Our #pepEntropy token value comes from @fjworld executing Qualitative Investing Strategies on various Hive layer 2 tokens.

A blog will be published in the near future to identify some of the main components of QIS. Also, a template will be constructed to make it easier to share future analysis. There are many layer 2 tokens to consider so a structure and process will be built to make it easier to share future analysis.

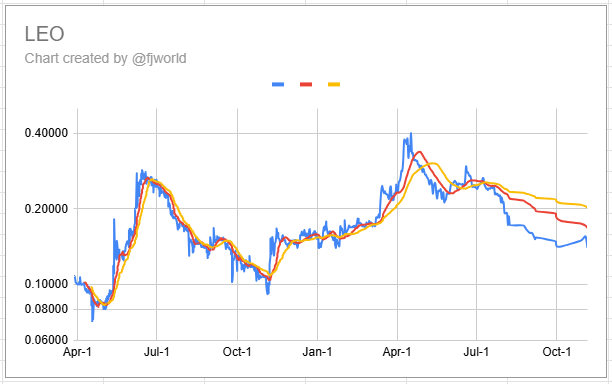

For now, the focus is LEO so let us look at a previous report that raised caution of a LEO disappointing trendline. Also, I hope you consider holding pepEntropy to offset risk from trading and holding various layer 2 tokens. pepEntropy is a good layer 2 token risk management vehicle.

Quote from July 13, 2024

This is where holding some pepEntropy tokens is a great way to profit from risky investments. And #LEO is a risky investment.

Looks like Leo was positioned for a drop.

Since July, our pepEntropy wallet unloaded our LEO holdings and started to accumulate at lowest possible price until we could stake 500 tokens for long term growth.

The risk is still high for LEO. Those who have been following a dollar cost averaging strategy should understand that a hope of appreciation is not a reliable investment strategy. You dollar cost average an investment when the current pricing is trading significantly lower than its book value. If you don't know the book value of a token then you are playing a crap shoot.

Looking at the moving average of historical spot prices we can say that the market perception of LEO is a decline in value.

How low will it go?

It could easily drop to 0.10 or lower. If so, this will provide some great capital gain for the astute investor.

Well, that is it for now. Time to look at some other tokens. Wishing everyone the best of days and I hope you find this trading analysis valuable.

Disclaimer

20% of the earnings from this blog is allocated to Project ePayTraffic (PEPT). Consider PEPT as your long term Digital Asset Builder.