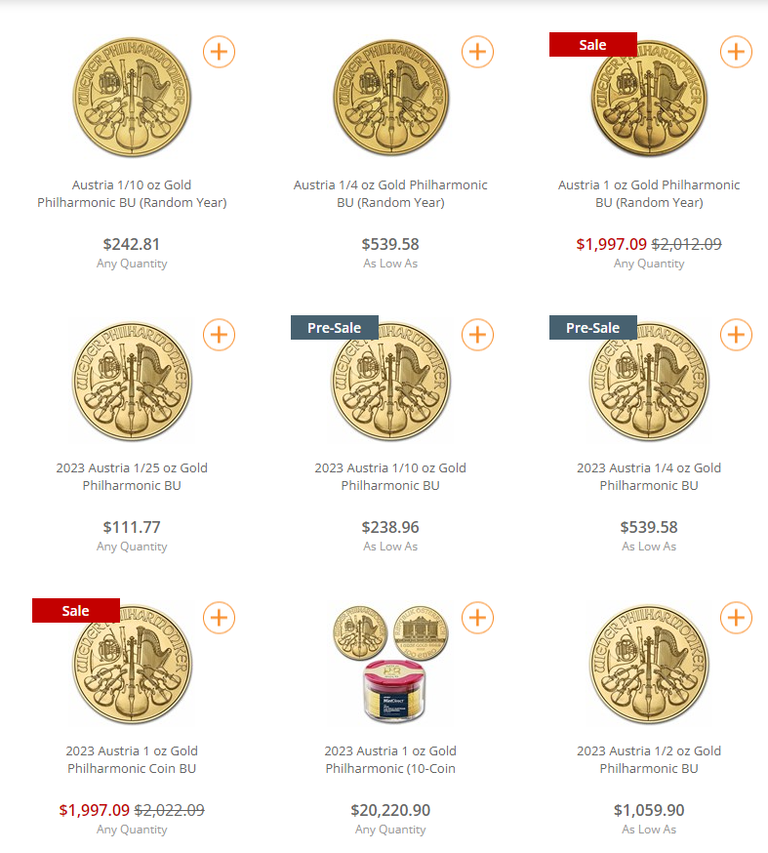

I picked up a 1/10oz Philharmonic recently. It costs slightly above my monthly budget for precious metals. I used to do half silver and gold each month but decided to alternate the type of metal each month instead. The biggest reason is to save on the premium I would pay over time.

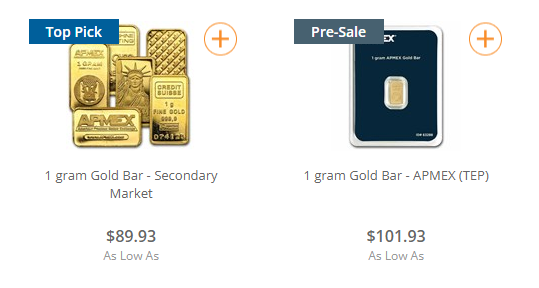

When you look at a vendor like APMEX, it's clear that the more you can afford, the better deal you can get for your purchase over time. It sometimes feels discouraging to realize a poorer person's DCA strategy is worse than someone who is better off.

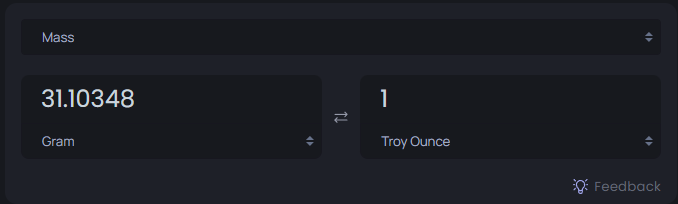

Hopping between grams and troy ounces may be challenging for some. If you are reading this post, you could look up the conversion between the two units.

When you put the units in perspective, you will notice that it doesn't make much sense for you to buy 1 gram pieces. That applies even when you buy them in bulk numbers. Since most exchanges don't offer free shipping for purchases below $200, you would rack up extra costs for buying a small amount of precious metals. You are literally losing a few ounces of silver for not buying at least $200 worth of products each time.

In the grand scheme of things, buying a 1/10oz every other month doesn't go too much above my monthly budget. The same principle applies to bulk silver purchases as well. Just like gold, trying for cost-efficiency will be maddening since most of us can't be dishing out thousands of dollars frequently. I suppose you could put aside money and do one big annual purchase. That would require discipline and maybe even some help from your banking institution's account management. I might try that out one of those years to save $2 an ounce on silver premiums.

Keep on stacking! Having a strategy to obtain assets is better than no strategy!