If you've ever sent money to someone in another country, chances are you’ve used SWIFT a messaging system used by banks and other financial institutions all over the world. SWIFT stands for the Society for Worldwide Interbank Financial Telecommunication, and it’s been around for almost five decades. It’s headquartered in Belgium and is controlled by the G-10‘s central banks, as well as the European Central Bank. It was founded with 239 banks in 15 countries and now connects more than 11,000 member banks in 200-plus countries and territories around the world. Trillions of dollars worth of currency are sent across borders every single day and it’s largely thanks to SWIFT.

Before SWIFT, the world used a telex or a telegraphic transfer to transfer funds internationally. The system was slow, usually taking between two to four business days to complete a transfer and it involved describing each transaction with sentences instead of codes. So how does SWIFT work, and what happens if you lose access to this important part of the international economy?

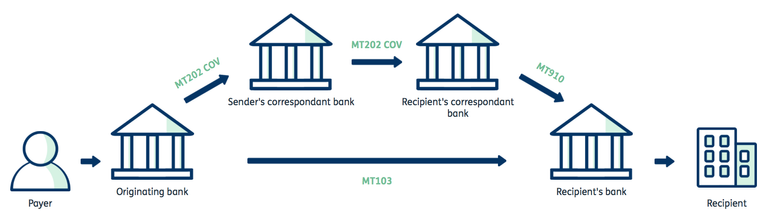

SWIFT is a safe and fast way for banks to communicate. Let's say I want to send money to my friend Tom in the UK from Singapore. My bank is going to require a few details like Tom’s account number and his bank’s SWIFT code, which is a unique 8–11 character code that identifies each bank in the network. Once I’ve keyed those in, SWIFT sends messages between the two banks. Remember, SWIFT is a messaging platform, not a payments system. If these banks have an account with each other, they authenticate the payment request and Tom receives his fund transfer. If the banks don’t have a relationship, the banks would be sent through intermediary banks until the payment request is verified for Tom to receive his money.

Since many banks and institutions do not have accounts with each other, they have to trust intermediaries. And these intermediaries usually have a presence in the United States, given the dominance of the greenback, which means they can be policed by U.S. authorities. It’s really about secure automated payments, so they help banks make payments to each other in a secure way, but particularly in an automated way so that everything integrates with the bank’s systems. While SWIFT is overseen by a neutral organization, its influence has made it a tool for policymakers to impose economic sanctions on countries that step out of line.

In February 2022, several Russian and Belarusian banks were barred from the SWIFT network, as part of economic sanctions after Russia invaded Ukraine. It’s become a symbol. So, it says we can exclude you from Swift, and that's kind of a substantial threat. But really, it’s shorthand for saying we’re going to exclude you from financial transactions around the world.

However, Russia’s not the first country to be disconnected from the SWIFT system. North Korea and Iran have also had their banks barred. The killer thing is that the payments are automated. What SWIFT allows is for all the messaging to integrate into the bank systems, so there’s no manual intervention. If I'm sending $1000 anywhere in the world, SWIFT makes it work and the actual cost is probably less than a dollar. But if I do it manually, it could easily cost $100 or more to get people to make the necessary telephone calls. But for the big payments of a million dollars, the automation, is convenient, maybe it helps get things done a bit quicker, but in the end, it doesn’t matter so much, they can still communicate, and get banks – if the banks are willing to make those transactions anyway.

SWIFT is a critical part of the world's financial infrastructure, but it is not the only option for international money transfer. For example, the Russian Central Bank set up the System for Transfer of Financial Messages SPFS in 2014. As of 2021, it had about 400 users, the majority of which were Russian banks and legal entities. Of the users, 23 were foreign banks.

China is also trying to create its system. In 2015, the People’s Bank of China established the CIPS network the Cross-Border Interbank Payment System. By 2019, it reached more than 3,000 banks directly and indirectly, across 167 countries and regions. I think the CIPS can be quite attractive for Renminbi transactions. So when China is engaged in trade with particularly, its near neighbors, we don’t know what’s going to happen as a fallout of the Russian invasion of Ukraine, but it’s certainly possible that a response to Western sanctions, Russia will be engaging in greater trade with China. And one can certainly see the payment messaging for all those products and services going through the Chinese system, rather than SWIFT.

How hard or easy is it for a bank to join alternative networks?

It’s hard to see that being used much outside of those specific countries. Ultimately, you want to deal directly as possible with the banks you have relationships with, and SWIFT is in a very strong position in being able to provide that required connectivity.

How effective could cryptocurrency be as a workaround for economic sanctions?

There are many reasons why crypto is probably not your tool of choice. One, just as we have in traditional finance, crypto has systems in place which allow people to be alerted if they are interacting with a sanctioned entity or individual. Secondly, blockchain, on which crypto is. based, is a permanent, immutable record that is publicly available of all transactions that have taken place on that blockchain.

Should SWIFT be afraid of blockchain technology?

I don’t recognize that view of SWIFT is ripe for disruption. I know there’re a lot of technology start-ups who claim that they can grab a big piece of the action, but I think we’ve got to remember the importance of payments of network effects. It’s very difficult to try and attract all 11,000 banks onto another system, especially which, on the whole, works pretty well. And 95% of SWIFT payments throughout the world, they’re all completed comfortably within 24 hours. That’s not to say that SWIFT is perfect. All this discussion about disruption has been quite positive because of its accelerated changes in the SWIFT system, including the GPI.

GPI stands for Global Payments Innovation. It was launched in 2017 to provide end-to-end tracking of funds, increase the speed of payments, and help make international payments more transparent. SWIFT doesn’t transfer money per se. It’s transferring information like banking orders. What’s interesting about a system based on blockchain is that you will have certain services which continue to be intermediate, like centralized crypto exchanges, for example, but it also allows people to hold their funds, their different forms of value and allows you to control that in a very direct way. And I think what we’ve seen in terms of how the industry evolves, is that that’s something that some people want to do. They want to have that sort of personal control. Other people still want to continue using an agent service. But the great thing about this technology is that it finally gives people this opportunity.

Blockchain technologies are still evolving, and rerouting the world's financial transactions over smaller messaging networks is not possible for now. However, in the long-term, these networks could mature, and the way money moves around the world could change. You don’t detach from a legacy technology or legacy system like SWIFT overnight. There have been huge amounts of investments in that. But there are certain capabilities and features that blockchain-based systems have that can’t be matched by traditional systems.

One of the more interesting developments is what is known as the central bank's digital currency. It's certainly possible that in 10-15 years that businesses and individuals will get quite used to exchanging digital currencies, perhaps directly with each other. Now, in that case, the role of SWIFT would begin to change. It will still be the messaging to support international payments, but they would have to adapt to take account of that new type of payment. That’s certainly a possibility for the future.