I am posting this on @buynburn account. I will use any HIVE or HBD I receive on this post to purchased failed coins on #hive-engine.

Now For the Post

I can't believe it!

We did it!

In the category of "Play Stupid Games, Win Stupid Prizes" the HIVE ecosystem can now jump up and down in celebration.

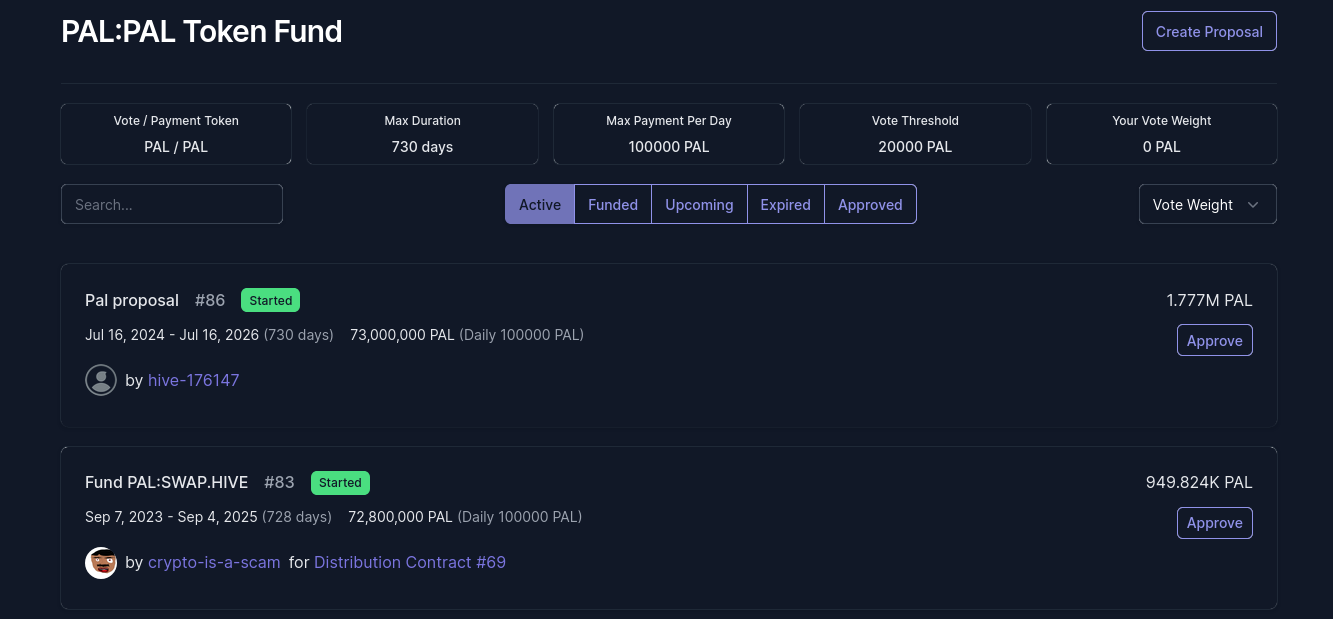

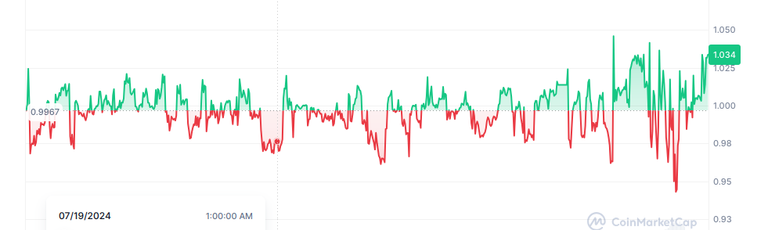

I checked into HBD Dollar Monitor to find that the HBD market cap is now over 10% of the HIVE market cap.

Financial collapse is the prize that people win when they play the game of debt.

To celebrate, I asked Nightcafe to create an image of insane people celebrating.

I was surprised that it took this long.

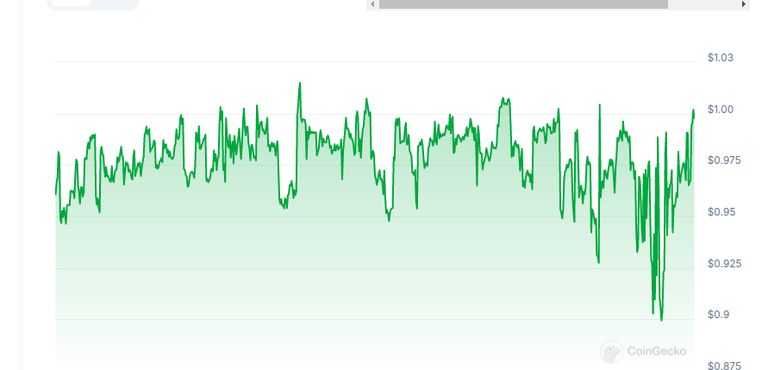

Of course, HBD really never gained the popularity of UST or the other failed stablecoins.

HBD is a derivative of HIVE. HBD derives its value from HIVE. The conversion operation will destroy the HBD and generate HIVE in its place.

When the witnesses raised the interest on HBD to 20%, I was expecting to see a large number of institutional investors jump in to take advantage of the high interest.

What happened is the investors is that investors looked at the HBD formula. They realized that the HBD/HIVE formula and realized that the 20% interest on HBD created an unstable structure.

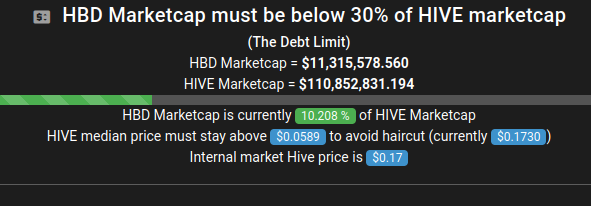

Geek Girl produces monthly reports on this slow moving train wreck.

Her reports show that we paid $133,454 HBD interest in June. If converted at $0.172, this HBD would produce 775,000 HIVE.

The HBD dropped from 133,454 to 126,956 in July.

The @geekgirl report confirms something that I've noticed about HBD.

People save HBD when the price of HIVE rises. They dump HBD when the price of HIVE falls.

The interest on HBD costs the platform way more than 20%.

We are currently experiencing the high point of the HBD experiment.

The crossing of the 10% marcap is the great milestone of HBD.

The sad truth is that HIVE is likely to start experiencing the downside of massive debt in the future.

As mentioned, the market has to absorb 778,000 HIVE a month to cover the interest on HBD.

The scary mathematics happens when the price of HIVE drops to a dime.

Ausbit says that there's 11 million HBD. Much of this is held by smart people.

People are likely to panic as HIVE drops below a dime. I would not be surprised to see people convert 5 million HBD to HIVE. 5 million HBD at a dime would dump 50 million HIVE onto a depressed market.

Who is going to buy this 50 million HIVE?

HIVE holders would be reeling from the devaluation of their investment. HIVE authors will be reeling from the continued drop in their earnings.

The HIVE authors who were depending on HIVE to pay expenses will have to accelorate their selling of HIVE.

The investors in HIVE Engine have already been destroyed. We will simply see more and more things break as the system implodes.

Celebrating the Mile Mark

I wrote this post to celebrate the greatest milestone on HIVE.

The HBD marketcap is now over 10% of HIVE.

This milemark has been the primary focus of the witnesses since the decision to raise interest on HBD to 20%.

We should celebrate.

Buying and Burning HE coins

I feel bad for raining on the parade. I will use any rewards from this post to buy and burn some of the failed HE coins.

I admit, most of the HE projects were lame. I was hoping that there would be better development on HE.

The 20% on HBD created a dynamic where it is impossible for the HE coins to compete.

I will buy up some of the failed coins has it helps people recover from their failed dreams.

I think I will burn another 1,508 VYB as it has been dropping of late. I've burned 5412 VYB so far. This brings my total to 6,920 VYB . The VYB marcap has fallen to $498. It appears that i am the only buyer. VYB won't hold.

There is no way we can burn our way out of the hole dug by the HBD debt.

Play Stupid Games. Win Stupid Prizes

The 20% interest on HBD was a stupid game. The game creates down pressure on HIVE when the market is weak. The low price of HIVE is the prize for HBD debt.

At least we are getting to be entertained by watching a platform being destroyed by debt. I want to give all the witnesses who supported the 20% applause for their stupidity as it takes bold form of stupidity to support debt.

)

)