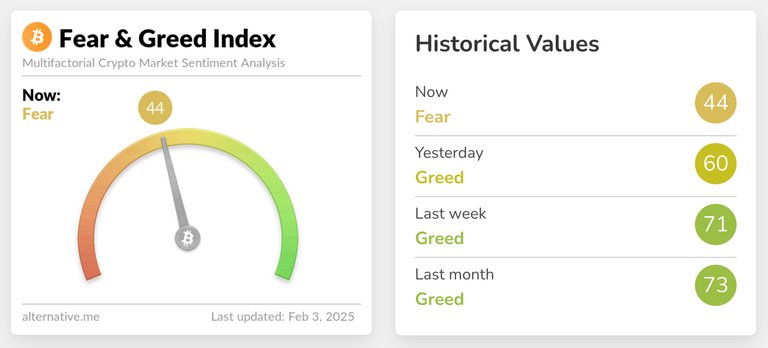

Fear and Greed

The Bitcoin Fear and Greed Index measures the social sentiment of the asset market. This is a great gauge on how irrational people's emotions are. It also really brings home the old Warren Buffet saying, 'Be fearful when others are greedy and be greedy when others are fearful'. You can see how quickly people get scared over a little news.

Here's the thing about that though, smart money knows how to play this and are waiting for you to capitulate and sell all your coins to them. Now, Wall Street doesn't want your silly memecoins, they want your Bitcoin, and if you are selling out of fear, you are giving into what they want!

Zoom Out and Chill Out

So go check out the Pi Cycle Top Indicator and add it to your charts, it will really kind of blow you away at how accurate it has been in calling the top. Remember, all we are seeing now is a macroeconomic freakout to some Trump tariff announcements. There has been no proof of how this will effect the actual economy, it's all just speculation. So use this volatility to your advantage if you are a trader. You should welcome opportunities to catch some good oversold bounces.

And don't forget, just because the price of crypto against the dollar dips, doesn't mean blocks have stopped being produced. The space is not going away anytime soon, this is just smarter, bigger traders doing what they do to scare you out of your bags. Hell, I am looking to see if any morons put up miners on sale for cheap. In my dudely opinion, we will have a bit to go before we are done with this cycle, but who really knows with Wall Street in control. But with so many institutional investors in the game at these price levels, I feel we are doing nothing but creating a floor at this point. We are building market structure around the 100K level and should expect and welcome the volatility. Because let's be honest, BTC has been a boring ass trade lately, lol. So just chill out and go with the flow of the markets!

Until next time...

Be cool, be real, and always abide with you my dudes!

Posted Using INLEO