Well...it seems that we have had an excellent start to the week, taking into account that we are still in the dreaded month of RECKTEMBER.

BITCOIN ETFs are once again experiencing more money inflows than outflows and it seems that in the long-awaited debate between Trump and Kamala the "crypto" topic has not been touched on at all.

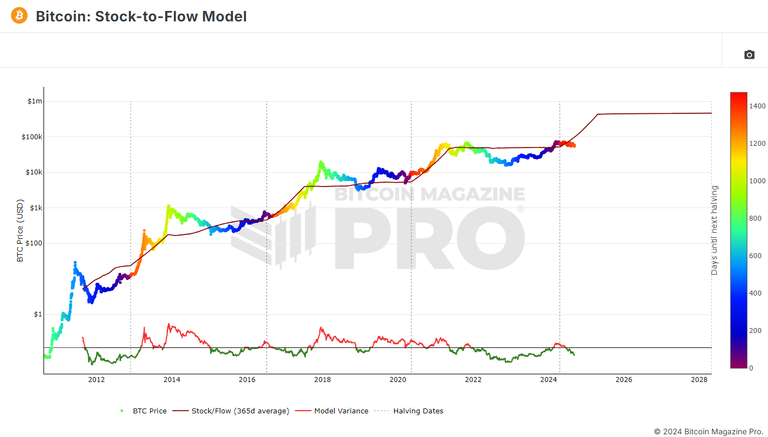

Looking at the famous Stock-to-Flow chart we could consider that it is still valid, despite the obvious variations...we are still a bit far from the yellow and green dots but we can assume that the prediction has a chance of being somehow correct...

However, I do not remember so much consecutive tedium in the previous cycles that I have experienced, perhaps I miss some catalyst that propels the masses to buy, so the explosiveness of this cycle may be less than expected.

The previous rhetoric has been outdated as the months and years go by and the only thing that seems "permanent" is the scarcity of Bitcoin and the idea of Bitcoin as a decentralized store of value...

We have no choice but to wait and see how far we get this time...I don't think the wait will be very long, maybe 4 or 5 more months will be enough to find out.

Patience.

@toofasteddie

Posted Using InLeo Alpha