The Bitcoin VS Ethereum is always an interesting debate! Will Ethereum surpass the Bitcoin market cap? The flipping! Will Ethereum be more valuable than Bitcoin?

Let’s take a look at some on chain data in the last period.

We will be looking at data for:

- Unique wallets

- Active wallets

- Number of daily transactions

- Fees

- Market cap and BTC dominance

The data is extracted from https://www.blockchain.com/charts and https://ethscan.com/, for the period July 2015 – October 2022.

Bitcoin is around since 2009, but Ethereum started with operation in 2015 and from then forward we will be making the comparisons.

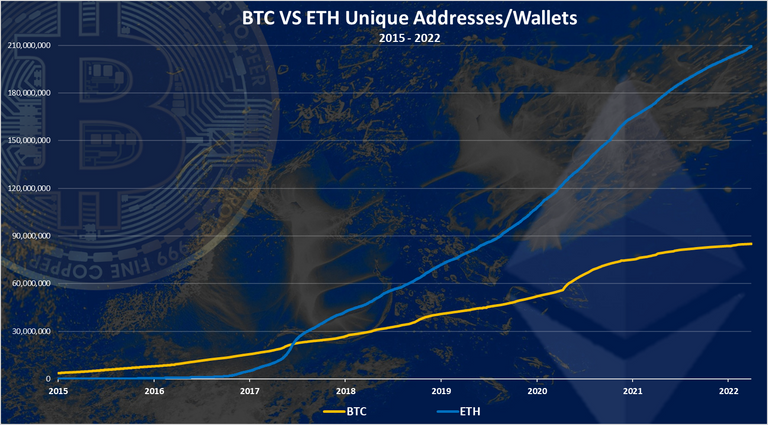

Number of Unique Wallets Created

Here is the chart for the number of unique wallets on Bitcoin and Ethereum.

Up until 2017 Bitcoin was leading in the numbers and then in January 2018 Ethereum took the lead in number of wallets and has been increasing the lead ever since.

In January 2018 the number of Bitcoin and Ethereum wallets was just above 20M. Today Bitcoin has almost 85M wallets and Ethereum 210M. Ethereum is leading in terms of number of wallets and has the highest numbers in the industry.

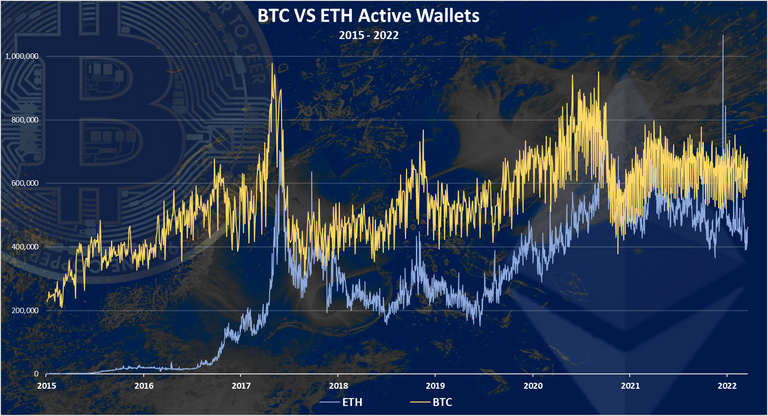

Active Wallets

The above was in terms of wallets created. How about active wallets? How many of those wallets created are actually been used? Here is the chart.

When we look at the numbers of active wallets Bitcoin is in the lead. Ethereum has come close to Bitcoin in the previous bull run, at the end of 2017 and the beginning of 2018. On few occasions ETH has surpassed BTC in number of daily active wallets. It has happen recently in 2022 as well.

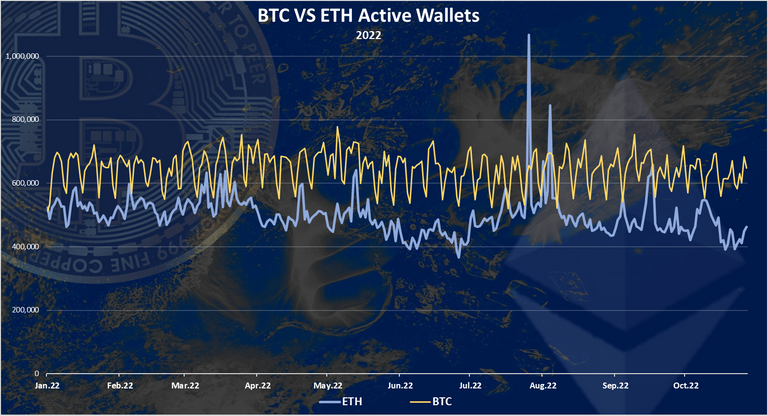

If we zoom in 2022 we get this:

Quite a constant numbers for both of the chains.

Bitcoin is leading as we noted above and has been hovering around the 600k active daily wallets in the whole 2022. Ethereum has been in the range of 400k to 500k active daily wallets.

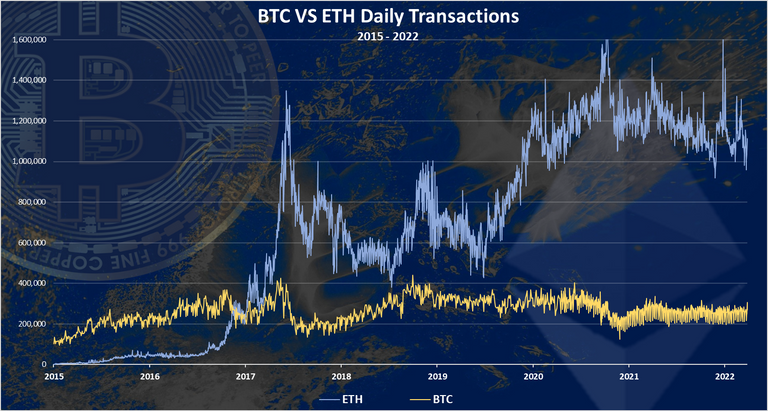

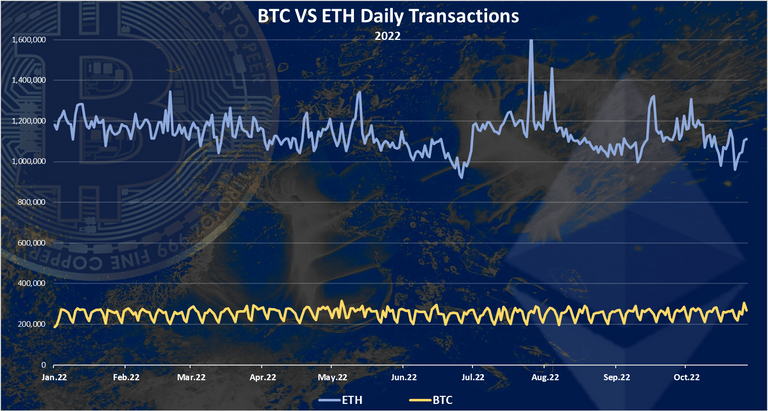

Number of Daily Transactions

Here is the chart for the number of daily transactions.

In terms of daily transactions Ethereum is in a big lead in front of Bitcoin.

Ethereum has overtaken Bitcoin in the previous bull run in 2017 and has been leading since then. In the last period Ethereum has more than 1M transactions per day, while Bitcoin is around 250k transactions per day.

When we zoom in 2022 we get this:

Ethereum has been in the range of 1M to 1.2M transactions, while Bitcoin is around 250k transactions per day, and it is very steady in the whole period.

What’s interesting is that the numbers are very steady no matter the decline in price for both of the chains. Seems like they have reached the cap and are working at that level all the time.

As we know Ethereum as a smart contract’s platform has a lot of different operations and transactions that can be made on chain, while Bitcoin is used only for one purpose, and that is transferring tokens from one wallet to another.

Ethereum has a smaller number of daily active wallets than Bitcoin, but obviously those wallets are making more transactions than the Bitcoin wallets.

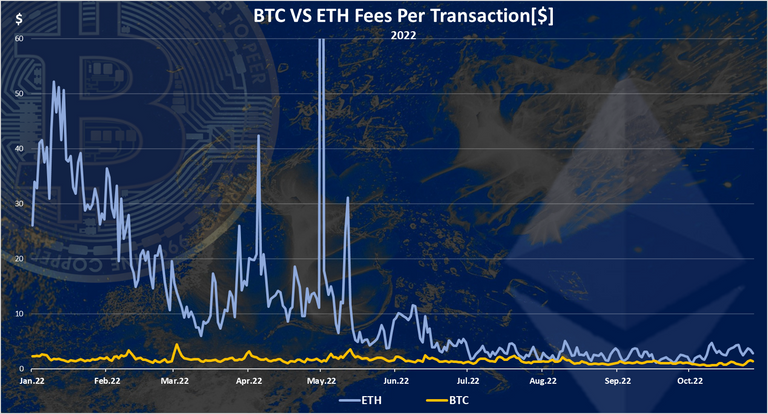

Fees

The chart for the fees in 2022 looks like this.

These are the average daily fees per transaction in $ value.

A significant decline for Ethereum, while Bitcoin remains almost at the same levels in 2022.

At the beginning of the year Ethereum had fees that were more than 40$ on average, while Bitcoin was in the range of few dollars. As time progressed the fees for Ethereum dropped and both chanis are now in the range of few dollars per transaction.

We can notice that in the last weeks Ethereum fees has increased slightly again.

In the long run fees are essential for the chains as they will be the main source for incentives for miners/validators providing infrastructure.

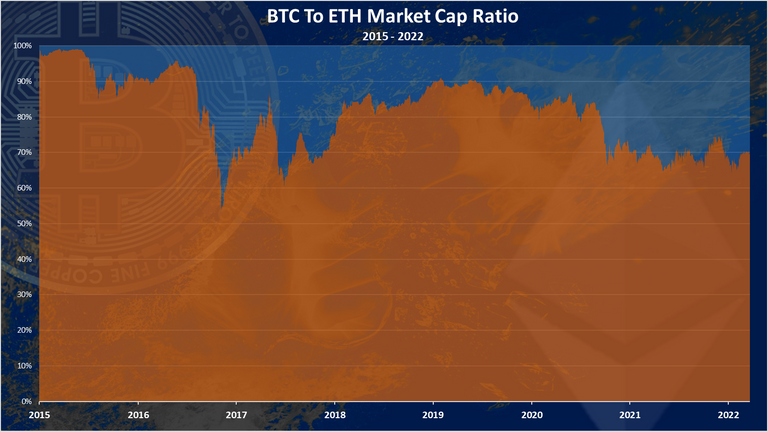

Bitcoin And Ethereum Market Cap

The interesting topic for Bitcoin and Ethereum is the flippening, or will Ethereum surpass Bitcoin in terms of market cap and become no.1 crypto.

Here is the historical chart for the Bitcoin VS Ethereum market cap.

We can see that at first in 2015 Ethereum has a very low market cap compared to Bitcoin. As time progressed in the bull run of 2017 Ethereum has come close to the market cap of Bitcoin on few occasions, but only for a short period of time.

In 2018 the ratio of Ethereum to Bitcoin market cap dropped from above 30%, to under 20% and it stayed there until now.

In the last period the ETH increased again and the BTC vs ETH ratio has is around 70% to 30%.

At the moment Ethereum has around 200 billions market cap, while Bitcoin is around 400 billions, or double the market cap.

Ethereum came closest to Bitcoin on June 18, 2017

On this date Bitcoin had a marketcap of 43 billion and Ethereum 37 billion. This is before the major bull run that happened late in 2017.

The chart for the share in marketcap on this date looks like this.

The closest that Ethereum came to Bitcoin.

This is pretty close. A 41B to 34B! A 7 billion more ant Ethereum would have flipped Bitcoin. Looks like the flippening is not impossible 😊. A 54% to 46% ratio.

Finally on the above metrics things stands like this:

- Unique wallets – ETH

- Active wallets – BTC

- Number of transactions – ETH

- Fees – draw?

- Market cap – BTC

Two for BTC, two for ETH and one draw. These are just a few metrics for the two chains and they for sure doesn’t paint the whole picture but represent just a piece of it.

A note at the end that comparing these two blockchains just in terms of the numbers above is quite interesting and useful but might be misleading as well.

These two blockchains have taken a different role now. Bitcoin as a scare’s asset a digital gold, while Ethereum as the leading smart contract platform enabling innovations, new dApps and use cases for crypto.

All the best

@dalz