The Fed’s preferred gauge of consumer inflation rose in April, reversing a recent slowdown and raising the chance of another interest rate hike in June.

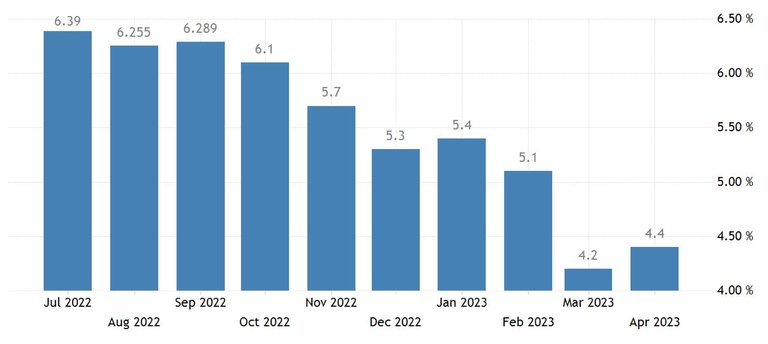

The Personal Consumption Expenditures (PCE) price index rose 4.4% year-on-year in April, up from 4.2% a month earlier, according to the Commerce Department.

It was the first rise in the annual figure since January, and came as a result of sharp annual increases in prices for services, food and goods.

Inflation excluding volatile food and energy prices accelerated last month to 4.7%.

Price increases also surged on a monthly basis, the Commerce Department said.

Earlier, Fed Chair Jerome Powell said the US central bank is taking a "data-dependent approach" to its next decision, where it will mull whether another rate hike is needed to bring inflation back down to its long-term target of 2%.

Futures traders now see the most likely scenario being another interest rate hike from the Fed on June 14.

US regional banks better tighten their belts