Canada, Probably one of the most beautiful countries in the world and home to my personal dream of owning a winter log cabin where I can have coffee and pancakes for breakfast with my perfect girlfriend who doesn’t exist yet, of course with Maple Syrup, to later do some kayaking with killer whales in the striking landscape of the British Columbia. But if you clicked on this article not looking for a National Geographic documentary are you? but an economic analysis of Canada, and that’s exactly what you will find here.

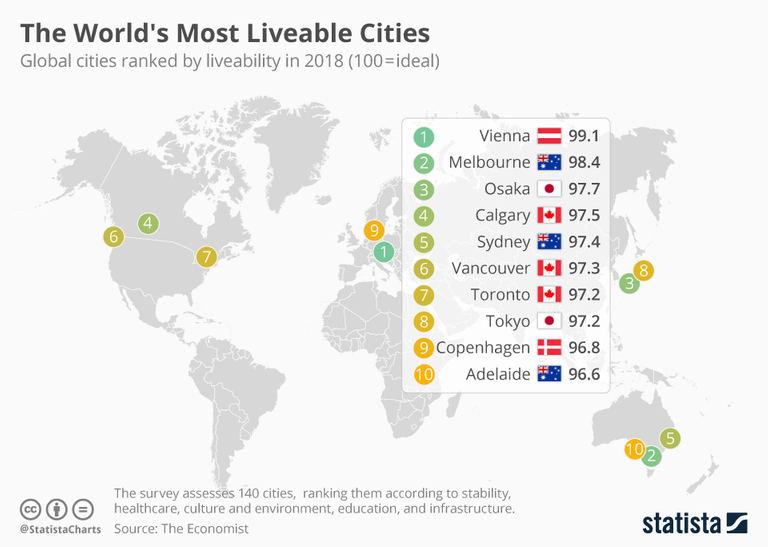

The Canadian economy has been for a long time one of the most admired and sought-after models to follow by other countries, in order to achieve healthy growth and high living standards for its population. The global liveability Index in 2019 picked three Canadian cities for their top ten list, recognizing the high standards offered by the Canadian economic framework. Yet in the 2021 report, Canadian cities have been downgraded. Toronto, Vancouver, and Calgary have continuously been included inside the top 10 years after year, yet in 2021 none of them made the list. The reasons behind this downgrade following the report point to severe stress suffered in the Healthcare system as a consequence of the second Covid19 wave and the difficulties experienced to cope with a bigger demand for healthcare.

world most liveable cities 2019, statistia

Ironically, the report also states that 7 American cities, 2 Spanish, and one Australian have been the biggest gainers for the opposite reason. The proven resilience of their healthcare infrastructure helped to source the needs of the population during the shady times of Covid’s second wave. But given that Canada is a member of the G7 while Spain and Australia are not and the number of covid related deaths and infections have been higher in Spain or even the US, the question arises if this can be a sign that something is wrong inside the Canadian economy, and the great numbers delivered in GDP and growth may be somewhat blurry.

How to become a successful Ex-British colony?

Canada is one of these former colonies that became independent and have handled extremely well a vast amount of land blessed with countless natural resources, enough for a tiny population relative to the extension of the country, to bank on their natural assets and build up a functioning and prosperous society. Still, an active member of the commonwealth, much of Canada’s economic and political structure was built upon the British foundations. Canadians have benefited for centuries from favorable business and trade environments with reliable institutions and a trustworthy legal system.

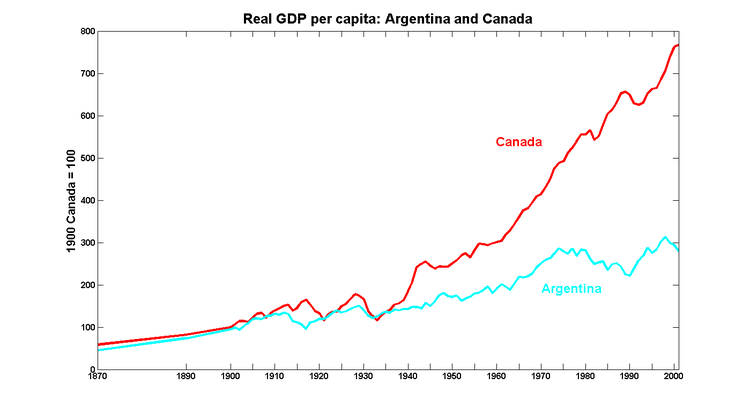

That’s one of the main reasons a resource-rich country like Canada is the world’s 9th largest economy and a resource-rich country like Argentina is not. I’m working on an article about Argentina by the way. But back to Canada. Another great boost for your economy is to have as your main neighbor the United States of America. This basically means Canada is the closest country to the biggest consumer market in the world, together with Mexico. Indeed, they are the 3 members of NAFTA, a treaty signed by the 3 in 1993 to eliminate trade barriers and help ease the speed of trade. Quite an advantage to have a neighbor flushed with cash and with so few restrictions to make a trade with him happen. But having your neighbor low on cash may also be an advantage.

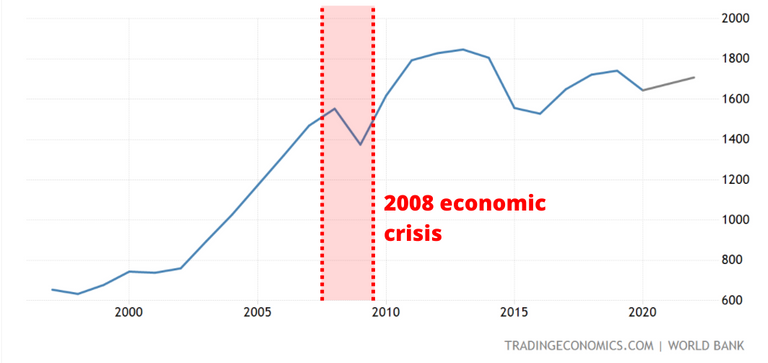

For many decades, Canada’s GDP was strongly dependent on manufacturing efforts in different types of goods, especially in the automotive industry. Yet since the 2008 crisis, the economy of Canada started to see accelerated changes in its structure, as the downfall experienced in advanced economies pushed faster the trends brought by globalization and outsourcing of labor to other cheaper countries like Mexico. Yet, the difference between Canada and the rest started becoming evident during the highs of the Great Financial Crisis.

canada GDP graph, tradingeconomics

How did the 2008 financial crisis affected Canada?

The history of banking in Canada is not similar to the one in the US. Canadian banks have traditionally been a lot more risk-averse than their American peers. In 1867, the Canadian Constitution Act gave the federal government the right to create banking legislation and control the issuance of currency, creating the Canadian dollar. Pegged to the gold standard and maintained a fixed exchange rate for the most part of the next century with the US dollar. The Canadian banking sector was older, more regulated, and tied to British banking standards than those in the US.

In America, The Federal Reserve wasn’t created until 1913 and continuous internal conflicts like the Civil war and the failure of the first 2 Federal Reserve banks, pushed private banks in the country to become more creative, resilient and risk lovers if they wanted to preserve the accumulated wealth in their deposits. This difference in banking culture became sound when the great financial crisis of 2008 ignited the biggest banking panic on record when Wall Street’s favorite Lehman Brothers collapsed and almost dragged the rest of the American banking sector with them.

Yet in Canada, the situation was not remotely close to the one in the United States side. Thanks to a conservative risk-averse approach inherited from the British banking influence. Canadian banks had almost no exposure to subprime mortgages, with only 3% of all outstanding loans being subprime, and limited or no exposure at all to Mortgage-Backed Securities. For instance, Toronto Dominion bank had 0% exposure to MBS. It is from this moment the Canadian economy, maybe without noticing much of the change, started shifting from its traditional approach to safety and low risk to embracing leverage.

Why? First of all, the American banking culture was also based on the American spirit of taking risks in business, growing, and investing, and to do that it's crucial to have a lending counterparty willing to bear that risk with you. The extent to which this happens in Canada is not even close to the one behind the border, hence Canadian banks have historically sought growth opportunities abroad and not home. But when the financial crisis shelled the balance sheets of American banks with margin calls and Canadian assets proved to be the most resilient on the planet, as they were the only country during the crisis without a single bank failure, which opened the window for them to increase leverage and lending.

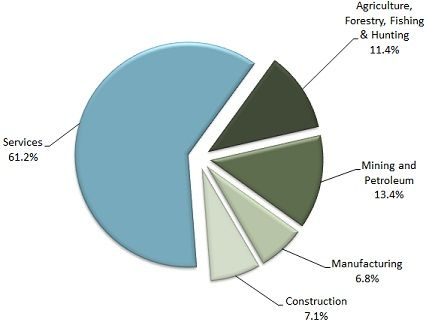

Shoved by emerging economies eating Canada's market share in manufacturing, the nation started shifting to invest in itself and today, 78% of Canada’s GDP comes from the service sector, employing 3/4 of the active labor force. The service sector includes other sub-sectors such as retail, tourism, construction, transport, banking, healthcare, and communication. Basically you need to achieve high living standards and make the country attractive for people to come and live in it.

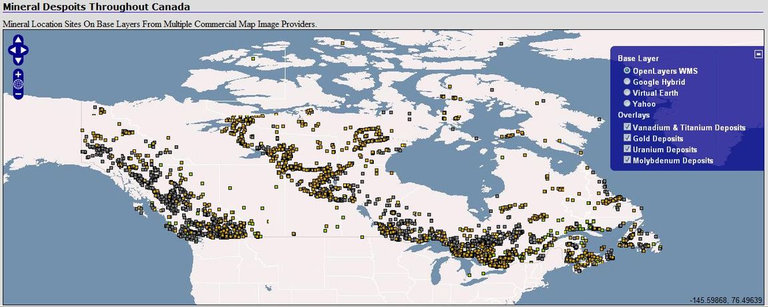

canada mineral deposits map (gold,uranium and others), carleton

But it also means Canada today relies much more heavily on itself. This is really surprising, as Canada is a living deposit of all kinds of commodities and shouldn’t face any issue to diversify itself, banking on the $33,4 Trillion pile of natural resources under its soil. To highlight a few. 10% of the world’s reserve of oil and the 4th largest producing country. 20% of all the Uranium deposits in the world and the second-largest producing country. 5th largest producer of gold globally and 80% of the world’s maple syrup supply. Not bad, right? Yet only 16,9% of Canada’s GDP comes from this sector, although indeed 11,5% is the number originated from natural resources, the rest are indirect revenues, from the service sector to support mining businesses.

Commodities are volatile and increasingly scrutinized because of environmental concerns and as a mature and wealthy economy as Canada is, it also brings with it many more restrictions and controls under federal law, making it harder for mining companies to operate and turn in higher profits in Canada compared to other regions like South America or Africa, with much more relaxed regulation. But maybe even more striking is the fact that despite Canada having one of the world’s best business-friendly environments and a good supply of high skilled workers, the country isn’t that competitive in the leading industry across the globe, which is technology. Just Shopify has an international reach and recognition as a tech leader. How can that be? When we look at some of the problems in Canadian society, we can once again find the answer in the evolution of the past 10 years.

A lost chance after the crisis?

So, we’ve previously mentioned how since the 2008 great financial crisis, Canadian banks started shifting towards increasing leverage and lending inside Canada, in part because of their more resilient capital structure. In banking regulation, you measure how prepared a banking institution is to face any type of shock by calculating its capital adequacy ratio. The capital adequacy ratio is just its Tier 1 capital, which is composed of equity and retained earnings, plus its Tier 2, which is high-quality debt, hybrid financial products, and undisclosed reserves. All are divided by their risk-weighted assets, which are all the assets owned by the bank multiplied by the risk perceived weight that the instrument holds. For example, something like a US 10 Years treasury bond may have a risk weight of 0%, meanwhile, an unsecured loan to a business can be highly risky and weighted at 100%. It's calculated with this method because banks try to assess realistically the potential loss for every financial instrument and calculate what is the potential recovery rate from every product sold out to clients. The challenge in calculating a capital adequacy ratio is the perception of risk.

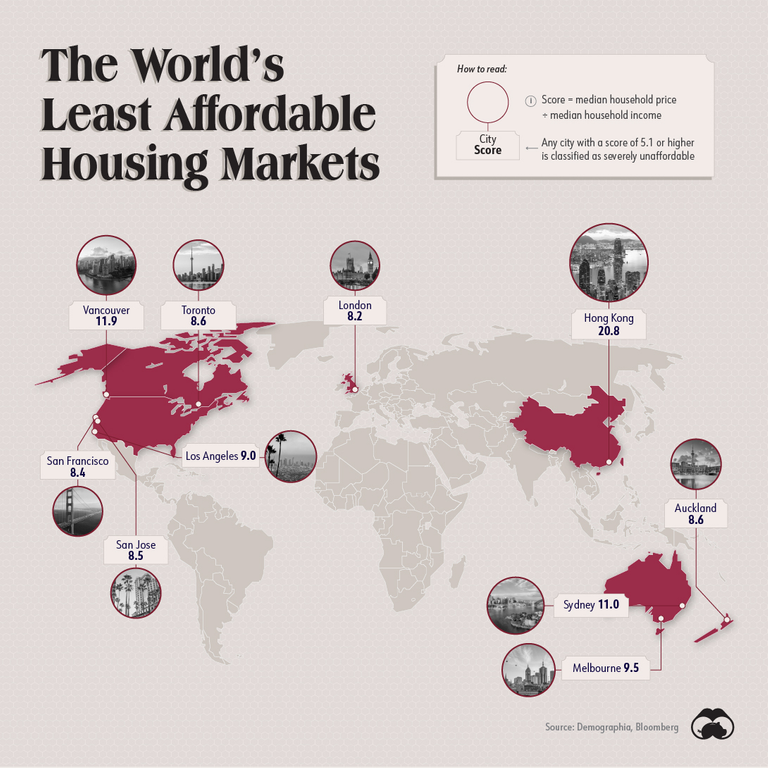

Today Canadian banks still have strong capital buffers, just in line with other countries or the United States itself, but that still depends on how we perceive the underlying risks. Canada’s real estate market is hot, very hot. So hot it is one of the most unaffordable in the world. With Vancouver being the second most unaffordable city globally and Toronto making the 5th slot. In Vancouver, the price for a median house is $1.4 million, but the average monthly income is $6,600. In Toronto, it hovers around $1million, with an average gross monthly income of $8181. But remember, that’s the average, not the median. Usually, the real average salary most people earn is much lower than the average.

least affordable housing markets map, visual capitalist

When a bubble blows, it often has a rational explanation behind the price increase. In the case of housing in Canada, increased leverage and exposure to the mortgage markets, low-interest rates, and most importantly, slowing house permits while demanding increases. Increasing environmental protection and related regulation to tackle climate change and planning sustainable communities have been key drivers for regulators in deciding to reduce the number of new house permits in Canada, as the country also houses 20% of the world’s freshwater reserves.

If the Canadian economy suffers a downturn, overleveraged house buyers and investment firms collecting less rent than expected from their investments may start showing struggles to pay down those loans, adding pressure to Canada’s banking sector. If we add the increasing risk of higher interest rates and ending of fiscal support measures, leaving more buyers with no government granted mortgages, the current weight on Canadian mortgage risk may be undervalued, and provoke a big shock to the Canadian banking system, despite a historical path of strong resilience and efficient regulation. It's no wonder the absence of entrepreneurship in the country by the native population, as Canadians have increasing living costs and struggle to create a life project with housing so expensive and salaries failing to catch up with higher costs. Fortunately for them, the solution is in their backyard. They flee to the United States and work for giant American tech firms, which make much higher money and take no investment risk of their own. To later come back to Canada when retired, enjoy the portfolio of services in the country, and build their dream log cabin by the lake.

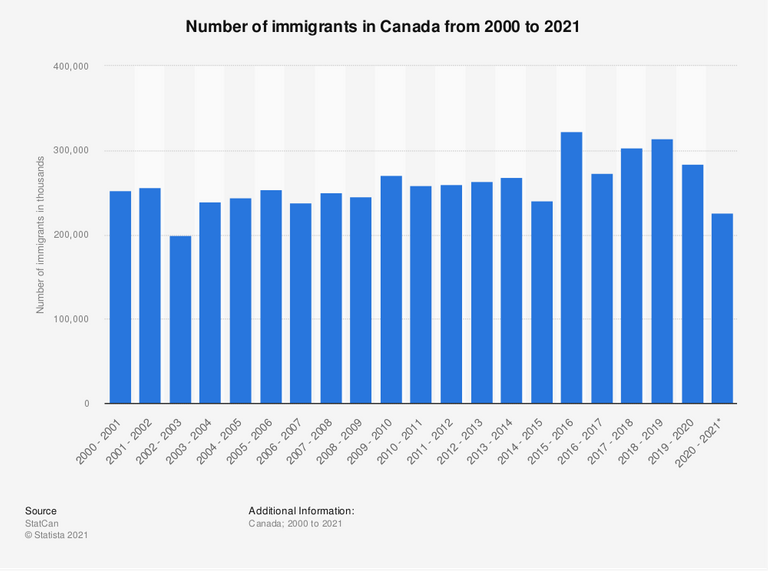

yearly immigrants graph, statistia

Imigration is playing a crucial role to sustain this expensive welfare system, as international migrants, often well trained, come to Canada willing to take lower wages in exchange for increased stability and opportunities to grow as professionals. In May 2019, the OECD released a report on migration trends showing Canada is inside the top 5 most sought after countries for entrepreneurship, high qualified labor relocation and it also made the top 10 list for the main destinations for university students, but it was pulled out of the top 5 for its high tuition fees, as Canadian universities are some of the most expensive in the world and a great source of revenue for its service sector.

Final thoughts

Canada is a great example of how political agendas and excessive regulation can turn a leading economy blessed with all that’s needed to succeed and prosper, into a living nightmare for a big part of its youth, unable to catch up with rising prices, especially in housing. Although that’s not happening in all parts of the country, and tinier cities with fewer opportunities still offer great living conditions, the problem is youngsters do not want to live there, they like Toronto, Montreal, and Vancouver. That being said, Canada is still one of the most well-organized, reliable and reliable economies in the world. No matter what future trends may bring to the world and what role Canada is playing at the moment. The flexibility of its economy, the resilience of its banking system, and capacity to undertake changes and adapt to new economic environments, are something embedded into the Canadian brand and hopefully will continue to be so in the long term.

But only if the political class shows the will and gains enough knowledge to understand their problems and offer successful solutions to their citizens because if they don’t, young Canadians will continue to leave to the States searching for affordable housing, higher wages, and lower taxes. So we can finally conclude, that the reality of Canada is more than decent, but it still has important issues making it a much harder place to live in than what the numbers suggest.