This is a reply to @finguru, who asked about some details for HBD and UST, the comment turned quite long, so I believe it deserves a short post :)

I go in details about HBD, while only rough overview about UST.

The basic mechanics for HBD are the conversions HIVE <-> HBD, where the blockchain gives you a price for HBD at $1, as long as the debt limit is not reached.

The debt limit is very important parameter, because unlike most of the other stablecoins, HBD by design is set to brake the peg of 1$ in case of emergency. While this might be seen as a bad thing it is actually a good thing because the protocol gives upfront information about the state of HBD and everyone can adjust their positions upfront, and this is a protective mechanics that allows HBD to be priced lower then 1$, but never goes to zero :).

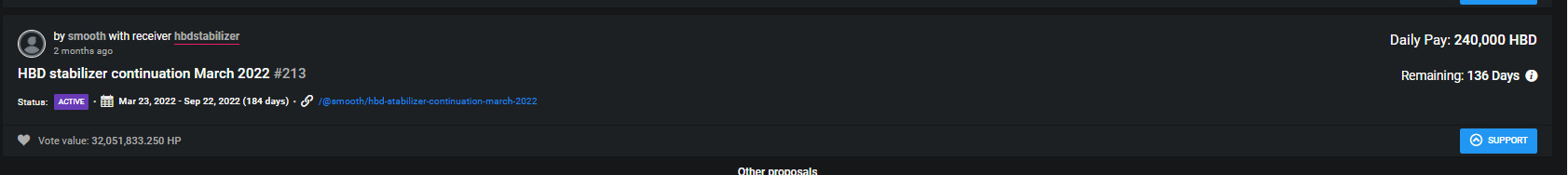

Another very important parameter is the internal DEX and the hbdstabilizer. HBD conversions are not instant (3.5 days conversions), and because of this there is market risk in the process of conversions. Because of this the conversions by themselves keep the peg loosely, but there is better security, because of a better price oracle of 3.5 days.

This is where the stabilizer comes in place. It basically provides instant conversions for HIVE to HBD and keeps the peg in a tighter range. The stabilizer has around 130k HBD per day in liquidity to keep the balance. It is a type of incentivized internal market from where all the external markets for HBD can arbitrage and keep the peg on the external markets.

In short

- debt limit that controls the HBD supply preventing overexpansion

- 3.5 days conversions preventing price oracle risks

- incentivized internal DEX providing instant liquidity

While for UST I know they have instant conversions LUNA-UST and they have some type of tax system (fees) as incentives for conversions.

I have posted about the debt limit and the haircut rule, and will post again details soon :)

Another important thing to add is that HBD is battletested. It has been around for a longer period of time then UST and has survived.