News

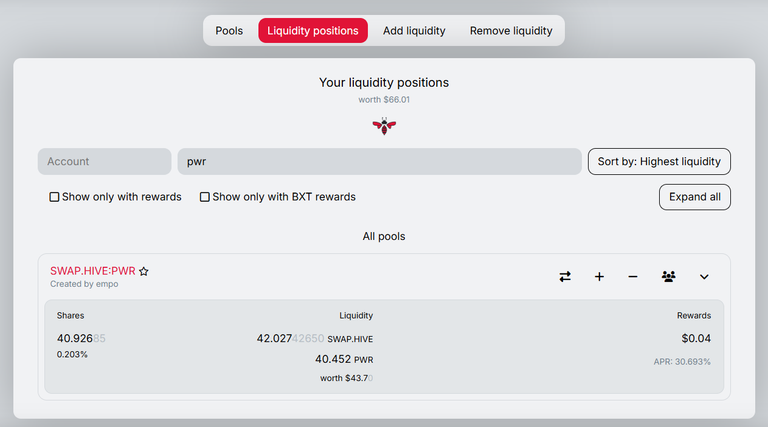

A couple of weeks ago I decided to leave this liquidity pool because its profitability had dropped significantly and it no longer met my investment criteria, but since then there have been some changes that have made it a good opportunity again, so I have decided to keep it. This week I added 0.27 PWR and 0.28 Swap.Hive to the pool.

As I mentioned, the profitability of the liquidity pool has returned to within my parameters, so I am removing it from the watch list and enjoying the returns.

I have to look for more solid power sources for this pool

Performance remains in line with the previous week.

I'm going to expand the type of investments I make in Hive and have chosen pools as a good way to increase the returns I get on-chain.

Why use pools? Because they don't require a lot of time to manage, I don't have too much free time, and because I think they offer good performance.

My investment strategy in Beeswap pools:

- I will choose pairs that have currencies that I like and think have a good future.

- The minimum performance has to be higher than the 20% that can be achieved in Hive.

- If it is possible that they have good liquidity.

- Have daily transaction volume

- If possible they are linked to Swap.Hive

- 7 pairs maximum

First pair - SWAP.HIVE:PWR -

- Liquidity - High

- Negotiation - High

- Profitability - 30,69% APR

- Linked to Swap.Hive - Yes

Token Name

Hive Power Ventures

Supply (Circulating / Total / Max)

60000.000 / 60000.000 / 1000000.00

Issuer

@vventures

Website

https://peakd.com/hive-167922/@empoderat/introducing-hive-power-ventures-pwr

Description

Backing the PWR token with HIVE.

Precision

3

Staking

No

Delegation

No