Rethinking $HBD Bonds and Witness Parameters for $HBD APY

[UPDATE: For those who might find this post "way too complicated" or want a "dumbed down version," I have published a lighthearted Children's Story Version (with the help of PeakD's AI button) 🤣.]

This post provides a hypothetical example of how to structure Layer 1 $HBD Bond offerings.

I am providing this to get members of the community engaged in deeper dialogue about the concept.

As @taskmaster4450 said in a post yesterday about “How To Implement Time Vaults And Hive Bonds”:

The interest rates ... have only one purpose: draw in capital.

My unique contribution to this discussion is the suggestion that we should focus our efforts toward managing the amount of capital we want to draw into the ecosystem rather than trying to manage the interest rates needed to do that.

Implementation of L1 $HBD Bonds will also require an instantiation of Layer 1 NFTs, which I discussed at some length during my talk on “Two Novel Use-Cases for Hive Layer 1 NFTs” at HiveFest.

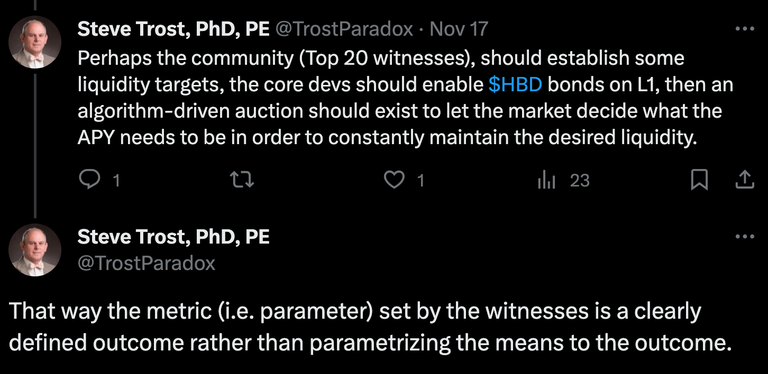

The Backstory: A Twitter and Twitter Spaces Conversation

A couple days ago, there was a lengthy twitter conversation about $HBD APY (in particular) and $HBD Bonds (in general).

The conversation began in response to a twitter post by @khaleelkazi that was a recording of a twitter spaces discussion (about stablecoins) between @khaleelkazi, @taskmaster4450, @anomadsoul, @theycallmedan, and @edicted.

@threespeak responded to @khaleelkazi’s post with a tweet of his own, saying:

- HBD supply is infinite

- Volume comes from local spending of HBD earnings from value added activities

- @edict3d u can make money on HBD purchases. The 5% does not exist if u do it properly

- pls lower APR to 6% lower risk on community and put 16% APR and risk on speculators

That sparked an extensive twitter conversation that included @threespeak, @khaleelkazi, @edicted, @trostparadox, @themarkymark, and @rubencress (and maybe a few others).

Much of that conversation was then discussed in more detail during Saturday’s 3-hour @cttpodcast, which can be listened to here or here or here (my brief comments start at 53:07 on 3speak.tv or 58:00 on twitter).

The purpose of this post is to expand on one of the suggestions I voiced during the aforementioned CTT. My suggestion was to parameterize (as a witness parameter) how much $HBD we would like to have locked up (and for how long), rather than parametrizing the $HBD APY itself. That way, the community can focus on the desired end result rather than merely the means to that end. Doing so allows for far more effective management.

(NOTE: In my twitter post (below), I used the term ‘liquidity’, but a better term would be total value locked, or TVL, so I will use TVL for the remainder of this post.)

The Suggestion: Parameterize the Amount of Desired Total Locked-In Capital

Here is one way to do this:

- Each witness ‘votes’ on how much TVL they would like to see for the specified time horizon (for our hypothetical example, we’ll assume a specified TVL time horizon of 18 months).

- Each witness ‘votes’ on a maximum APY for the specified $HBD Bond maturity (for our hypothetical example, we’ll assume a specified $HBD Bond maturity of 2 years).

- On the first day of each month, an L1 algorithm checks the Top 20 witness feeds and establishes and publishes that month’s $HBD Bond offering.

- On the seventh day of each month, an L1 algorithm receives bids for that month’s $HBD Bond offering. Each bid would be for a specific amount of $HBD, a specific APY bid, and must include a security deposit (e.g. 5% of the bond amount).

- NOTE: Any style of auction would suffice, but I would suggest a dutch auction. Under a dutch auction, the bids would be rank-ordered from best to worst (i.e. lowest APY to highest), the total bond amounts would be allocated starting with the best bid then moving down the list until all the bond funds have been allocated, with all bidders receiving the same APY as the last successful bidder.

- At the close of the bidding period, an L1 algorithm would:

- Return the security deposits of all unsuccessful bidders.

- Notify all successful bidders, informing them of the amount of their bond, the lock-up period, the APY, the balance due, and the deadline for completing their bond purchase.

- Mint new L1 $HBD Bond NFTs for each successful bidder who completes their purchase before the purchase deadline.

- Send (to the DHF) the security deposits for each ‘successful’ bidder who fails to complete their purchase before the purchase deadline.

Here is a hypothetical example of the way the process might proceed:

- An L1 Hard Fork (HF):

- Codifies two new witness parameters:

- Desired TVL at 18 months

- Max APY for 2-year $HBD Bonds

- Enables the creation of transferable L1 $HBD-Bond NFTs

- Enables L1 algorithms for determining monthly $HBD Bond offerings (based on witness parameters and actual TVL) and conducting a monthly auction for said $HBD Bonds

- Codifies two new witness parameters:

- On Day 1 of Month 1 (after the HF), the witness parameteers (median values of the Top 20 witnesses) are as follows:

- 18-month desired TVL: 100,000 $HBD

- 2-year max APY: 20%

- On Day 7 of Month 1, the L1 algorithm determines the following $HBD Bond offerings:

- 2-year: 100,000 $HBD (because the current 18-month TVL is zero $HBD)

- During the bidding period, the following bids are received (for 2-year $HBD Bonds):

- Bid #1: 100,000 $HBD at 20% (with 5,000 $HBD security deposit)

- Bid #2: 50,000 at $HBD 19% (with 2,500 $HBD security deposit)

- Bid #3: 40,000 at $HBD 18% (with 2,000 $HBD security deposit)

- Bid #4: 50,000 at $HBD 17% (with 2,500 $HBD security deposit)

- Immediately after the bidding period closes, the following security deposits are returned:

- 5,000 $HBD to Bidder #1

- 2,000 $HBD to Bidder #2 (500 $HBD of Bidder #2’s security deposit is retained, because they qualify for a 10,000 $HBD Bond, instead of the 50,000 $HBD Bond they originally bid for)

- The following $HBD Bonds are prepped for purchase (by L1 algorithm) (with interest rate set by dutch-auction rules)

- 50,000 $HBD for Bidder #4 at 19% APY

- 40,000 $HBD for Bidder #3 at 19% APY

- 10,000 $HBD for Bidder #2 at 19% APY

- After payment of the balance due is received from the successful bidders, the following $HBD Bond L1 NFTs are minted and transferred (by L1 algorithm) to the respective bondholders

- 50,000 $HBD for Bidder #4 at 19% APY

- 40,000 $HBD for Bidder #3 at 19% APY

- 10,000 $HBD for Bidder #2 at 19% APY

- If no changes occur to the Top 20 witness parameters

- On Day 1 of Month 2, no bonds are offered (because the 18-month TVL is 100,000 $HBD)

- On Day 1 of Month 3, no bonds are offered (because the 18-month TVL is 100,000 $HBD)

- On Day 1 of Month 4, no bonds are offered (because the 18-month TVL is 100,000 $HBD)

- On Day 1 of Month 5, no bonds are offered (because the 18-month TVL is 100,000 $HBD)

- On Day 1 of Month 6, no bonds are offered (because the 18-month TVL is 100,000 $HBD)

- On Day 1 of Month 7, 100,000 $HBD in new 2-year bonds are offered and auctioned (because the 18-month TVL has dropped to zero $HBD, due to the maturity date of the first set of $HBD Bonds dropping below 18 months in the future)

- Let’s assume the successful APY for the new set of $HBD Bonds is 18%

- On Day 1 of Month 8, no bonds are offered (because the 18-month TVL is 100,000 $HBD)

- On Day 1 of Month 9, no bonds are offered (because the 18-month TVL is 100,000 $HBD)

- On Day 1 of Month 10, no bonds are offered (because the 18-month TVL is 100,000 $HBD)

- On Day 1 of Month 11, no bonds are offered (because the 18-month TVL is 100,000 $HBD)

- On Day 1 of Month 12, no bonds are offered (because the 18-month TVL is 100,000 $HBD)

- On Day 1 of Month 13, 100,000 $HBD in new 2-year bonds are offered and auctioned (because the 18-month TVL has dropped to zero $HBD, due to the maturity date of the second set of $HBD Bonds dropping below 18 months in the future)

- Let’s assume the successful APY for the new set of $HBD Bonds is 17%

- As of the close of Month 13, the following total $HBD Bond amounts have been issued:

- 100,000 $HBD at 19%, maturing in 11 months

- 100,000 $HBD at 18%, maturing in 17 months

- 100,000 $HBD at 17%, maturing in 23 months

Conclusion

The above hypothetical assumes we start with a single time-vault maturity duration (e.g. 2-years). In @taskmaster4450’s post yesterday, he suggested starting with four (1-month, 3-months, 6-months, 1-year). From a technical standpoint, if the time vaults are instantiated as L1 NFTs where the maturity date is merely included as immutable reference data within the NFT, then we essentially have an infinite number of time vault durations we can implement. The challenge with that, for the system I’ve outlined above, becomes managing the monthly $HBD Bond offerings and their respective auctions.

With that said, we could do a hybrid between @taskmaster4450’s suggestion and mine, wherein we parameterize the short-term maturity APYs (and allow anyone to purchase any of those $HBD Bonds at any time, in any amount) and, separately, parameterize the TVL for a single-maturity long-term $HBD Bond. The advantage of this hybrid system would be that we would have, on a monthly basis, a market-based determination of the long-term APY, which would then provide the witnesses valuable information they could use when setting short-term APYs.