Tomorrow, Splinterlands fifth major set is going to be released and the excitement is pretty big throughout the community right now. After two harsh years of bear market, things are finally looking up again. The land expansion has been a smashing success and we are up 100% on the monthly chart:

This is bound to draw more eyeballs on the Splinterlands ecosystem as a whole. The most obvious investment would be to just buy SPS, stake it and see how things progress in the next two years. On the other hand, a new set also means fresh opportunities, so let's take a look at the Rebellion set from a strictly investment point of view. Would it be a good idea to invest in Rebellion packs and how would you do that?

Let's talk fundamentals first. A Rebellion set is $5 and you can use up to 5 vouchers per pack to bring that price down to $4. Also, if you buy at least 2000 packs at once, you will receive 15% bonus packs on top of your purchase. Vouchers are worth below $0.04, so the price per pack would come down to $4.2. Assuming you buy at least 2000 packs, which only makes sense if you are doing it for investment reasons,then you would receive 2300 packs for roughly $3.65 per pack which we now will assume to be the price point for any further consideration.

Now lets say you are buying the packs, what would be the strategy to profit from that investment? There are two viable strategies there, one is simpler, while the other one probably provides a better return. You could either

- Put the packs aside for resale value in the future

- Open the packs, combine the cards, and rent them out on the market

Either way, you will also be able to participate in the so called conflicts. This is the new airdrop system coming with Rebellion. To make use of this, you have to buy wagons at 50 vouchers a pop which will then allow you to stake your cards and/or packs there in order to participate in the current conflict. After each month, players receive airdrops based on how many packs and/or cards they had staked for that time. It's important to note that staked cards can still be used in battle, so you can stake them and rent them out at the same time. Here's what the interface might look for that:

Keep in mind that airdrop cards have historically been some of the most expensive cards coming from each set, so taking part in these conflicts is going to be more than worth it for everybody. Here are some of the most expensive cards from older sets for reference:

For Untamed the 4 most expensive cards came from airdrops.

For Dice, the first, third, and fourth most expensive cards came from airdrops.

So as you can see, the airdrops alone are going to be pretty interesting and certainly will provide a nice bonus. But lets look at the actual investment. Holding packs vs. opening them to rent out cards.

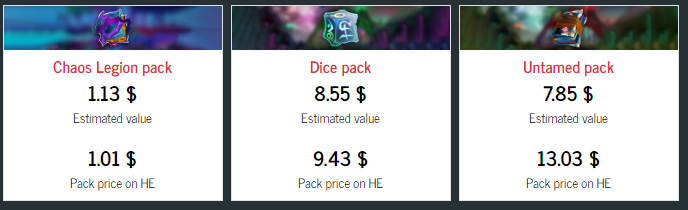

Lets talk about holding packs first. The play here would be to just buy the packs and then sit on them until Rebellion goes out of print and demand exceeds supply of packs on the market. Then and only then you'd start to sell these packs. Ideally, that would happen during a bull market but alas, you can't time markets, so let's look at resale value of older sets right now:

A pretty mixed bag. Chaos Legion as the most current set was sold at $4 a pack, while Dice was sold at $3 a pack and Untamed was sold at $2. So for Chaos Legion, you'd be at a 75% loss while Dice would be a 300% gain and Untamed even a 650% gain. So which scenario is more likely? Well, I'd say Untamed/Dice is a lot more likely than Chaos Legion, but let me explain.

Chaos Legion was released at the very height of the bull market in 2021. It is absurdly overprinted, was given out for free in reward chests, and sold for a fraction of its worth in different sales. If you bought in large enough quantities, you could buy packs at more than 50% discount. On top of that, different additional incentives were given for buying Chaos Legion packs, which obviously prompted people to buy packs for the added rewards and then just resell their packs for what ever they could get for them. All things considered, a lot of mistakes have been made there and the team openly confirmed that.

The positive thing here is that they did learn from that. There's never going to be a sale that will bring the value below the $3.65 we've established above. There are no added incentives to buying Rebellion packs other then getting the packs, and if you want to take part in the airdrop, you will have to hold on to your packs/cards. Because of that, there's basically no reason anybody would want to resell their packs on the secondary market as long as Rebellion is in print. This in turn should both help the market value of the set as well as keep the number of unopened packs after the print runs out comparably low. We'll have to wait and see how things go and how future sets look, but overall, I'd say a 500% increase in value for Rebellion packs is realistic within 2-3 years of the set going out of print.

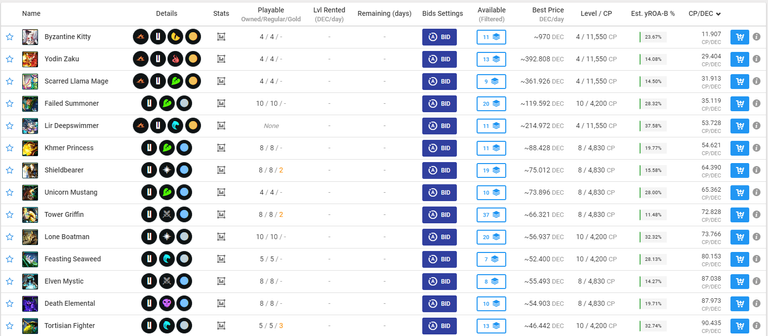

Now the other option would be to open your packs, combine the cards, and rent them out on the market. The obvious upside to this would be that you'd get a continuous cash flow right from the start instead of sitting on your hands for several years. The downside is that the resale value would be quite a bit lower. Just look at the pack values again and you'll see that an Untamed pack is worth $13.03 while the contents of the pack are only worth $7.85 on average. This usually gets worse the longer the set has been out of print and the less packs remain unopened. So to make it worth it, the cards should rent for a good amount of money. Let's look at the Untamed rental market:

As you can see, the yearly return on cards is usually between 10% and 30% with some cards being below and some cards being above that. What's important to keep in mind, though, is that these values are in comparison to what it would cost to buy the card off the market now, at its already highly inflated price. If you bought the cards during the Untamed era, your return is obviously quite higher. As indicated above, I expect Rebellion to be a pretty scarce set, especially in the beginning, so I'd expect at least 40% yearly return on average across all the cards you put on the rental market. This would also mean, that you'd get your money back in less than 3 years. After that, it's "free income" or you can obviously always just sell your cards.

In that regard, I'd consider Rebellion to be a rather good investment. The question remains, though, is it better than other investment opportunities in the ecosystem. As indicated initially, you could also just buy SPS and stake that. And that's the issue with these kind of investments. SPS doubled within a month. It's ATH is at about $1 - that would be another X25 from here. I'm not saying we are guaranteed to see those numbers during the next bull again. But... they are not too outlandish either. So while Rebellion is an interesting investment opportunity, the potential return on SPS is higher.

On the other hand, though, SPS lost more than 98% of its value during the bear market - we are an alt coin after all. While cards obviously suffered as well, they didn't suffer nearly as bad. So if you are looking for a long time play, Rebellion is certainly less risky than SPS and while it won't appreciate as much as SPS, it's only not going to suffer as badly during a bear market. So all things considered, I'd say Rebellion is a decent investment opportunity and also a great chance to diversify your holdings within the ecosystem. For me personally, I do intend to set up at least some rentals over time to build another passive income stream for myself!

And that's all from me for today, thank you all for reading and see you next time!