| Previous Week | Next Week |

|---|

This is the #87th edition of the "Week through Adrian's Lenses" weekly Hive and crypto news roundup.

Let's see what we have for this week. We cover:

Hive

- HiveFest

- Hive Rally Car

- INLEO

- Stolen Credentials & Fraud

- Keychain

- BeeD

- Block Explorer

- Hivehound

- PWR

- Slumpy Market

- Splinterlands

- Holozing

- SPS DAO

- dCity

- Rising Star

Crypto

- Polygon

- Bitcoin L2s

Week on Hive

13 of 30 tracked posts made it to this week's issue of the "Week on Hive" roundup.

In the Spotlight

HiveFest 2024 Is Next Week!

HiveFest starts next week on Tuesday, September 10th, in Split, Croatia, and officially lasts until Sunday, September 15th.

Traditionally, the first day is reserved for people checking in and being welcomed, and with a light schedule, since most of them come after long flights or road trips and are tired.

The next two days, Wednesday and Thursday, will be reserved for conferences and networking, usually with some evening schedule, and the last two-three days have a more touristic focus, where participants that remain after the conferences enjoy some local attractions and more networking and fun.

While the first HiveFest I "caught" on-chain was in 2018 in Kraków, Poland (so without the first two), since then I believe in-person HiveFests (not the 2 ones via VR) generally respected this format of daily schedule, but of course each of them had their own flavor, and participants often remember what was special about them.

This HiveFest in Split promises to be one to remember as well, both thinking about some of the speakers and the progresses and plans they will hopefully announce with their projects, and the non-conference part. Being an European location, we might see a higher participation too, even in this slumpy market.

Looking forward to next week and HiveFest 9! By the way, next year will be the 10th consecutive year of holding this event! Well, two of them were via VR "thanks to" our dear politicians.

If you're going, don't forget to get your HiveBuzz badge and your Splinterlands in-game epic title on sight.

Marketing / Awareness / Branding

Hive Rally Car in Acropolis Race in Athens

In the last update, the team was getting ready to start the shakedown and the ceremonial start the next day. The Hive Rally Car will also be present at Hivefest next week.

Governance / Development / Dapps / Education

INLEO: Improvements to the Referral System and In-House LeoAds System Coming Soon

I wrote yesterday a full blog post about the existing and changes to the referral system planned for Inleo for this week. I'm not going to rehash the same information again here, but I do find it important. Note that when I started writing this report the Inleo platform wasn't accessible (probable issues with a rollout), but I'm sure they will be fixed by the time I finish and publish this. Of course, I couldn't wait since it takes me a long time to write these reports, and here's where the power of Hive with its multiple front ends shows once again. If one is temporarily disabled, you can always use an alternative and go on with your work. Could you have done the same on Facebook, when they had a few hours of blackout in recent history? Nope!

One other thing Khal talked about in this week's Inleo AMA was Inleo's In-House LeoAds System. If you don't know what that is, it's a full-fledged internal advertising platform like all big platforms have, instead of relying on 3rd party ad managers and providers. This system that Inleo has built has a dashboard for the advertisers from where they can start campaigns, select preferred ad placements and manage their campaign, including budget. Khal also mentioned, they will start with very low pricing for ad spaces, and increase them gradually (perhaps through auction) as more advertisers become interested.

On the other side, they want to try something revolutionary, to make ad approval system decentralized, via a 24h poll, LEO stake-weighted. It is a risky approach, but we will see where this goes.

The big takeaway from this is "wen". I may have heard wrong and I won't listen through the AMA again to convince myself, but I think I heard him say they are planning on releasing this by September 15th, which is... in about a week and a half? I hope I haven't heard wrong. If this is true, I didn't think they are so close to releasing this part, since they pushed in different directions recently, from shorts to referral system, from LeoAI to now LeoAds.

Unrelated, in his Chain Chatter mostly weekly show, Khal had an interesting guest, as he often does.

About Credentials Theft and Arbitrage Fraud on Hive

@guiltyparties published a questionnaire for potential victims of credential theft and arbitrage fraud on Hive. This is a good way to create awareness, although I don't know how many of the victims would like to respond to the questionnaire publicly.

Keychain Mobile v.2.3

The new version (Antroid and iOS), added the option to automatically stake HE tokens previously introduced for browser extensions, plus the feature to receive funds via QR code, explained in the announcement.

New Stablecoin on Hive-Engine: BeeD

In an announcement in discord after the smart contract of BeeD had been deployed, Aggroed described it as the stable coin of Hive-Engine, much like DEC is for Splinterlands.

I however learned about it from @achim03, who saw it on the TribalDex interface before anything was mentioned in discord. Here's his post.

Development Updates for Hive Block Explorer UI

@mcfarhat and a few others he onboarded for this purpose (different than the Actifit team), have been working on the Hive Block Explorer UI, which was developed in the back-end by the Blocktrades team. In his post, @mcfarhat describes what they worked on recently.

Hivehound: An Old App Revived

As we discovered from this post of @solominer, he tried to get coders to revive an old app for years. Until he got to @sagarkothari88 and his team, he wasn't successful. Sagar and his team apparently built it in 48 hours, we find out from Solo's post. As his title says, this app is a post aggregator with filters. Considering content discovery is awful on Hive, filters can be a great help.

PWR Dividends to Start in a Few Days

@empoderat let us know that dividends on PWR (only those in LP) will start on September 11th. Paid half in SWAP.HIVE and half in PWR, with a confirmed APR of 20%. Here are the details.

Slumpy Market "Let's Be More Cautious" Discussions

I guess this can be a section of its own during these times in the crypto market, which to be honest, feels like have been dragging on forever, but we may be quite close to the end of the tunnel. The problem is the first one that exits the tunnel is bitcoin and for altcoins it may still be a while.

In this context, people on Hive are asking questions, coming up with potential solutions and debating what to do if this keeps going.

Last week was a pretty intense focus on authors and their rewards. I linked some posts in last week report in that sense.

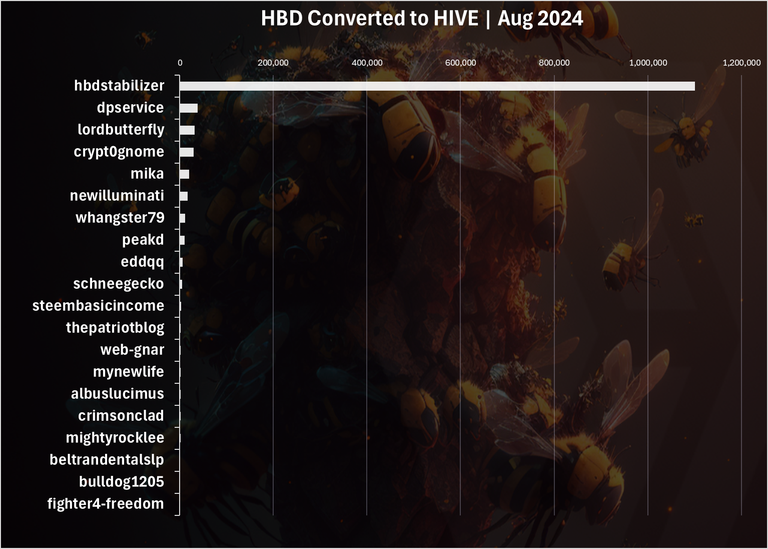

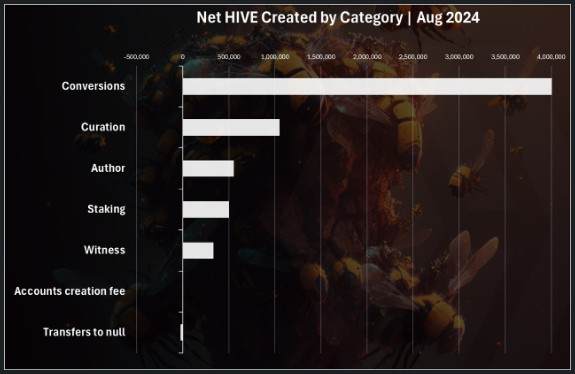

This week, we come back to the DHF proposals and... conversions.

@blanchy has been trying to put together numbers send and received by various projects from Value Plan for a good while. He may be kind of sarcastic sometimes, but that doesn't mean some of the information he puts head to head isn't at least an inquiring approach that is worth attention, particularly since some elements do seem outrageous, absent clarifications from the ones mentioned. This is his latest report, part 1.

In a conversation about conversions, we learn how much HIVE needs to be minted at these prices to keep HBD at peg. The discussions on the post are very interesting. @sps.dao will help a bit when it will convert its 825k HIVE it already purchased to HBD, which is a conversion in the other direction to what is predominant these days. Likely, we will need to suck it up on this one. In the uptrend that will eventually come back, the direction of conversions will slowly reverse.

Games

Splinterlands Promo Cards and Voucher Shop

Splinterlands began their series of 10 promo cards in 5 events, with 2 promo cards, one legendary (50k DEC per BCX) and one rare (3k per BCX).

There are also two new abilities introduced, Blasphemy of Uul - Permanently gain +1 ranged power for each allied 0 mana card from the Chaos Legion set, and Cleanse Rearguard - Cleanses the last allied backline unit with a magic debuff.

There is a leaderboard based on which at the end of all promo events will be distributed titles to the first 500 ranked.

And finally, according to a passed proposal, we now have a Voucher Shop. In the Voucher Shop there is a common card to buy at 30 VOUCHERs per BCX. Another card will be introduced in its stead after a while. Here are all the details.

Holozing Updates

Setting a referrer feature is going away! I don't know if it's still there, but if it is, it's your last chance to set a referrer. Going forward referrers will be set only if they join with a referral link.

Also, an email newsletter is coming, and those who will confirm an email address will get a little reward.

The Inventory page will be updated soon, and more soulbound rewards will come based on the amount of contributions of everyone (amount of ZING earned).

We also have another teaser that starter pack purchases are coming soon. Here is the announcement.

SPS DAO Proposals Status

@clayboyn published a situation of the passed SPS DAO proposals and their current status, in progress, on hold, or completed, with additional explanations for each of them.

dCity Student Claims

Last week was announced that students may be claimed by holders of Communal Housing, Luxury Street and Migration Center. This change is now live and the prices of claims in SIM have also been announced.

Also, for newer potential investors in the game, the post describes what SIM Power and what the SIM CLUB are.

Rising Star - New Cards

Rising Star has the habit to introduce new cards at the beginning of every month. This one was no exception. @nupulse shared them.

Week in the Crypto World

Polygon Begins Transition from MATIC to POL

POL will be Polygon's new staking and gas token of Polygon 2.0 (which will turn into aggregator of chains - kind of like Cosmos?), replacing MATIC in these roles. POL will also be slightly inflationary (2% annually), compared to a max supply of 10b and slightly deflationary for MATIC. Some holders of MATIC on Ethereum, centralized exchanges, or hard wallets may need to migrate manually, but there is no deadline so far. Here are more details.

New Bitcoin L2 Offering Bitcoin Liquid Staking (and it's not the only one)

Have you heard of Bitcoin L2 Core? I haven't, until recently. It is a EVM-compatible Bitcoin sidechain that uses both mining and DPOS to secure its network. Basically, they build upon the security of Bitcoin, adding additional functionalities of other chains, from what we see so far, from Ethereum.

LstBTC is a ERC-20 token issued by Core, but backed by native BTC held in a multisig account on Bitcoin L1. Liquid staking rewards are paid as CORE tokens, the native utility and governance token of the Core network.

It's obvious a push to build on top of the Bitcoin network that brings more utility to Bitcoin without needing to move it at the base layer, due to fees. We will likely see more of that. Here's the article with more details.

Full list of "Week through Adrian's Lenses" posts

Want to check out my collection of posts?

It's a good way to pick what interests you.

Posted Using InLeo Alpha