Hello Hivians, I am wishing all the best of life in this day.

I will like to share some watch outs or facts before trading a particular crypto asset.

Obviously the best time to buy a crypto asset is when the price it’s in the bear market. This is to say when the price have fallen low is the better time to buy and when the price is in a bull, you can sell to take out profits.

I will like to share some facts about crypto trading which I will start by defining the terms involved.

What is Crypto Trading

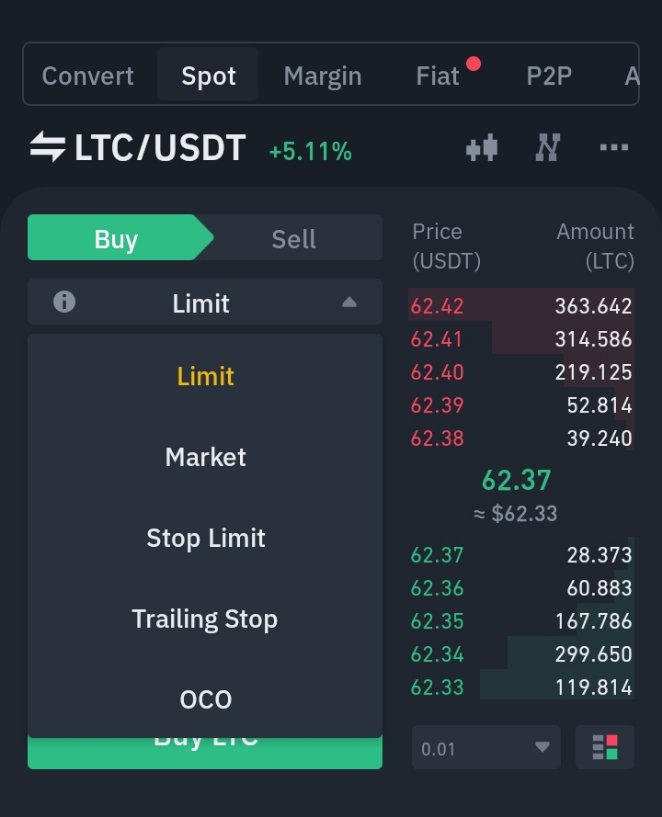

Cypto trading is the act of buying and selling a digital asset. There are two kinds of trades which involves short term and long term trading**.

Buying a digital asset and holding for a longer time to earn profit is long term trading.

Short term trading involves the buying and selling of a digital asset within a short time frame.

There are essential factors to consider before trading.

Liquidity

It is highly recommended to check for liquidity of an asset before investing. Liquidity means the asset can be converted easily to another with minimal or no change in price.

For instance,

I bought BNB when it was $270 per dollar and it grew up to $320 in the month of November, when it started to drop I had to convert to USDT which I didn’t secure loss as much because the asset is liquid.

A good trader must check for liquidity before investing in an asset.

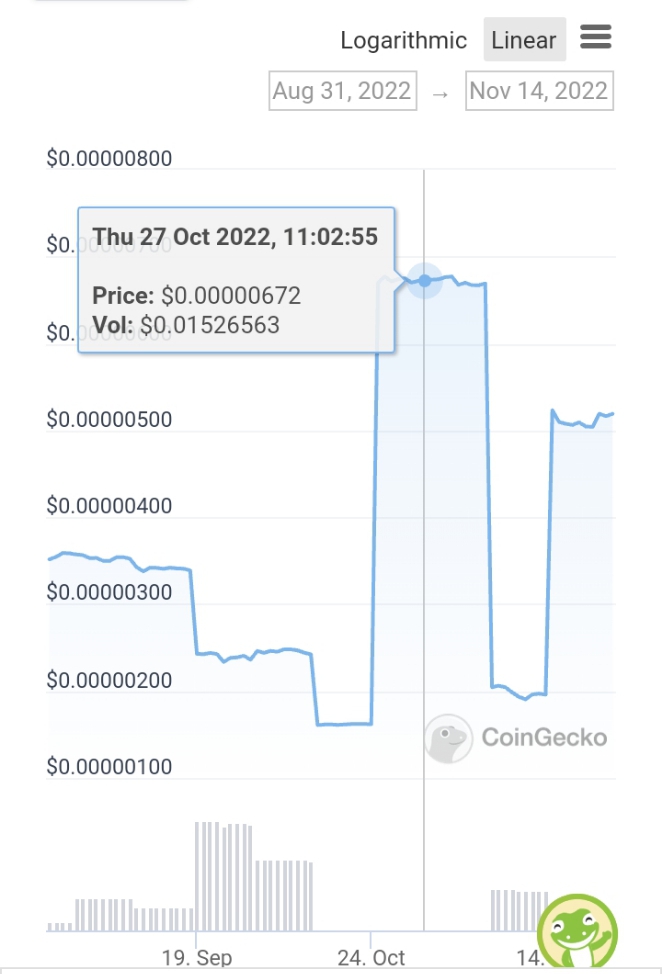

Volatility

Volatility is one of the trading secrets. In crypto, it is the fluctuation in price of an asset. When the price is low is the best time to buy and when it has increase where you have already made some good amount of profit you can sell.

I will like to state clearly when the price of an asset is volatile significantly, it is not good to invest in it

This means an asset today worth’s $1 and after a day it worth’s $10 after the next day it worth’s 20 cents and like that as it keeps fluctuating significantly. It is advisable never to invest in such asset.

Stop Orders

To limit the amount of loss, it is essential to use stop loss. This will help you sell your asset automatically when the price gets below the fixed limit which you set.

Check for volume

It is advisable to check for volume when investing in an asset. This will tell you how volatile is the asset. i.e been traded on a daily. Assets with bigger trading volume is good for investment. it shows the it is actively traded in the crypto market.

Another companion of volume is Market capitalization

Market capitalization is the total amount, staked, invested, on an asset. The price of an asset can be determined by the market capitalization divided by the total number of unit in circulation.

Conclusion

This article has been able to present concerns as regards crypto asset trading. With this, it is obvious that HIVE is a good asset to trade. It offers good annual percentage of investment return.

Please note

This is not a financial advice. If you wish to trade do your own personal research which involves proper study and analysis of charts.