%20Charts%20Data%20&%20News%20-%20Yahoo%20Finance.png)

Yesterday the HUI Index of Gold Mining Stocks broke through July's Low. The Bear's continued to maul the mining shares driving the HUI down to close at 180.72.

Gold is knocking on support with July's LOW of $1678.40. Well the Miner's broke the July LOW yesterday. And as you will see Silver broke down yesterday and continued today.

The only question is will gold follow suit?

So what does this all mean?

The downtrend in the precious metals complex remains intact and there is no sign of anything bullish on the charts.

Silver closed today at $17.62 on the COMEX, so surely that means there must be a "fire sale" on bullion coins?

So I went to JM Bullion to determine what is the price of real silver in my hot little hands!

A cool $13.00 dollar premium on an American Eagle, not exactly a bargain given the beat down silver took today.

The premium on the generic rounds are a little more reasonable, an ounce of silver for $23.11 is not bad BUT is it down in the Bargain Basement?

So the best explanation I can come up with as to why the route continues is that the BOND YIELDS on US Treasuries are once again rising.

And with rising bonds comes a rising Dollar.

%20-%20Investing.com.png)

I suspect that as we enter the Fall Season, it has probably dawned on many Europeans that industry without Russian natural gas will probably be shuttering. I can only imagine the sticker shock that many Europeans will have as the power bills roll in and the jobs roll out.

If you can go ahead and make sure the food pantry is stocked before Winter sets in. You might want to stock up on daily essentials like toilet paper, dish soap, cleaners and any paper products.

I have seen reports that the farmers in the Netherlands are protesting new "Green" regulations over some nonsense.

Take it from the Tinfoil Hat Cat, when you are cold and hungry, you not give a dang about solar panels and electric cars.

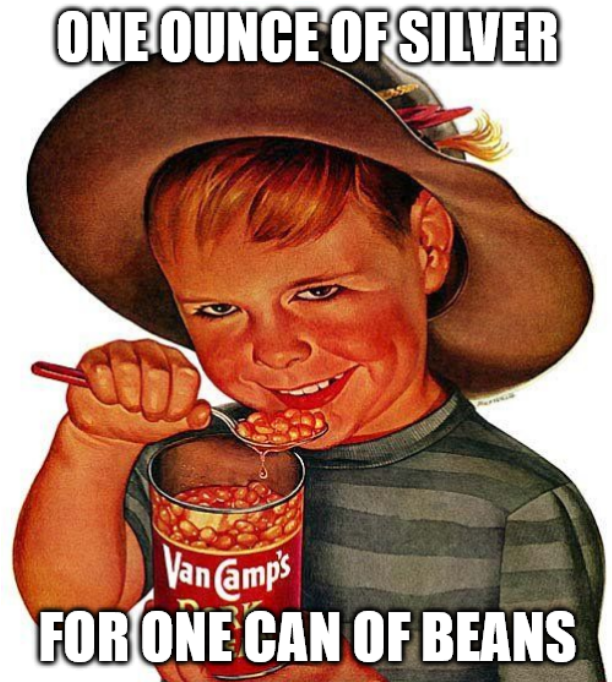

As a side note, you can't eat your silver, you might be able to buy something to eat with it, BUT DO NOT make the mistake of thinking that the people with the FOOD will not charge you an outrageous sum for it, even if you are paying in silver.

Better to buy those things now!

I am keeping an eye on the Italian Bond Market in particular, as I figure if the Italian Bond Yields skyrocket and liquidity vanishes with it, it is only a few weeks before all heck breaks out World Wide.

Except perhaps in Russia, a nation that cleverly tricked the entire West to destroy itself.

Be Prepared.

Peace Out and Stack On!