Day 1 - Coming off the back of a big win

Account Overview

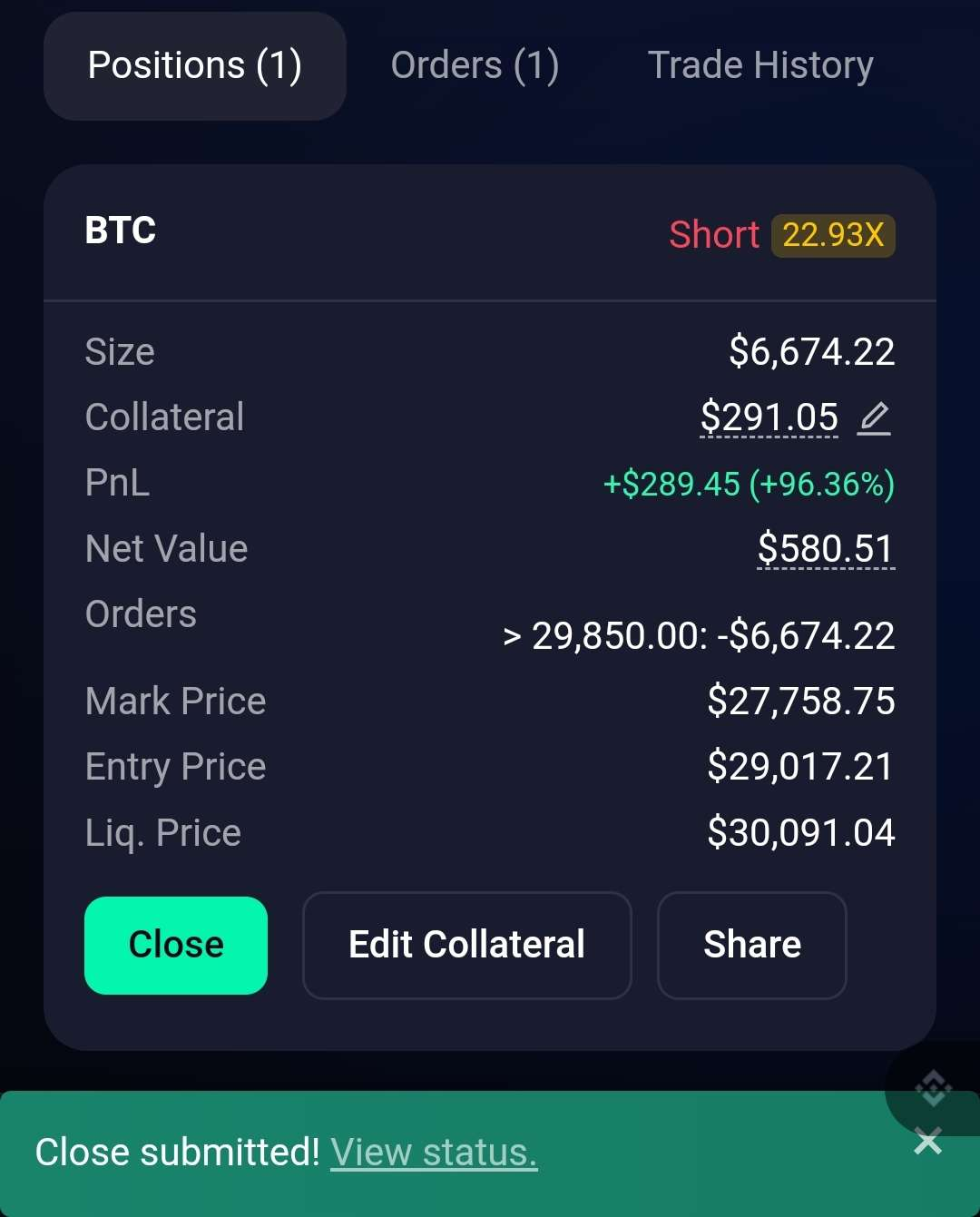

What's up fellow Degens? How are we all doing on this fine Monday? I myself am doing pretty well as last week comes to a close and this week finally starts because I pulled off one of my most profitable trades USD-wise in a long while. I YOLOD my entire paycheck for last month into a 22x short on BTC and held it for the week while I waited for my trade to play out before finally closing it out for a near 100% profit but after taxes, it was closer to 85-90%.

Trades

23x BTC Short

For the past couple of weeks or so I've used any opportunity where we've rallied to above 29k to short the market. with my most recent entry coming in at 29,017. Although my entry was a bit early and we had a pump up to around 29.7k which had me at an almost 80% drawdown for 2 days while I was at work, of course, this added a lot of unnecessary stress to the whole process. we had an initial drop which would have netted me a 35% profit or 120 USD, I used my diamond hands, held my position and waited for my TP at 27.6k. It hit that target the next day so waking up to a 100% profit was a nice sight to see. For some reason, my trade wasn't able to close on Mummy due to technical issues for an hour which cost me my perfect exit which would have given me an extra 25%~ profit but it's about the meat in the middle not timing everything.

50x BTC long

I saw an opportunity I had to take this morning while having my lunch so I hopped into a 50x long on BTC with about 1/4 of my capital and an entry of 27850. This will be a shorter-term trade aiming for 28 to 28.8k depending on the run and with a clear SL below support and swing low the RR set-up seems favourable.

Market Overview

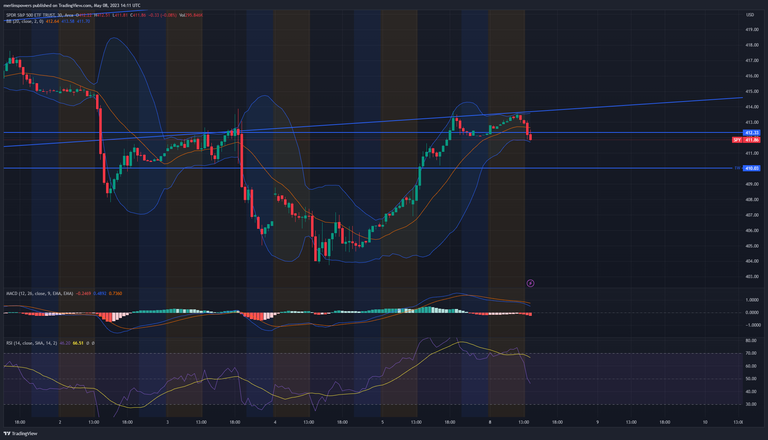

Taking a look at BTC on the 4h we can see a steady decline since 31k recently and we are beginning to see more downward pressure so I am personally leaning more towards the short side rather than the long side, especially for anything shorter term. BTC does however have an extremely oversold RSI and is running into heavy support so I don't expect it to move down in a straight line, a break above the diagonal for me would be a chance to look for longer-term long plays after a clean break of the next horizontal resistance till then rips are for fading.

In terms of the SPY 30m chart, we can see it failed to reclaim the diagonal after it broke below recently so we should be expecting more downside in the future although the CPI may change this as it is hard to predict. But again as long as it holds below that diagonal I'm more bearish on equities than bullish.

Final Thoughts

Although BTC has had a massive run-up from 16k to 32k I still believe this is a bear market rally until we break above the previous bull market lows at around 32k. If a gun was put to my head I'm expecting 16-20k before we break above 30k again but I know that's an unpopular opinion and I'm not saying its a guarantee so don't trade on this information but just something to think about. Ill outline my explanation for why in the coming days.

This is not Financial advice, do not and I repeat do not copy me you will lose all your money like I have many times, this is simply for educational and informational purposes.

Please use my Bybit link if you plan to sign up as it would hugely help with what I'm trying to do here.

Posted using IceBreak