Hello everyone! We are back again today with another edition of Splinterland Economics - a series in which we introduce a basic economic concept and then apply it to Splinterlands. If this is your first time reading, just to tell you a little bit about myself: my day job is in an unrelated area but I consider myself a little bit of economics nerd - I read a little (or maybe way, way) more news than I should, double majored in econ, and am obsessed with optimization. I love the way Splinterlands is equal parts card game and resource allocation game. My goal with these articles is to share a little bit of what I know with you all.

Our subject today is an important concept which helps us to describe human behavior and explain some of the less rational choices we make in our day to day lives. Being aware of it in both yourself and in others can help you to make better decisions and perhaps improve your investment returns (NFA). Today, we'll be dipping back into behavioral economics for a bit to talk about Loss Aversion!

What is Loss Aversion?

Loss Aversion refers to the concept that people don't like losses. And while this may seem like an obvious idea - nobody likes losing! - what it is getting at is that more specifically, human beings tend to place a value on losses which is greater than a value assigned to equivalent gains. For example, the pain of losing $100 which you experience is likely to be much greater than the joy of winning $100. Notably, loss aversion is irrational, going by a pure mathematical approach. People may tend to avoid a gamble with a positive expected value where we would on average come out ahead, because we are afraid of the downside loss.

If you have ever participated in a fantasy sports league where no trades end up being made or have sat in traffic getting frustrated as cars pass you by, then you may have experienced or observed loss aversion. People are likely to overvalue their losses - a fantasy player which may have had a good game for their team recently, or a spot in traffic on their way to work. And on the flip side, they can (relatively) undervalue their gains - a perhaps more consistent player they receive in return, or all of those other cars you happen to be passing and maybe didn't even notice! Do you love or hate gambling? That can be a strong indicator of your degree of loss aversion - gamblers are likely to be less averse to losses. And I would like to note here that being more or less loss-averse is not a bad thing, it is just an important thing to be aware of about yourself.

How do we apply it to Splinterlands?

Splinterlands is an economic game, with a multitude of investment and asset types. We can apply the same types of strategies to Splinterlands investments that we can to outside investments. Personally, I do my best to avoid trying to time markets and try to keep a diverse set of investments. This decreases the impact of loss aversion in my decisions because while the losses still hurt, I can set a plan ahead of time and stick with it regardless of how I feel since my investments become automated to a degree. In Splinterlands, that means making consistent card and SPS investments over time, and spreading my assets over a variety of currencies and cards (as always: just my opinion, NFA).

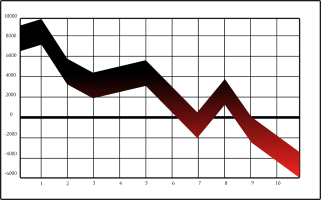

In Splinterlands, as with other investments, it is important to try and optimize your investment returns. This means being able to consistently evaluate and re-evaluate your investments and asset allocations, and determine whether your current positions are ideal or not. If they aren't, then don't hesitate to reallocate your capital. I see plenty of people who say that losses aren't locked in until you sell. And while this is technically true, you may be able to see better gains by "locking in" your loss in order to use those resources more efficiently somewhere else.

Why should we care?

Being aware of loss aversion can help us in multiple ways. If we are aware of our own loss aversion then we can take a closer look at our own decisions and determine whether we are really making the optimal choices. While you never want to make bad bets, skipping out on a prospective investment or opportunity just because you overvalued your potential losses is something to avoid whenever possible.

We can also look at other people's (or entities') actions and see if there are market inefficiencies or opportunities to make gains due to the loss aversion of others. If there's an asset class, token, or card that is undervalued on account of other people overvaluing potential losses, then it may be a prime opportunity to go shopping. On the other hand, do you think that something may be overpriced because everyone is holding on to it and is just afraid to realize their losses? Stay clear.

Remember that investing, in Splinterlands or elsewhere, is not an exact science. Nobody is going to be correct 100% of the time, and occasional losses are inevitable, unless you are incredibly lucky. But doing our best to avoid common pitfalls due to loss aversion can dramatically impact our account values in the long run.

Thank you so much for reading all the way to the end. Interested in seeing some more of my writing in the future? Be sure to give me a follow! In the meantime, if you'd like to see some of my recent posts:

Let's Do the Time Warp Again - Using Time Mage in Battle! - Last week's battle challenge, featuring Time Mage!

Splinterlands Economics: Asymmetric Information - An introduction to asymmetric information, and how being aware of it can help us in Splinterlands.

Splinterlands Economics: (A very brief introduction to) Behavioral Economics - An introduction to the field of Behavioral Economics, and how some of its concepts can help us in Splinterlands.

Thinking about giving Splinterlands a try but haven't signed up yet? Feel free to use my referral link: https://splinterlands.com?ref=bteim, and be sure to reach out to me if you have any questions!

All images used in this article are open source and obtained from Pixabay or Unsplash. Thumbnails borrowed with permission from the Splinterlands team or made in Canva.