The BXT token was launched in November 2021 by @gerber, with the rewards starting on November 26th. You can check the whitepaper here.

It is a fee sharing token where the users that stake BXT gets a portion of the fee for the HIVE to SWAP.HIVE deposits and withdrawals that is available on beeswap. It is an alternative gateway to Hive Engine, that offers deposits and withdrawals for 0.25% fee unlike the 1% on Hive Engine.

Let’s take a look at some data in the period.

Users can earn the BXT token by providing liquidity in 10 pools. It is the closest thing to defi farming on Hive. The fees sharing part gives the token an actual use case and revenue unlike most of the yield farming tokens.

Here we will be looking at the following:

- Issued BXT token

- Token supply

- Top BXT earners

- Staking

- Top accounts that staked BXT

- HIVE payouts to BXT holders

- Top HIVE earners

- BXT Pools

The period that we will be looking at is November 2021 to August 2022.

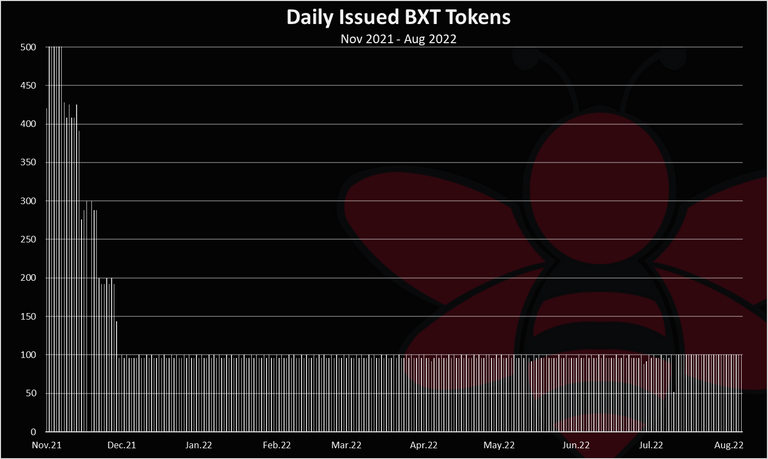

Issued BXT Tokens

Here is the chart for the issued BXT tokens.

According to the whitepaper, BXT tokens are issued 500 a day in the first week, then 400 a day the next week, going down 100 each week to 100 a day and it stays there.

From the chart above we can see that the issuing have been following the schedule, and after the first few weeks with promotional tokens, new BXT has been minted at a 100 per day. Monthly this is around 3k tokens or 36k tokens per year.

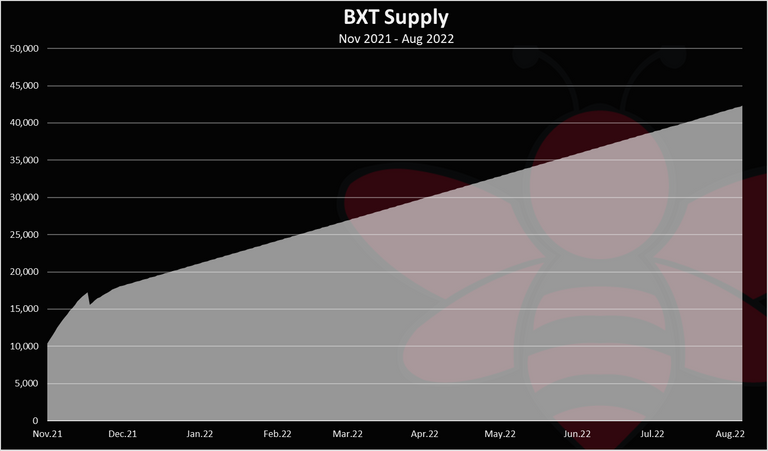

When we sum the tokens issued we get the supply for the first year.

Just above the *40k mark for the tokens supply. In the first year there will be more then the 36k yearly because of the first month high speed inflation.

By the end of 2022 there should be around 54k tokens in circulation. Starting from the next year 2023 this will be the base for calculating the inflation and with 36k new tokens minted per year this will be around 65% yearly inflation. This might sounds like a lot but having in mind that in the first year there was no base or it was very small, the inflation was in the multiple hundreds like 300%. As years will pass the inflation will continue to drop.

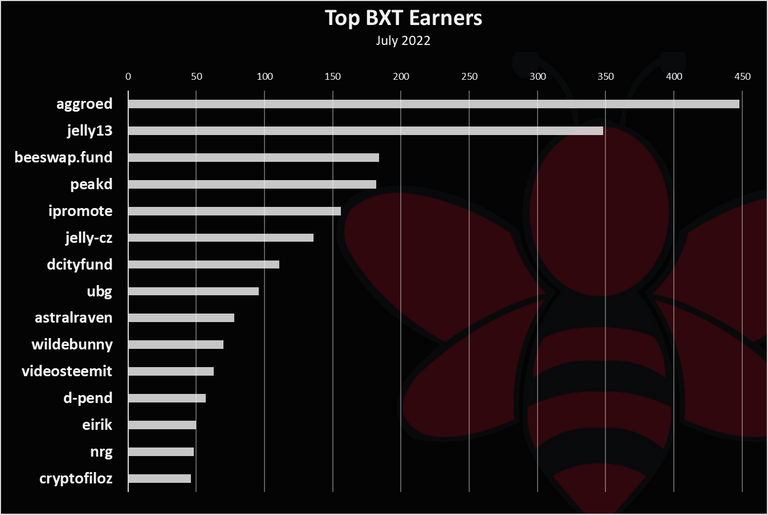

Top BXT Earners

Who has earned the most in the period? Here is the chart.

Since BXT is issued to liquidity providers, the ones that provide the highest liquidity earn the most.

We can see that @aggroed is on the top with almost 450 BXT earned per month, followed by @jelly13 and the @beeswap.fund.

Aggroed is providing a lot of liquidity on Hive Engine in general, so it is not a surprise he is on the top.

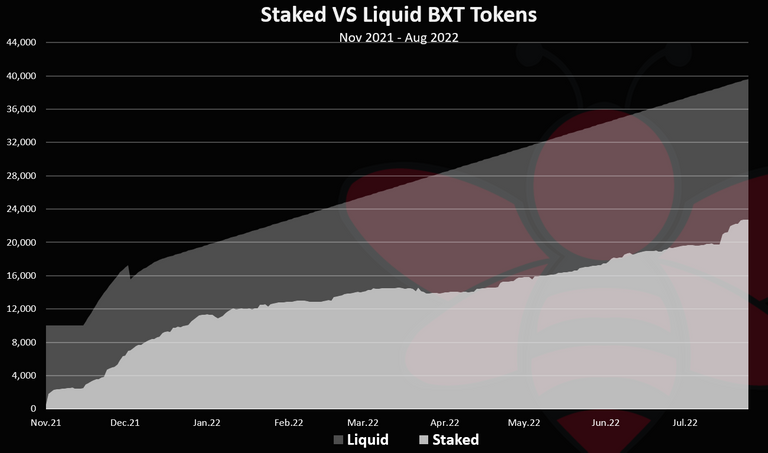

Staking

Here is the chart for the cumulative staked BXT.

At the moment there is 23k BXT tokens staked from the 40k supply, or 58% share staked.

We can see that the historically the amount of BXT tokens staked has constantly been growing up, although not always as the issuing of the tokens. Sometimes the share of liquid tokens has been growing and the opposite.

In the last weeks there has been an increase in the tokens staked.

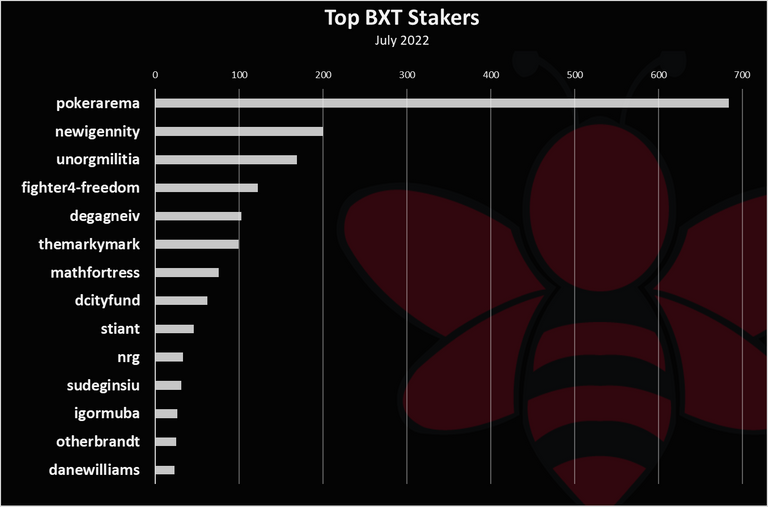

Top Accounts That Staked BXT

When an account is staking BXT it receives daily rewards in HIVE from the bridge fees. At the moment the APR for staking BXT is 36%.

Here are the accounts that staked the most BXT in the last month.

@pokerarema comes on the top here with almost 700 BXT staked.

In terms of all-time tokens staked there is a rich list on the BeeSwap UI https://beeswap.dcity.io/bxt?richlist.

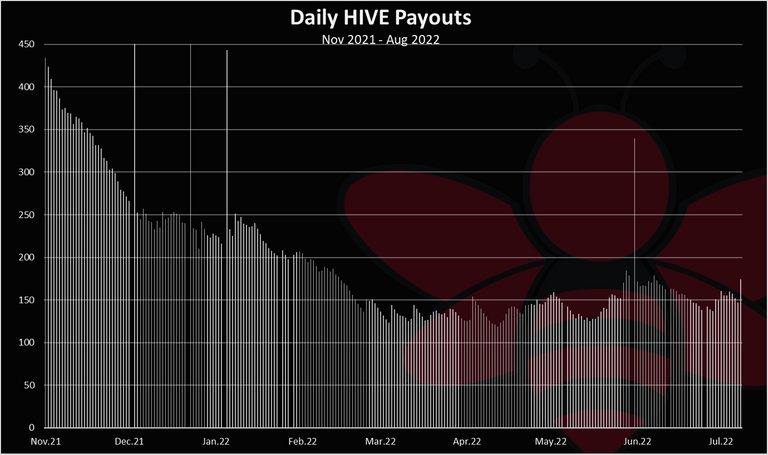

HIVE Payouts

Here is the amount of daily HIVE payouts.

As mentioned the BXT token has an actual revenue from the bridge fee that it distributes to accounts that have staked BXT.

From the chart above we can see that at first this revenue dropped from 400 to around 150 HIVE per day, but since then it has stayed steady at that level and is generating that much in terms of fees each day.

Note that only 50% of the HIVE from fees is paid to the accounts staking BXT, while the other 50% goes to the accounts that actually provided HIVE as liquidity in the HIVE to SWAP.HIVE bridge.

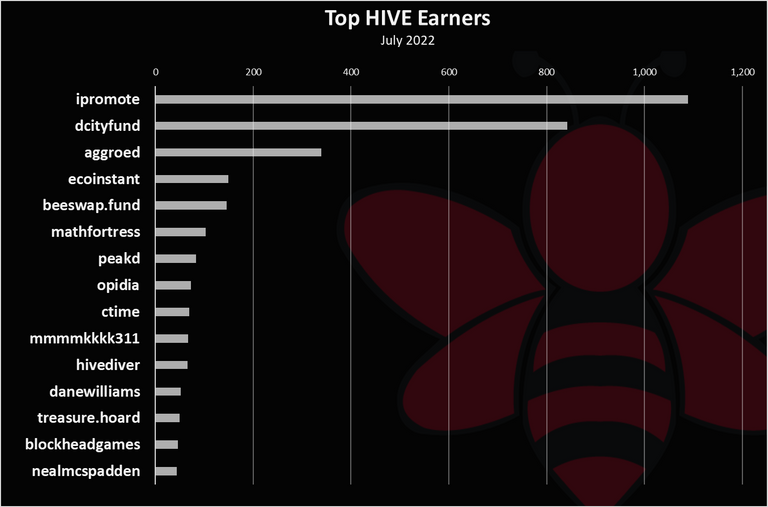

Top HIVE Earners

Here are the top accounts that received HIVE from the @beeswap.fees account.

As mentioned above, HIVE earned from fees is distributed 50/50% between the accounts staking BXT and the ones providing the HIVE liquidity for the bridge. The @ipromote account is on the top, followed by @dcityfund. These are accounts that are providing large amounts of HIVE to the bridge.

@aggroed as the largest holder of staked BXT is on the third place.

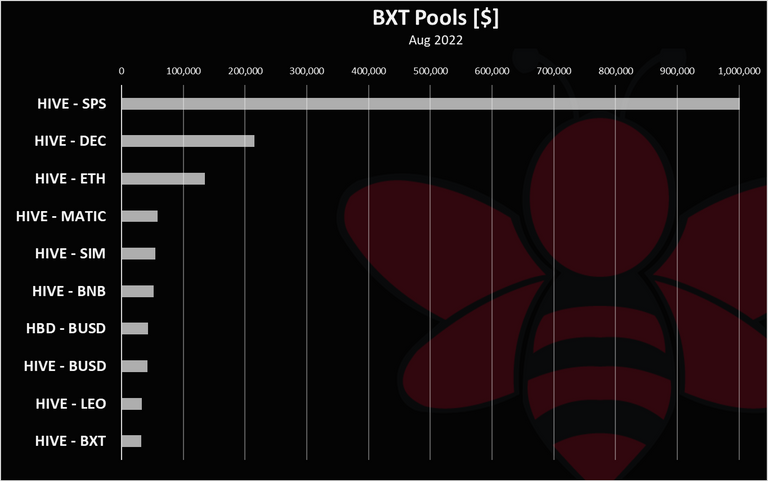

BXT Pools

Here are the pools where there is BXT incentives for providing liquidity and the liquidity in them at the moment.

The SPS and the SPS pools are on the top in terms of liquidity. Those are incentivized by Splinterlands, so BXT just comes on top.

Next is the ETH pool with almost $1350k in liquidity, then the HIVE – MATIC pool, etc. All the other pools are in the range of 30k to 60k USD. Before the drop in the general crypto market these pools were above 100k.

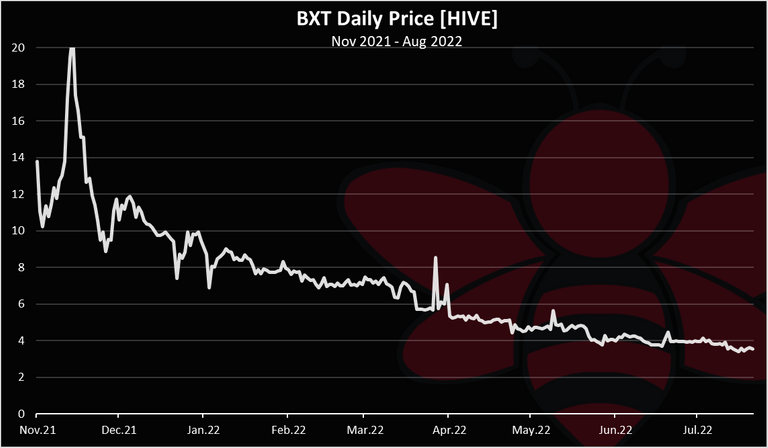

BXT Price

What about the token price? Here is the chart.

The price is in HIVE, since the token is heavily corelated with HIVE.

We can see some volatility at first and a general downtrend since then.

In the last months the price seems to be stabilizing around the 4 HIVE mark. As the supply grows, the APR for one staked BXT drops and so does the BXT price. As the issuing levels out so will the price.

All the best

@dalz