Markus Winkler

Whilst some people are good and disciplined on their money dealings and built a secure and stable finances early on, others (like me) learned it later in life and in a hard way. It did make me wish they teach such in school rather than theories and solving numbers. But then again, maybe it's just how it is.

My parents are great at managing their finances and I've observed how they made their way through from since I was young and able to send us to private schools and support our needs. They were both undergraduates yet they knew better. In fact, my father didn't really believe in banks and whilst mother has a different opinion, she showed support nonetheless. For some reason, I didn't learn from them and never really knew how to budget or at least save. Although I had good-paying jobs from since I was 20 through my mid-30s, there isn't anything to show about it. Perhaps my parents wanted me to learn on my own so they never interfered back then.

So you can imagine I'm one of those many people who lived like everything is set and didn't really plan on creating or building a nest for the future. Spend, spend and spend some more until the next payday and then the cycle repeats. It was until a few years ago when while listening to an audiobook, both the husband came into a realization that we absolutely needed an overhaul and make changes with respect to our money dealings.

Although we are able to sustain our needs without any difficulty, we are by no means financially secure. But we are taking steps and hopefully be there one day. Thanks to the wisdom of Arkad (The Richest Man in Babylon) for guiding us through. Now, I can confidently say that we are learning and doing better than how we did before.

Paying ourselves first

First thing we learned to apply (and still do) is that we have to pay ourselves first. That is for every money that comes in no matter how small, we take no less than 10% and put them aside as our savings. This is by far one of the best nuggets we took from the book. I shared not so long ago of the proper savings formula, (re: Income minus Savings = Expenses)

It actually took us a while to adjust before we are able to do it consistently because we were used to doing the opposite (re: spending first and when there's left, that's what goes to savings). The good thing about this method is that we became more mindful of how we spend and it is surprising that while we are able to buy our necessities, enjoy some entertainment and a bit of luxury once in a while, we still have something left which we put aside which gets added to our emergency fund.

The savings we accumulate through this method are mostly used to invest in real properties and a few percentage of it to buying stocks.

It follows that while paying ourselves first (saving), we are controlling and managing our expenses well. We are also able to add to our investments (putting money to work). The real properties we invest in (mostly agricultural lands) are then utilized to earn continuously. This method is working quite well so far. It's how my parents built their nest and we see it's been effective for them. With mom's health concerns and continuing medication, they are able to finance their needs without difficulty and are not relying on us to provide for them. They have insurances, they have enough liquid cash, they have properties bringing money in and they are debt-free. It is safe to say that their nest is secure. We hope to one day be in such a stable financial stage through the discipline we are doing these days.

Not having any bad debts

The next drastic measure we did was to let go of our Mastercard. This was one of the culprits that contributed to our financial blunders because of its high credit limit. I was holding onto it because of the perks and benefits of owning one but letting it go was one of the best decisions we made.

Although we still have one credit card to date, we ONLY use it for necessary things and we pay the charges in full before they become due.

Building through Hive (Passive)

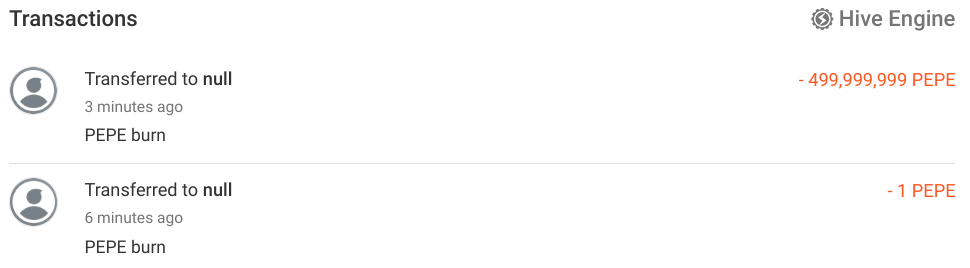

This is a long-term goal and one of the reasons why I am so keen on growing my Hive Power whilst I'm able and time allows me to be active here as much as I can. Those who have built their Hive Power to a decent amount are now earning passively through curation rewards.

HBD Savings is another way too, although I've just started this through the Penny-A-Day method which I've learnt via the Saturday Savers Club.

TL:DR;

Having stable financial future takes work and discipline. And these are how we are working to creating and building ours:

- Paying ourself first

- Mindful spending

- Appropriate investing

- Avoiding bad debts

- Building through Hive by growing Hive Power and HBD Savings

Of course, none of these are financial advice.

And this is my participation to the first question on this week's LoH prompt, re:

Some individuals are excellent planners when it comes to money matters. Others are not. If you are financially secure, how and when did you become so? If not, how do you plan to become secure in your finances?

Photos sourced as acknowledged above. 20052023/10:35ph