Welcome to my Not financial advice – May 2022 post!

Hi everyone!

So... I think my predictions have been going pretty solidly so far... in that I've been predicting sideways and flat movement in the markets based on what the US Fed is doing.

In my previous post:

Not financial advice – April 2022

I mentioned that @edicted is looking for 90k-108k price for Bitcoin in May and to me that's looking less and less likely. Of course bull markets and run ups can happen super quickly, but the reason I don't think it's likely is this:

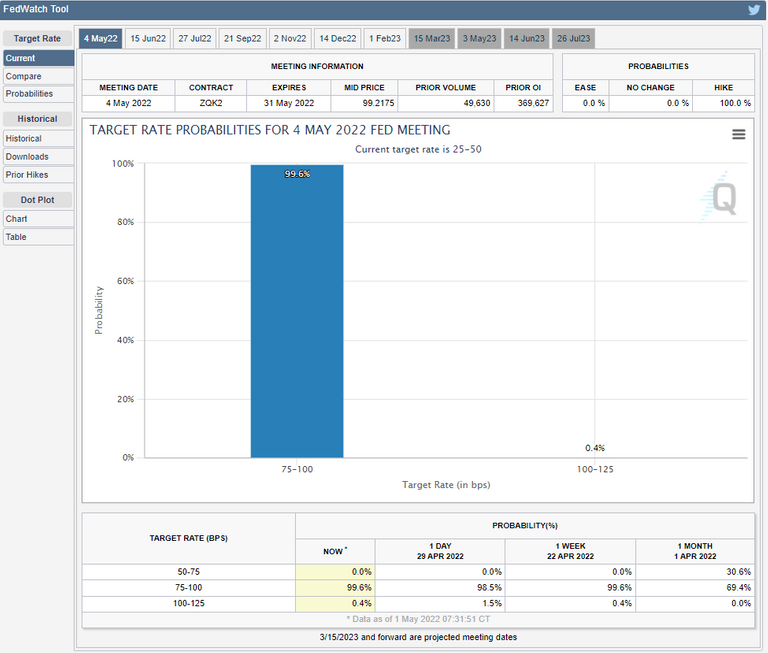

Source

So the next US Fed meeting is in 2 days. The market is 99.6% sure that we're going to see the US Fed announce an interest rate hike of 50 basis points. We're currently at 25-50 basis points and the market is expecting it to go to 75-100 basis points which is an increase of 50 basis points.

If the US Fed comes out in 3 days and say that there is no interest rate hike, or a smaller hike of 25 basis points... the market will go bananas and throw all it's money in... but that's really unlikely to happen since the market is 99.6% sure it's going up 50. You also never see the market this sure of anything...

If the US Fed does what is expected, and announces a 50 basis point increase, we're going to see more money move to the sidelines and the crypto market will essentially going sideways or decrease over the next 3 months.

Despite what you see in the newspapers, the US economy is doing really well... the unemployment figures are ridiculously strong at the moment and while the GDP went down by 1.4%, there are still individual sectors doing very well. The US is not close to a recession at the moment. In a recession you can expect crypto to go straight into a bear market... but we're not there yet so I expect a whole lot of sideways action for BTC and the crypto market in general.

Source

On the 1st of April 2022 BTC was at $46k and now it's at $38k.... honestly I expect it to hover around the $35k mark for most of May. If the US Fed announces a 100 basis point interest increase (which is very unlikely) then Bitcoin and the crypto market might decrease very suddenly as institutions pull their money to the sidelines to manage their risk. If the US Fed announces a 0 or 25 basis point (also unlikely) then we'll see Bitcoin head back up towards $50k.

Personally I think if Bitcoin hits $36k or lower I'll cautiously DCA in for a bit... it could totally go lower if the rumblings of a recession get louder... but at the moment there are still quite a few indicators indicating strength in the US economy. If BTC goes lower and we start to see a real crypto winter, that's fine, that's the best time to buy small regular amounts until it starts to show so strength again.

Before there is strength in the markets, I think the US Fed will have had to sell off a lot from it's balance sheet... and we've got quite a long time before they've finished that. As far as I know, the US Fed is still buying assets, just at a much lower rate than they were.

So.... numbers go sideways or down for the foreseeable future... so what else am I thinking about?

Crypto.com

Unfortunately Crypto.com made some really annoying announcements this week.... oh, and also one great annoucement.

Source

So, at the moment I've got a little bit of DAI (earning 12%), a little bit of CRO (earning 6%), some BTC and ETH (both earning 6.5%). At the end of this month, the rates will drop to 8% for DAI and 4% for BTC & ETH... plus, if you have over $3,000USD worth of total crypto in your account then you'll only receive 50% of that rate.

I'm sure it's no surprise that the CRO token has dropped 18% since this news came out... but to be honest, I'm pretty bummed with these new changes.

Source

They have to lose customers over this.

I suspect they've done it to drive their customers into their DeFi platform... I have nothing against DeFi, I very much loved Uniswap until Ethereum gas got way too crazy... but with DeFi you always have the potential for impermeant loss... whereas with Crypto.com's locked in interest rates, they are carrying all the risk for the opportunity to use your crypto.

Crypto.com was always one of those platforms that I'd share with the crypto-curious... bragging about it's 12% interest rates and super easy UI and bank deposits.

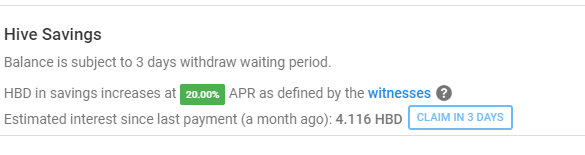

Now I'm just going to have to tell people go for the 20% APR for HBD on Hive. I don't think it's quite as easy as the one-button click on Crypto.com but you can buy it on Bittrex, send it to your Hive account and collect that 20% annual interest. It's honestly pretty amazing.

Otherwise you can post content on the Hive blockchain and then any HBD you earn you put into savings. That's what I've been doing and you can collect it each month...

Source

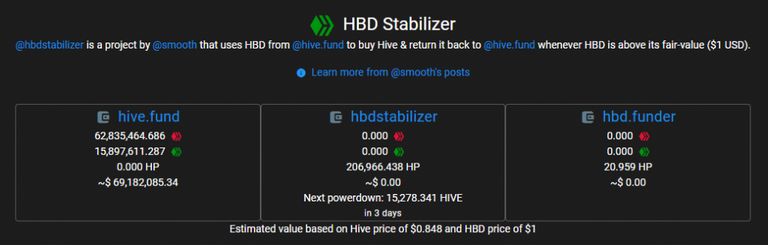

HBD is the Hive Backed Dollar... it's the algorithmically calculated stable coin pegged to 1 US dollar. If it goes below the $1USD peg the blockchain automatically buys Hive... reducing the supply of HBD, and when it's over $1 then it sells Hive...

Source

If a crypto winter is in our long term futures, then collecting HBD and putting into your HBD savings account to collect the 20% APR is a great way to warm you up.

The good announcement from Crypto.com was that they are now selling Splinterlands Shards (SPS):

I did buy some to get into their competition... if you were one of the first 1000 people to buy $SPS from them then you could win $50 worth of SPS. I missed the first announcement and bought it the day after... so I'm not at all confident I was in that first thousand.

The other part of their competition was to put SPS into Trading Arena, and the top 20 can win $1000 worth of SPS, but man... look at the top 10 already...

Source

There's still 10 days left of this comp.... so that's a big yeah nah yeah nah from me.

When I did buy SPS from Crypto.com, I was charged a $12.18 fee... which I was not expecting. I don't buy crypto often, but I think the last time I bought anything from Crypto.com it was around $6... which I already thought was too expensive.

Splinterlands SPS

One thing I am really excited about is SPS. SPS and HBD will really be my main focus for the next few months.

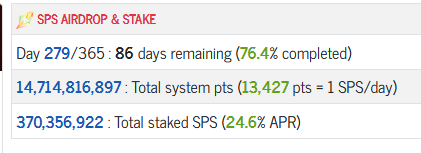

Source

There are only 86 days remaining of the SPS airdrop.

Currently each month sees 71,145,833 SPS minted by Splinterlands. However, as of yesterday, the initial investors have now all been paid off so from now on only 51,145,833 SPS will be minted monthly.

After the SPS airdrop, this will drop to a 17,812,500 monthly minting of SPS by Splinterlands.

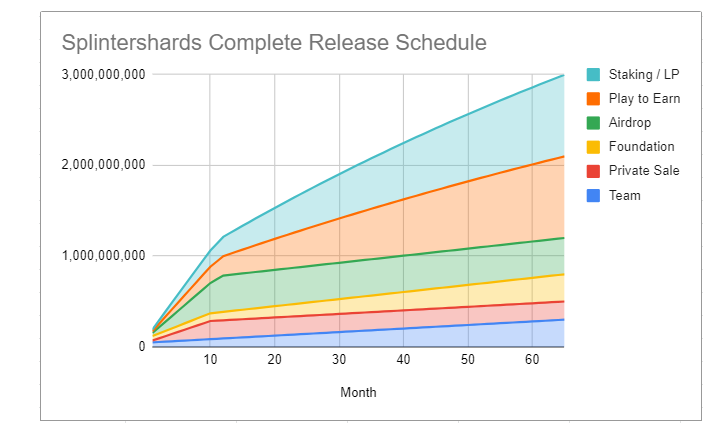

At that point there will be no way to get SPS apart from buying it... however, later this year; ranked battles, liquidity providers, guild brawls, and SPS validator nodes will eventually bring the monthly SPS minting to 43,062,500 per month, to decrease by 1% each month until they hit the 3 Billion supply cap:

Source

I'm really super curious about the SPS validator node licenses. It will be a good way to continue to earn SPS until they hit the 3B in the full 5 years (65 months). We're in month 9 so there are 54 months left to earn SPS via battles, brawls and the nodes.

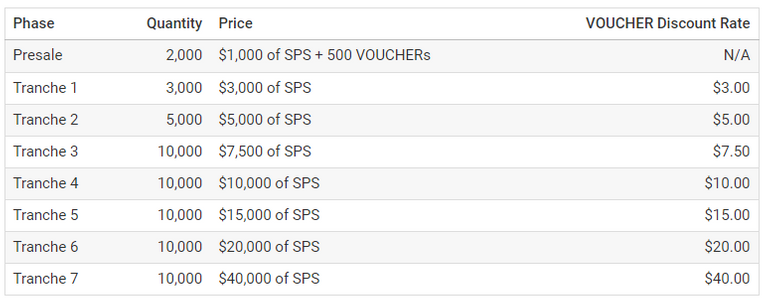

These are the prices of the SPS validator node licenses:

Source

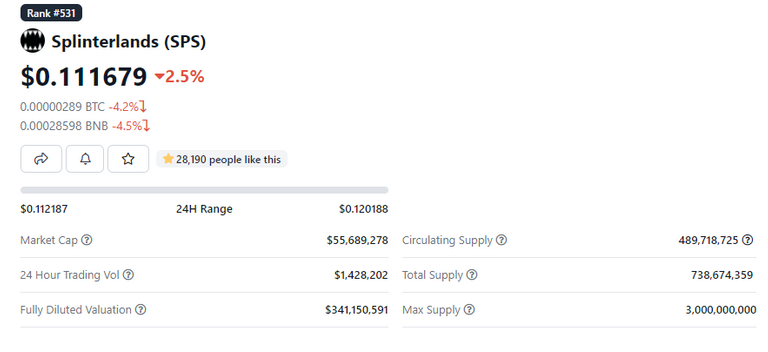

So, let's take SPS values right now:

Source

There is currently 738,674,359 SPS out in the wild... however, 370,356,922 is currently staked within the Splinterlands application right at the minute. It takes 4 weeks to fully unstake SPS in Splinterlands - you get 25% instantly, 25% in the second week, etc...

Let's not complicate things... let's just say there 738,674,359 available to buy nodes.

Today $1000 USD equals 8951 SPS. The first 2000 licenses sold in presale will cost 17,902,000 SPS. Tranche 1 with 3000 licenses will cost 26,795 SPS each (let's forget about the voucher discount) for a total of 80,385,000 SPS. Tranche 2 with 5000 licenses will cost 44,679 SPS each for a total of 223,395,000. Tranche 3 with 10,000 licenses will cost 67,034 SPS each for a total of 670,340,000.

80% of the SPS used to purchase SPS Validator License nodes will be burned.

17,902,000 (Presale) + 80,385,000 (Tranche 1) + 223,395,000 (Tranche 2) + 670,340,000 (Tranche 3) = 992,022,000.

80% of 992,022,000 is 793,617,600. There is only 738,674,359 SPS out in the wild (not really).

So if the SPS price stays at the current levels, you'll only get partway through Tranche 3 (of 10) before you've run out of all the SPS currently available in the market. I can't predict the future, but with the dramatic decrease in supply and demand staying the same... the price of SPS has to increase.

However, if the price of SPS starts to increase, that means each validator node is earning more... which you'd think would then increase demand. Decreasing supply plus increasing demand potentially gives SPS jet fuel in the price department.

SPS Validator Node Licenses will earn 3,375,000 SPS / month rewards per license (as long as they're running the node software - still waiting to find out if you have to run it 24/7 - I think you might.)

Let's say that the Presale and Tranche 1 licenses sell out in the first week. That means 5,000 licenses will earn 3,375,000 SPS / month which is an extra 675 SPS earned a month. At this rate it would take 13 months to earn back the 8,951 SPS it took to purchase the license.

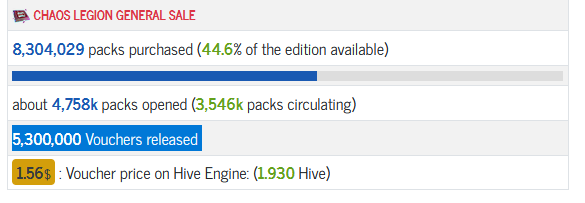

An additional 20,000 vouchers will also be available to each license per day, so an extra 4 vouchers (120 per month) for our hypothetical 5,000 license holders.

Of course, I expect the price of SPS to shoot up in the days leading up to the license sale which means it would cost less SPS to purchase the license, fewer months to make back the purchasing SPS and each license theoretically earns more value back each month.

The licenses will be NFTs that can be sold on Hive-Engine and other secondary sites... and I'm sure there will be many people looking to flip the licenses rather than run a node.

The Land Plots were initially sold on the Splinterlands site for $20. Today you can buy one on the Hive-Engine secondary market for $200.94. That's a 10X increase for those people looking to flip them. There was 150,000 plots for sale at the $20 price point. The Validator Node licenses will only have 60,000 available...

Technically, if someone purchased a license in the Presale and then sold it while Tranche 10 was active, they'd make just under 40X ROI. The weird thing is, those people looking to flip will always be competing with Splinterlands itself... so they could never sell a license for more than Splinterlands is selling them... so if someone bought one in the Presale but Tranche 2 was still active, they could only get 5X ROI. Not terrible, obviously... but that'd be the max.

The Validator Node Licenses will have to take years to sell out... because there literally isn't enough SPS that's been minted yet to buy all the licenses (at current prices).... of course 5,300,000 Vouchers have been released so that changes the math (in regards to the discounts offered) quite a bit.

Personally I expect the Presale licenses to sell out in a few minutes... even if the math of the monthly SPS return isn't great at current prices, I think enough people will look at the 10X of Land Plots and will want the exposure to these assets.

People will be more interested in the opportunity to flip the assets more than the monthly SPS returns I think.... although, as a warning to potential flippers... you'll always be competing with Splinterlands who offers at most a 50% discount for vouchers:

Source

Vouchers are currently going for $1.56 on Hive-Engine.

A person who has no vouchers wanting to buy into Tranche 1 will either need to buy $3000 worth of SPS to buy a license... or buys 500 vouchers off Hive-Engine at $1.56 for $780 to save themselves $1500 in SPS. So $1500 in SPS and $780 in vouchers which equals $2280. So, assuming vouchers stay at a price of $1.56 (which I can't imagine they will) then a flipper can buy in the Presale for $1000 (plus vouchers) and sell for just under $2280. Potentially. Maybe. We'll see.

Of course, there are elements of friction here... buying vouchers off the Hive-Engine requires you to hold Hive tokens, which might have to buy off Bittrex or similar... then move to your Hive wallet, then move to your Hive-Engine wallet. Splinterlands is looking to build in a non-card market to help people buy SPS, DEC, Land, Vouchers, etc... potentially just with PayPal. A lot less friction for people new to Splinterlands. This means someone wanting to flip a PreSale license in Tranche 1 could potentially sell their license for just under $3000... because then maybe a person doesn't have to buy SPS first.

That non-card market doesn't exist just yet... so we'll have to see what functionality is available when the vouchers go on sale.

Source

Personally I'm going to try to pick up a SPS Validator Node license in the Presale. There are so many variables here (price of SPS, price of vouchers, number of licenses sold) that it's hard to calculate if there will be a good return on investment regarding the SPS and vouchers earned by running the node.

However, I really enjoy playing Splinterlands and I very much would like the game to succeed... so if running a node helps decentralize and potentially speed up the game, then I'm all for it. If running the node software requires it to be on 24/7 and/or reduces my internet bandwidth then I might have to pass.

I think there is a likely chance that the NFT licenses sold in the Presale will be worth more in the future as an asset class themselves... but I definitely can't guarantee that. There is a SPS opportunity cost with this purchase, if it costs 8951 SPS ($1000 worth at today's price) and the burning of all that SPS shoots the price up then you've spent way more than $1000 worth.

SPS costs $0.115 today.

If SPS shot up to say $0.30 because of the SPS getting burned in the Presale... then your $1000 worth of license actually cost you $2685.30... and then the Tranche 1 license with vouchers costs you 5,000 SPS.

As I mentioned previously I'd hope that the SPS price would shoot up before the Presale... but the SPS burning process of the Validator Node License NFTs is very likely to affect the price of SPS itself.

However way you carve it up though, it's an exciting time to be holding Splinterlands Shards...

Source

Let me know what you think... are you thinking about buying SPS, or a SPS Validator Node License NFT? Thanks for reading my Not financial advice – May 2022 post. Please do let me know if my math or assumptions are wrong.

Posted from my blog with Exxp : https://lifebe.com.au/opinion/not-financial-advice-may-2022/