On May 14th, the Trade Hub was added to the Land Expansion of Splinterlands. That includes the ability to trade between Grain and DEC (for now), but also to provide liquidity in return for half of the swap fees.

The swap fees are set at 10% according to the Land 2.0 whitepaper, of which only 5% are paid to liquidity providers, with the rest being burned. In Land 2.0 there will be a way to reduce the burned portion of the swap fee.

Although calculating the APR when LPs are rewarded from swap fees is an unreliable metric, since it can vary significantly depending on the volume of swaps in the pool, I wanted to make this calculation to have some sort of idea where this stands at this time.

How did I calculate it? Anyone who has done this calculation manually before should know...

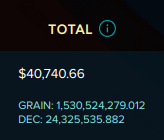

I took the TVL at this moment, that is 40,740.66 US Dollars.

I also took the total swap fees earned by LPs, which is 547.00 US Dollars:

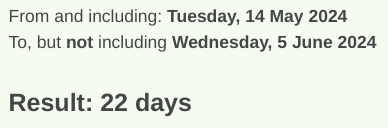

I calculated how many days have passed since Trade Hub is live: 22 days (excluding today).

In consequence, APR = 547/40740.66*365/22 = 0.2227 (otherwise said, 22.27%)

Note that, the longer time passes, the more irrelevant it is to calculate the APR based on swap fees earned starting from the day when TradeHub was launched. In the future, it would be useful to know the swap fees earned in the last 7 days, for example, for a more accurate APR at the time of calculation.

Some additional remarks could be useful:

- there is no additional inflation used to pay for these LP rewards

- TradeHub is a deflationary feature, since it burns up to half of the collected swap fees

- this APR is likely to be quite volatile based on trading volume variations over time in the pool

- Grain-DEC LP is only available for Land owners, unlike the Splinterlands LPs incentivized with SPS, or staked SPS

- the LP shares autocompound with each swap fee collected, so there is no Claim button to click to collect the rewards

- withdrawing from the Grain-DEC pool before 30 days have passed incurs a 10% fee that goes to the remaining liquidity providers

I am not a big Grain holder/producer, but I jumped into this pool from the start, and continue to add to it. It's one of the reasons for my new Grain productivity boost goal.

Want to check out my collection of posts?

It's a good way to pick what interests you.

Posted Using InLeo Alpha