The idea that gold zigs when stocks zag is refuted by the recent gold rise.

In the past, investors who are unsure about their investments have found refuge in gold. However, this year it has kind of resisted that idea.

Granted, this is not always the case—gold does not always climb when stocks do. However, historically, investors have kept their money in gold as a hedge against inflation, unstable global financial markets, and unpredictable economic conditions.

Bond markets have advanced along with strong increases in stock markets. In that case, one may anticipate that the return on gold would lag behind that of stocks.

Rather, gold has performed better this year than stocks.

One reason may be provided by central bank demand. Central banks have purchased a record amount of gold in the first half of this year, 5% more than they did in the same period the previous year.

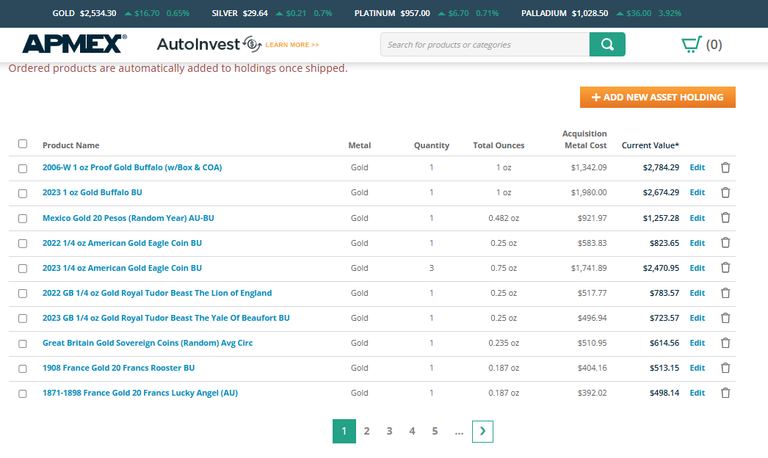

While everyone's situation is different, stackers like myself own physical gold. It is the purest form of ownership. Because they are more portable and come in smaller quantities, gold coins and jewelry may be sold easily for a premium.

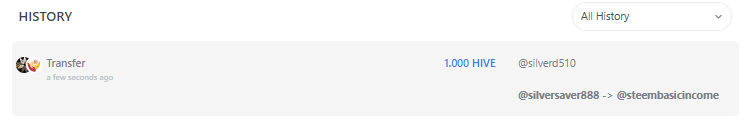

This is a page of my Precious Metals Portfolio from one of the coin dealers. Make you own judgement.

😍#ilikeitalot!😍

Gold and Silver Stacking is not for everyone. Do your own research!

If you want to learn more, we are here at the Silver Gold Stackers Community. Come join us!

Thank you for stopping by to view this article. I hope to see you again soon!

I hope to see you again soon!

Hugs and Kisses 🥰🌺🤙!!!!

I post an article daily. I feature precious metals every other day, and on other days I post articles of general interest. Follow me on my journey to save in silver and gold.

)

)